As a seasoned crypto investor with battle scars from previous market cycles etched deep into my trading portfolio, I can’t help but feel a mix of excitement and cautious optimism as Bitcoin inches ever closer to a new record high. The last resistance level standing tall at $69K feels like the final boss in a long-running video game, and breaking through it would indeed be a sweet victory.

Enthusiasts of cryptocurrency are ecstatic because Bitcoin‘s value appears to be reaching a previously unattained peak following several months during which its price remained relatively stable.

Yet, there’s still one last resistance level that should be broken.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the daily graph, the asset has been surging forcefully following its break above the 200-day moving average, approximately at the $64K mark. At present, the market is attempting to breach the significant $69K barrier, a point where sellers might make their final stand. If this level is overcome, it would result in a new record high and potentially a prolonged upward trend for Bitcoin.

Despite the current bullish trend, it’s important for investors to exercise caution, as the Relative Strength Index (RSI) is nearing the overbought zone. This might lead to a potential correction or pullback.

The 4-Hour Chart

On the 4-hour price chart, there’s been a recent break above a large bullish pennant, pointing towards an upward trend. Additionally, the significant resistance at $64K has been breached, with the market now approaching the higher resistance level of $69K. Despite the overall positive market structure, the Relative Strength Index (RSI) indicates that the market may be overbought.

This could cause concern, leading to a pullback or decisive rejection from the key $69K resistance level. Yet, a short-term pullback followed by a bullish continuation seems more likely.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

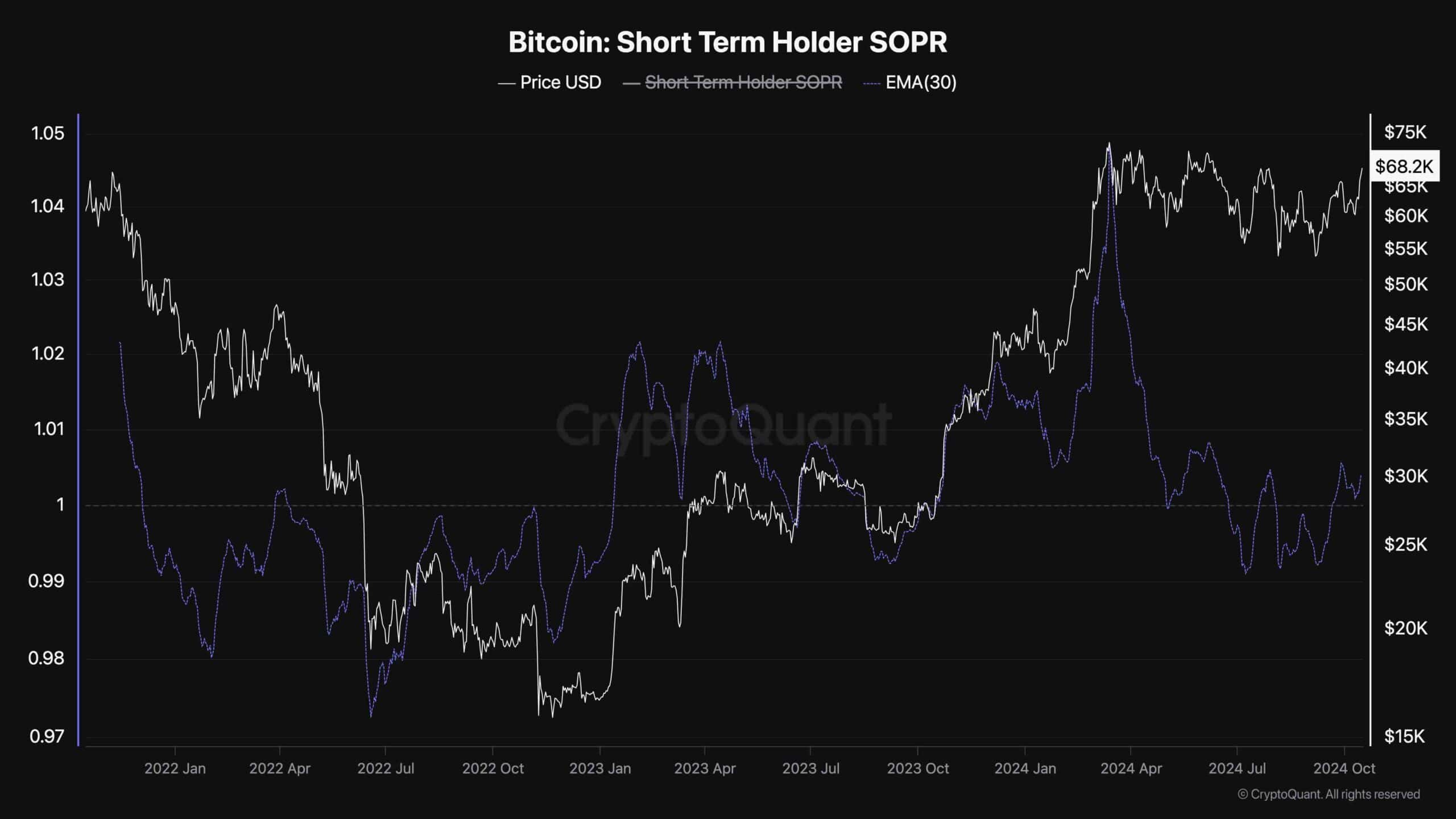

Bitcoin Short-Term Holder SOPR

It appears that Bitcoin (BTC) might be reaching a new peak, leading short-term investors to cash in their gains. This observation is supported by the chart showing Bitcoin Short-Term Holder SOPR, which illustrates when profits or losses are being made. A positive value suggests profits are being realized, while negative values indicate losses are taking place.

As the chart suggests, after months of aggregate loss realization by short-term holders, they are finally beginning to take profits on aggregate, as BTC is appreciating. While this is a natural behavior in a bull market, it could lead to a correction if it leads to excess supply and selling pressure.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- CGO PREDICTION. CGO cryptocurrency

- PRCL PREDICTION. PRCL cryptocurrency

- NUUM PREDICTION. NUUM cryptocurrency

- Rob2628: The Best Builds to Play in Season 5 Diablo 4

- PENDLE PREDICTION. PENDLE cryptocurrency

- Top Gift Ideas for Your League of Legends-Obsessed BF on a Budget

- TARA PREDICTION. TARA cryptocurrency

- RSR PREDICTION. RSR cryptocurrency

2024-10-16 20:50