As an analyst with over a decade of experience in the crypto space, I’ve witnessed firsthand the ebb and flow of this dynamic industry. The recent resurgence of cryptocurrency activity in the Caribbean, particularly in the Cayman Islands, is not only intriguing but also promising. The shift towards well-known centralized exchanges like Coinbase and Binance, coupled with the influx of Layer 1 and Layer 2 solutions, suggests a maturing market that’s learning from past mistakes.

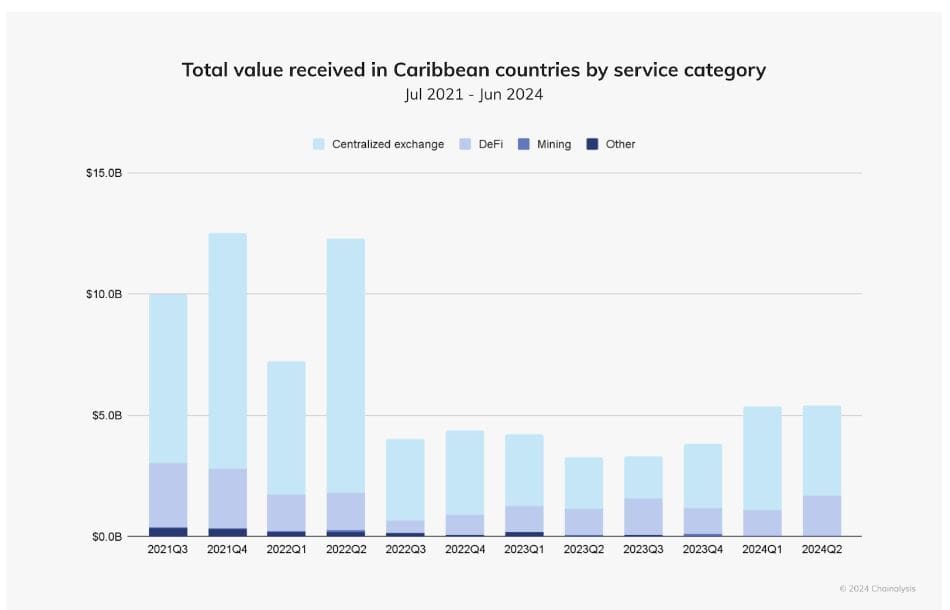

Following the collapse of FTX, a period of uncertainty and reduced participation in cryptocurrency activities swept through the Caribbean, causing a significant erosion of trust in digital platforms. Yet, since the end of 2023, there’s been a marked resurgence of these activities across the region, indicating a recovery.

It was stated by a leading blockchain research firm, Chainalysis, that users within the region are showing a growing preference for established centralized cryptocurrency exchanges such as Coinbase and Binance.

Caribbean’s Resurgence in Crypto Activity

The 2024 Geography of Cryptocurrency Report by Chainalysis, recently made available to CryptoPotato, showcases a notable increase in foreign clients setting up legal businesses in the Web3 and blockchain industries, specifically within the Cayman Islands, over the past twelve months.

As an analyst, I often come across ventures that encompass Layer 1 and Layer 2 solutions, extending their applications to diverse sectors like artificial intelligence (AI), cross-chain infrastructure, gaming, and data/cloud storage. Recently, insights into this were shared by David Templeman, a Specialist Financial Investigator for the Cayman Islands Bureau of Financial Investigation.

The aftermath of the collapses (FTX, TerraUSD/Luna, Celsius Network, and Three Arrows Capital) has led to an increased need for the industry to learn from past errors, enhance supervision, and establish stronger safeguards. There is a robust community of blockchain and Web3 companies, both physically located and legally based, within these Islands.

According to Chainalysis, there’s a good chance that the recent surge in cryptocurrency usage in the Caribbean could make it a significant center for adoption in the coming years.

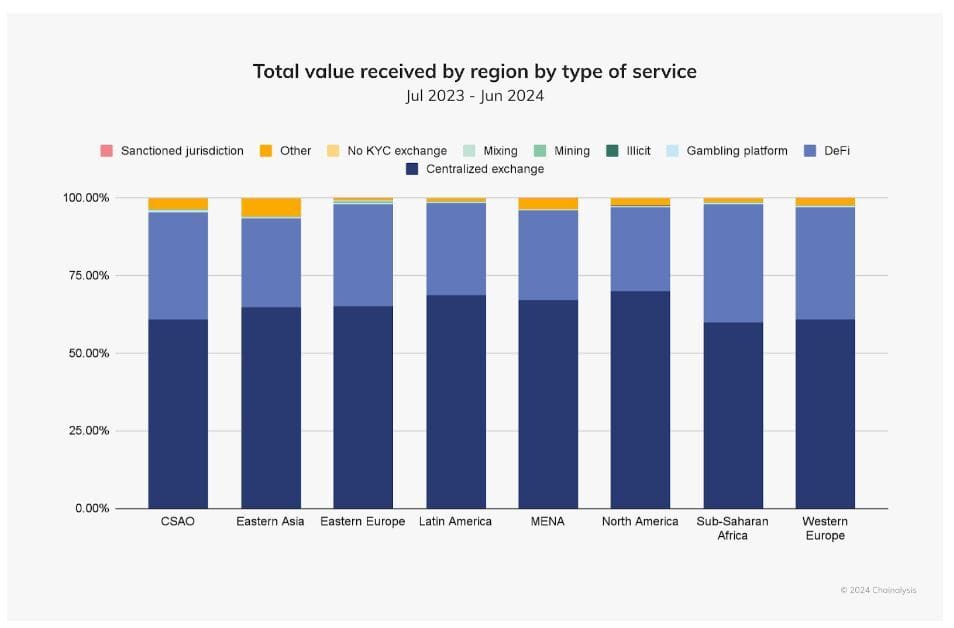

It’s worth noting that Latin America ranks as the second-quickest area globally for cryptocurrency acceptance, with a year-on-year (YoY) expansion pace roughly equating to 42.5%. According to Chainalysis, the preferred service among Latin Americans is centralized exchanges (CEXs), which are used by about 68.7% of users. This usage rate is slightly lower than in North America.

Major financial entities, especially those making trades exceeding $10,000, significantly contribute to the overall worth of transactions in this area, being the main contributors.

Latin America’s Crypto Renaissance

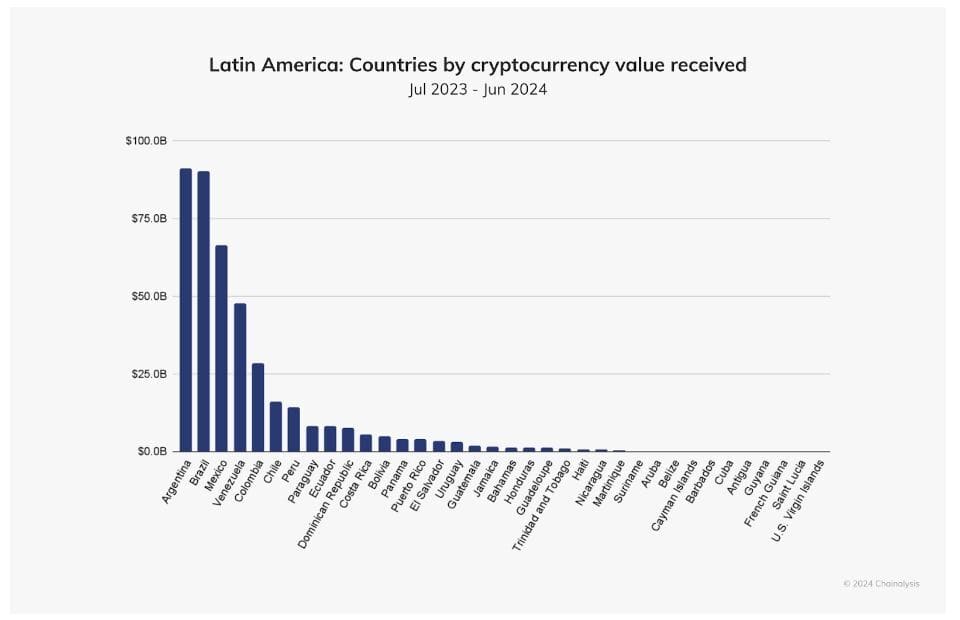

Argentina takes the lead with an estimated $91.1 billion in value from cryptocurrency transactions, just barely outpacing Brazil at about $90.3 billion. In terms of stablecoin market dominance within Latin America, Argentina stands tall, handling 61.8% of all stablecoin transaction volume. This figure overshadows Brazil’s 59.8%, and it is substantially higher than the worldwide average of 44.7%.

In the recent period, significant growth in institutional crypto activities within Brazil is noticeable, with a rise of approximately 29.2% in monthly transactions worth over $1 million between the last two quarters of 2023 and an additional 48.4% increase from Q4 2023 to Q1 2024. This indicates that major financial players are showing renewed interest in cryptocurrency.

Moreover, it’s worth noting that Venezuela has been rapidly developing as one of Latin America’s leading crypto markets, experiencing a year-on-year growth rate of 110%, significantly outpacing all other nations in the region. This growth comes amidst the ongoing challenges faced by the Maduro government.

It’s worth noting that Decentralized Finance (DeFi) is another area of expansion within the realm of cryptocurrencies in Venezuela. While centralized services have held the majority of value since 2022, there has been a significant increase in curiosity about DeFi, which became particularly evident by the end of 2023.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- GBP CNY PREDICTION

- PAW PREDICTION. PAW cryptocurrency

- Rob2628: The Best Builds to Play in Season 5 Diablo 4

- From Season 3 Episode 3 recap: ‘Mouse Trap’

- Why Fortnite Players Believe Epic Games Forgot Key Characters from Pirates of the Caribbean

- DAO PREDICTION. DAO cryptocurrency

- NUUM PREDICTION. NUUM cryptocurrency

2024-10-13 17:38