As a researcher with a keen interest in the dynamic world of cryptocurrencies and blockchain technology, I find it fascinating to observe the unique ways in which Ukraine and Russia are shaping the global crypto landscape. The resilience of these nations, particularly Russia, amidst challenging geopolitical circumstances is quite remarkable.

In this year’s Global Crypto Adoption Index, Ukraine and Russia are among the top ranks at 6th and 7th respectively, signifying their significant roles in the international crypto market.

Based on a recent report by Chainalysis and as reported by CryptoPotato, Russia has significantly improved its position by six spots compared to last year’s ranking. This notable advancement is occurring amidst the ongoing conflict and escalating sanctions against Russia. Intriguingly, Eastern Europe takes the lead with approximately $182.44 billion in cryptocurrency inflows flowing into Russia, with Ukraine coming in second place at around $106.1 billion.

Russia and Ukraine’s DeFi Growth

It was discovered by Chainalysis that there has been a substantial increase in cryptocurrency inflows towards decentralized exchange platforms, primarily in Eastern European countries, with Ukraine and Russia taking the lead.

Worldwide, Decentralized Exchange (DEX) platforms accumulated approximately $149 billion in cryptocurrency. The inflow to DEX platforms in Ukraine increased by more than 160% to reach $34.9 billion, while Russia’s inflows grew by over 173%, amounting to $58.4 billion. Furthermore, DeFi lending services in Moldova, Hungary, and the Czech Republic also experienced significant growth, taking in a total of $11.29 billion in digital assets.

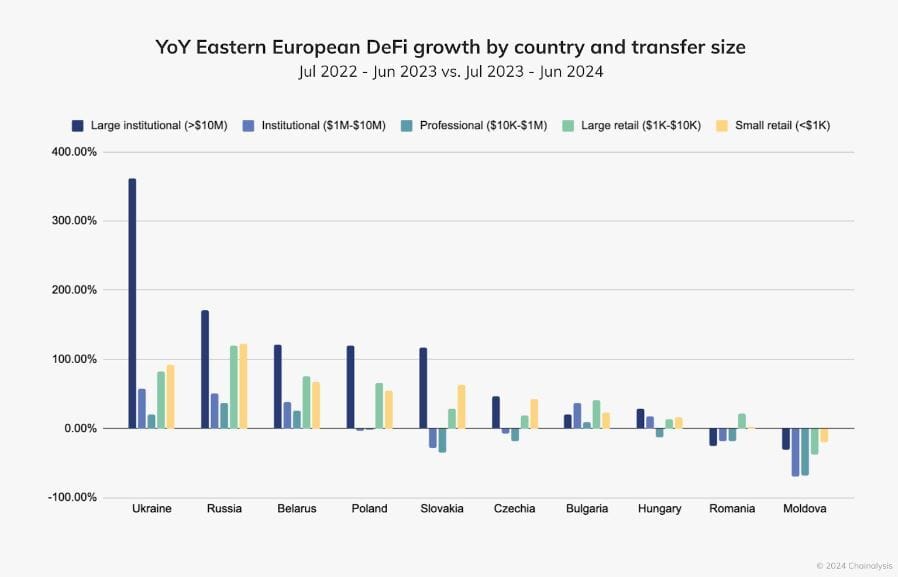

Over the course of the last year, I’ve observed significant patterns in DeFi transaction sizes across Ukraine and Russia. In Ukraine, there was a staggering 361.49% increase in large institutional transactions, which I define as those exceeding $10 million. Notably, these substantial transactions accounted for the majority of Ukraine’s DeFi activity.

In addition to Russia, countries such as Belarus, Poland, and Slovakia have seen significant expansion in Decentralized Finance (DeFi) due to substantial institutional transactions.

In a notable surge, both large and small retail transactions in Ukraine experienced substantial growth. Specifically, there was a 82.29% increase in larger transactions and a staggering 91.99% rise in smaller ones. This trend points towards grassroots adoption of cryptocurrencies, possibly indicating that investors are employing crypto for everyday expenses as Ukraine maneuvers geopolitical issues and inflation recovery efforts.

Sanctions Fuel Growth in Russia’s No-KYC Crypto Platforms

Over time, homegrown cryptocurrency services in Russia have seen an increase in demand, attracting substantial investments from within and outside the nation. Notably, according to Chainalysis, while traffic to centralized exchanges has remained constant, Russian-language decentralized exempt-from-KYC platforms witnessed a surge in activity last year, followed by a steady period since then.

It’s plausible that the surge is associated with financial restrictions imposed on Russian banks, causing residents to resort to these digital platforms for changing their traditional currency into cryptocurrencies.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- PRCL PREDICTION. PRCL cryptocurrency

- NUUM PREDICTION. NUUM cryptocurrency

- Top Gift Ideas for Your League of Legends-Obsessed BF on a Budget

- TARA PREDICTION. TARA cryptocurrency

- PROM PREDICTION. PROM cryptocurrency

- PNK PREDICTION. PNK cryptocurrency

- BORA PREDICTION. BORA cryptocurrency

2024-10-17 13:48