As an analyst with over 10 years of experience in the cryptocurrency market, I find myself closely monitoring Bitcoin’s current state of indecision. Having navigated countless bull and bear markets, I can attest that this consolidation phase we’re witnessing is a common occurrence before a significant price breakout.

The price of Bitcoin is showing uncertainty, being trapped between a narrow band, with the 100-day and 200-day moving averages acting as its boundaries.

An impending breakout from this range will likely determine the asset’s short-term direction.

Technical Analysis

By Shayan

The Daily Chart

Since March 2024, Bitcoin has been in a prolonged period of sideways movement, hovering between approximately $55,000 and $71,000 without showing any definite upward or downward tendency.

For a while now, the market has been in a holding pattern, suggesting that the number of buyers and sellers is roughly balanced. However, there’s been more accumulation towards the lower end and distribution towards the upper part of the range. But, there’s a potential negative development: Bitcoin has fallen below its 200-day moving average at $63.4K, which could be a bearish signal.

Initially, the trend continued downwards until it reached the 100-day moving average at $61K. But instead of continuing its descent, the price paused and entered a period of relatively stable fluctuations at this point.

Bitcoin’s price movement is being tightly controlled between a limited span, with the 100-day and 200-day moving averages acting as boundaries. This indicates that a potential breakout could soon determine its short-term trajectory. A clear move beyond these boundaries would probably signal the start of the next significant trend.

The 4-Hour Chart

Over the last extended period of sideways movement on the 4-hour chart, an ascending wedge shape has emerged. This wedge serves as a range within which the price has been bouncing up and down. If this wedge breaks below, it usually indicates a resumption of the initial downtrend.

As a result of intensified selling activity around the 0.786 Fibonacci Orthogonal Trend (OTE) line, Bitcoin underwent a substantial price drop, falling towards the lower edge of the wedge.

Bitcoin has strengthened following a supportive level, but there’s an attempt by sellers to push it below the lower boundary of the forming wedge, which aligns with the $60,000 support zone. If this downward break happens, the next significant resistance for Bitcoin could be the $58,000 support area.

On-chain Analysis

By Shayan

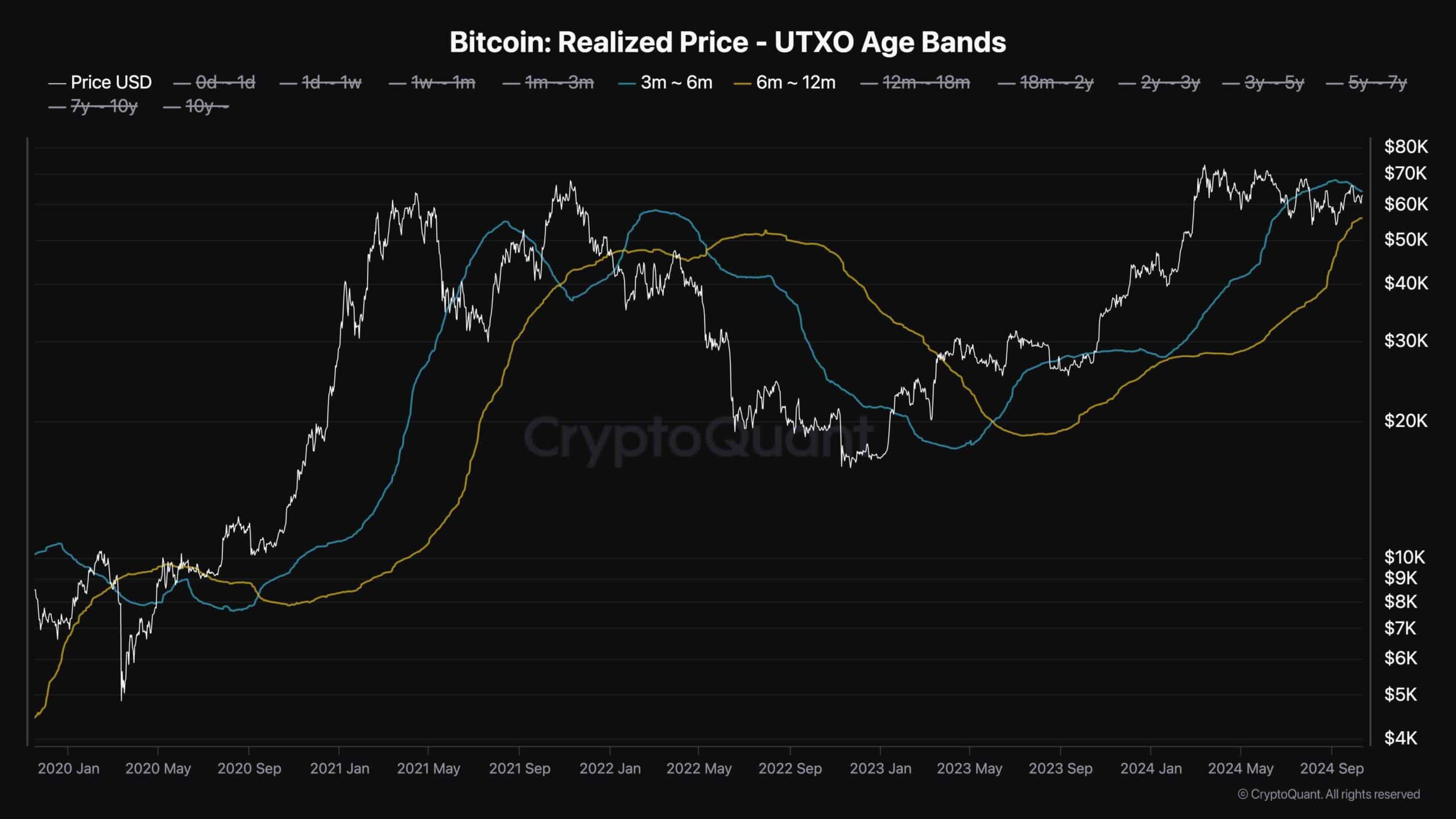

As a crypto investor, I find it valuable to closely watch the realized price UTXO age bands when analyzing Bitcoin’s market behavior. This on-chain metric helps me understand the typical cost basis of coin owners, segmented based on their holding duration. Essentially, it provides insight into the average price at which coins were bought over time, offering a more nuanced perspective on market trends.

Previously, the prices attained by Bitcoin cohorts within the 3-6 month (short-term) and 6-12 month (long-term) periods have been significant markers for both support and resistance. When Bitcoin fails to surpass the average purchase price of these groups, it usually indicates a bearish trend. However, if Bitcoin manages to exceed this average purchase price, it typically implies growing bullish sentiment, as new investors are willing to maintain their holdings at higher prices.

At present, Bitcoin’s price is hovering between the realized prices of these two groups:

- $64K for the short-term holders (3-6 months)

- $55K for the long-term holders (6-12 months)

Bitcoin has been moving closer to the resistance level of around $64,000 that was previously established by long-term investors over a period of 3 to 6 months. If it manages to exceed this barrier, it could be an indication of strong upward movement and continued bullish sentiment. Conversely, if Bitcoin fails to surpass this zone, it might suggest increased selling from short-term investors, which could lead to a downward trend towards approximately $55,000.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- GBP CNY PREDICTION

- DAO PREDICTION. DAO cryptocurrency

- NUUM PREDICTION. NUUM cryptocurrency

- Why Did Persona Use the Term ‘Poo Poo’? A Dive into Localization Mishaps

- Why Fortnite Players Believe Epic Games Forgot Key Characters from Pirates of the Caribbean

- Rob2628: The Best Builds to Play in Season 5 Diablo 4

- PIP PREDICTION. PIP cryptocurrency

2024-10-12 18:06