As a seasoned crypto investor with a knack for deciphering market movements and legal jargon alike, I find myself both encouraged and apprehensive regarding the latest developments between Ripple and the SEC. The court’s decision to rule XRP‘s secondary sales as non-securities is undeniably a positive step, yet the $125 million fine and subsequent cross-appeal from the SEC have injected an unwelcome dose of uncertainty into the mix.

TL;DR

- Judge Torres ruled XRP’s secondary sales aren’t securities, but Ripple was fined $125M. The company filed a cross-appeal after the SEC contended, adding more legal uncertainty.

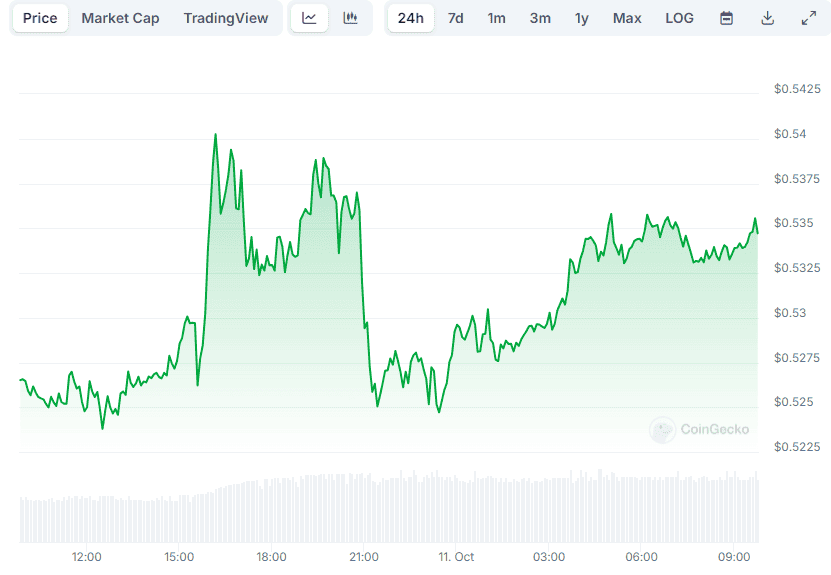

XRP saw a slight recovery to $0.54 but remains down in the past two weeks.

The Latest Update

The legal battle between Ripple and the US Securities and Exchange Commission (SEC) hit a significant turning point in early August when Judge Analisa Torres ruled that the sales of XRP on secondary markets to individual investors were not classified as securities transactions. Contrastingly, she mandated the company to pay a $125 million fine for breaching specific regulations.

The figure merely symbolized a tiny portion of the $2 billion the SEC originally sought, leading numerous individuals, including Ripple’s CEO, to deem the decision a victory.

The regulatory body contested the 2023 ruling, which in turn led to a significant drop in value (double-digit) for the indigenous cryptocurrency, introducing fresh uncertainties.

Most recently, Ripple’s CLO Stuart Alderoty said the firm filed a cross-appeal “to ensure nothing’s left on the table, including the argument that there can’t be an “investment contract” without there being essential rights and obligations found in a contract.”

He reminded that the SEC has already stated that it doesn’t contend with the magistrate’s decision that XRP itself isn’t a security. “They even apologized in another case for suggesting a token itself could be a security,” the executive added.

To summarize, Alderoty expressed that the company is eagerly anticipating the federal court of appeals to decisively end Gensler’s ill-advised assault on the cryptocurrency sector.

XRP Price Reaction

Following Alderoty’s announcement, I noticed a notable surge in the asset’s price, peaking at approximately $0.54. At present, according to CoinGecko’s data, it is trading around $0.53, showing a modest 1.5% growth on a daily basis.

Despite this, XRP has been consistently trading in the negative over the past fortnight, mirroring the overall downturn experienced by the cryptocurrency market during that timeframe.

Regardless of the recent instability in the token’s performance, several experts remain hopeful that a robust surge could occur soon. The user Dark Defender recently contended that the news concerning the Ripple vs. SEC case holds only minimal influence on XRP, as its value is primarily driven by technical indicators.

When Heikin Ashi Candles, or average-price candles currently valued at $0.57, are taken into account, it’s significant that the monthly average price remains above the crucial support level. This trend is reinforced by the MACD indicator, which shows a green dot on the monthly time frame for XRP. I am extremely optimistic about this and believe that XRP will likely continue in a similar fashion.

Read More

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- AEVO PREDICTION. AEVO cryptocurrency

- NCT PREDICTION. NCT cryptocurrency

- USD HUF PREDICTION

- GAMMA PREDICTION. GAMMA cryptocurrency

- APFC PREDICTION. APFC cryptocurrency

2024-10-11 10:23