As a seasoned crypto investor with over a decade of experience navigating the volatile Bitcoin market, I find myself cautiously bearish at this juncture. The recent rejection at $66K and the break below the 200-day moving average have raised red flags for me, signaling that bearish sentiment may be gaining strength.

As an analyst, I’m observing a significant shift in the Bitcoin market. The failure to surpass the $66K mark and the subsequent drop below the 200-day moving average hints at a growing bearish outlook among investors.

If the price doesn’t maintain its stability around $60,000 as a support level, there’s a higher chance it could dip towards the range of $52,000 to $55,000 in the near future.

Technical Analysis

By Shayan

The Daily Chart

As an analyst, I observed a significant uptick in Bitcoin’s price on the daily chart, propelling it above both the 100-day and 200-day moving averages. This temporary movement ignited a renewed sense of optimism among investors, suggesting a potential bullish trend.

Nevertheless, when Bitcoin approached the $66K mark, strong selling activity arose, effectively ending the upward trend. This level has been traditionally tough for Bitcoin to break through, and its inability to do so led to a substantial reversal or “rejection.

As an analyst, I’m observing that Bitcoin’s current trading price falls below its 200-day moving average at approximately $63.4K, and it’s now hovering around the 100-day moving average at about $61K. This area is significant because the $60K psychological and substantial support level lies beneath.

If Bitcoin falls beneath the current threshold, it might lead to a medium-term drop towards the $52K to $55K region, which appears to be the next significant support zone. Should the negative trend persist, this area could potentially serve as the destination for further declines.

The 4-Hour Chart

On a 4-hour timeframe, Bitcoin’s rise encountered strong opposition within the Fibonacci OTE retracement area that aligns with approximately $66K in price.

Due to strong selling activity, there was a significant price drop by approximately 10%. The high number of sellers around the $66K mark suggests that this level continues to be a tough hurdle, serving as a crucial resistance point in the overall market perspective.

Due to recent developments, it’s predicted that Bitcoin could enter a brief period of stability, with the significant resistance at around $60K being a key point to monitor closely. If Bitcoin maintains its position above this level, it might stabilize before making another price increase attempt. Conversely, if the $60K level is broken, a more substantial drop toward the $55K range could occur, potentially signaling a switch to a prolonged downtrend.

On-chain Analysis

By Shayan

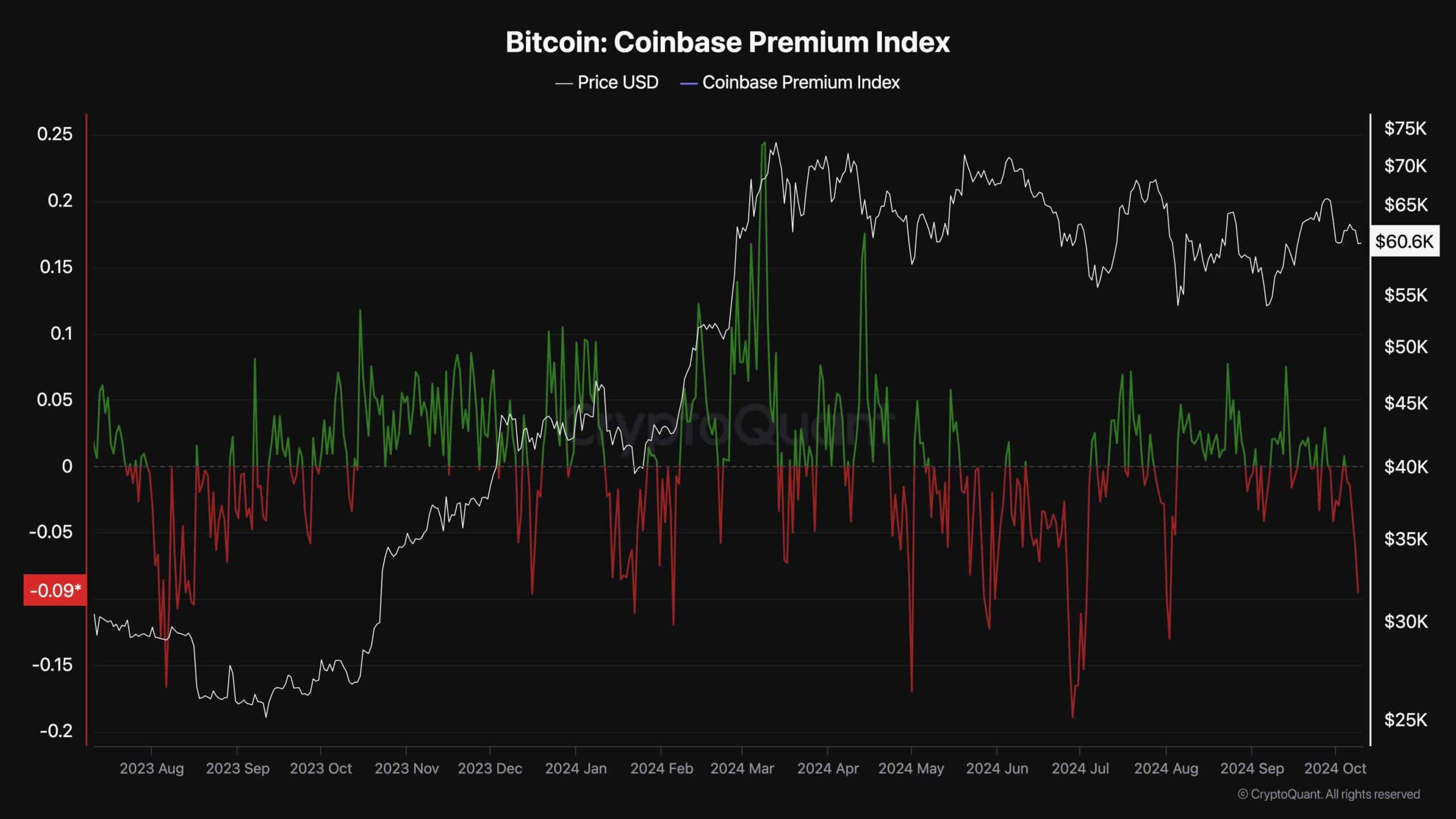

The Bitcoin Coinbase Premium Index serves as a crucial tool for determining if major American investors and traders are actively purchasing or offloading Bitcoin on Coinbase more than other platforms. At present, this index displays negative figures, suggesting a pessimistic market atmosphere, possibly due to intense selling pressure or a halt in large-scale investment accumulation.

In the short term, the negative premium indicates that U.S.-based institutional investors are not showing much interest, which has a bearish impact on the market. But, this temporary pessimism among investors can sometimes offer good buying chances for long-term holders. From a broader viewpoint, even though the market is currently following a downward trend, both the urge to buy and sell seem to be decreasing.

From my perspective as a researcher, it appears we’re in a phase where the market seems undecided, neither the bulls nor the bears seem to have a firm control over the price movement. This ambiguity doesn’t bode well for short-term trading, as the absence of a clear trend introduces an elevated level of risk.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- DCB PREDICTION. DCB cryptocurrency

- PERI PREDICTION. PERI cryptocurrency

- BEETS PREDICTION. BEETS cryptocurrency

- INR RUB PREDICTION

2024-10-10 16:50