As a seasoned crypto investor with over a decade of experience navigating the volatile and ever-evolving world of digital assets, I can confidently say that the recent surge in Bitcoin’s price is undeniably influenced by the influx of funds into US-based Bitcoin ETFs. The impressive numbers we’ve seen over the past few days are a testament to growing investor confidence and the increasing legitimacy of these financial vehicles.

The surge in Bitcoin‘s current prices is primarily due to increased investments into U.S.-based Spot Bitcoin Exchange Traded Funds (ETFs), as these funds have experienced their strongest three-day influx since June.

At the same time, the landscape around the Ethereum ETFs is quite different, yet again.

Bitcoin ETFs on the Rise

Regardless of whether Donald Trump, who claims to be pro-crypto, is becoming more likely to win the upcoming election or not, investors have shifted their general viewpoint regarding Bitcoin ETFs over the last few days.

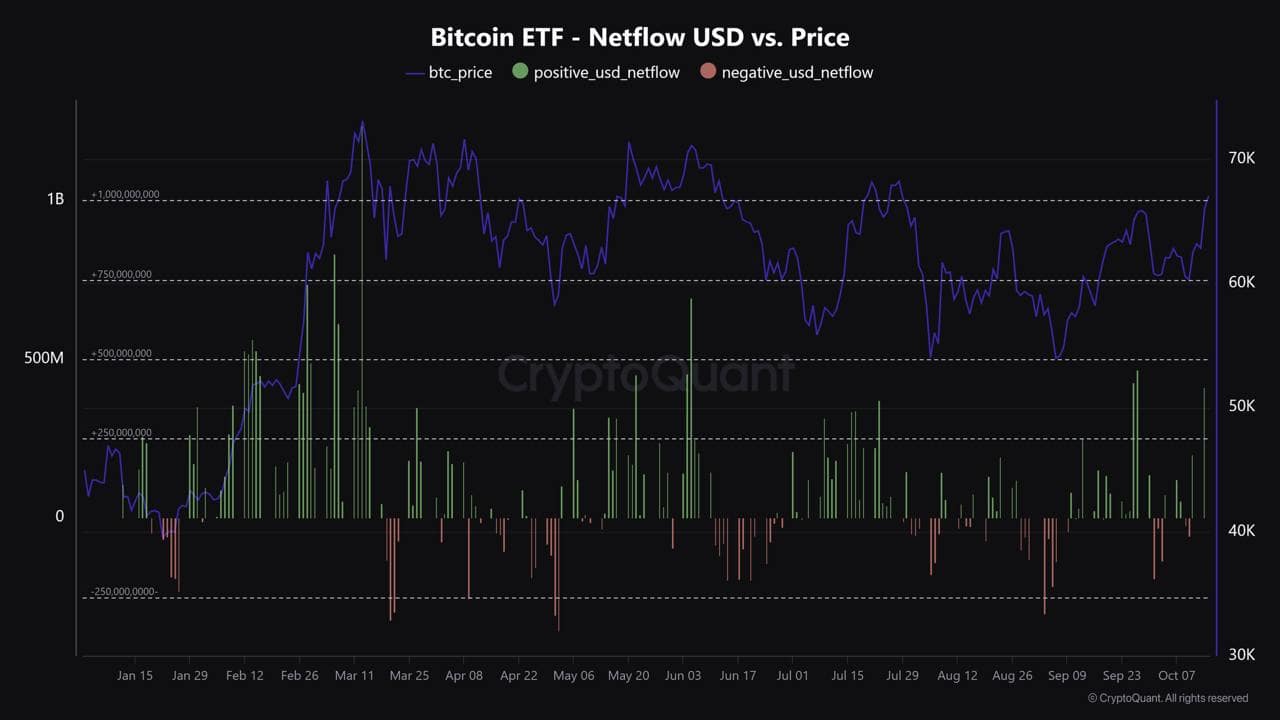

As a crypto investor, I’ve been closely monitoring the trends, and it seems that there’s some significant activity happening lately. After experiencing net withdrawals from Tuesday to Thursday totaling approximately $627.5 million, we saw a remarkable reversal on Friday with inflows of $253.6 million. This was followed by an even more impressive influx on Monday to the tune of $555.9 million and another $371 million yesterday. These figures indicate a strong interest in our financial vehicles, which is certainly encouraging!

During this timeframe, we’ve reached a grand total of $1,180.5 billion, marking the strongest three-day stretch since June. On Monday, Fidelity’s FBTC and Bitwise’s BITB topped the charts with $239.3 million and $100.2 million respectively. Yesterday, BlackRock’s IBIT reigned supreme with an impressive $288.8 million in new investments.

As a result, it was found by CryptoQuant that the combined asset under management (AUM) across all Bitcoin Exchange Traded Funds based in the U.S. reached an impressive milestone of about $60 billion, as of current market values.

It’s quite plausible that the strong performance of ETFs is driving Bitcoin’s current price surge. To put it into perspective, Bitcoin dropped to around $59,000 last Thursday, and now it has climbed by approximately 13.5% to reach $67,000.

Familiar Landscape Around ETH ETFs

Despite Bitcoin ETFs experiencing significant demand, the same cannot be found for their Ethereum counterparts. In fact, Ethereum spot ETFs have been facing difficulties garnering interest and have been in a negative trend since their launch in late July, largely due to the substantial withdrawals from the Grayscale fund.

Last week, there were two days without any significant trading, followed by minor inflows. The beginning of this trading week showed some positivity, boasting $17 million in net inflows on Monday. However, on Tuesday, there was a net outflow of $12.7 million.

Nevertheless, ETH’s price has also soared since last Thursday’s dump and is up by 7% on a weekly scale. As of now, the second-largest cryptocurrency sits above $2,600 after surging by 14% in the past month.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- Rob2628: The Best Builds to Play in Season 5 Diablo 4

- PRCL PREDICTION. PRCL cryptocurrency

- NUUM PREDICTION. NUUM cryptocurrency

- Top Gift Ideas for Your League of Legends-Obsessed BF on a Budget

- PENDLE PREDICTION. PENDLE cryptocurrency

- CGO PREDICTION. CGO cryptocurrency

- VRA PREDICTION. VRA cryptocurrency

- DFL PREDICTION. DFL cryptocurrency

2024-10-16 11:12