As a seasoned researcher with a decade of experience in the cryptocurrency market, I have witnessed countless bull traps and bearish reversals. The recent attempt by Ethereum to break above the descending channel’s middle threshold was no exception – it turned out to be another false breakout, leading to a sharp decline.

As a researcher, I’ve observed that Ethereum‘s latest effort to surpass the middle barrier of its multi-month descending channel at around $2.6K appears to have been an unsuccessful attempt, resulting in a significant reversal and subsequent drop.

As a researcher, I’m observing a pattern that hints at a possible prolongation of the downward trend towards the $2.1K support level in the medium term.

Technical Analysis

By Shayan

The Daily Chart

The way Ethereum’s price movement is shaping up on the daily chart suggests it may be a trap for bullish investors, much like the situation in late August when ETH surpassed the middle line of the descending channel but was quickly turned down. A similar pattern seems to have emerged more recently.

Following a brief spike above the $2.6K barrier, the price struggled to sustain its upward movement and encountered substantial selling forces, leading to a 15% decline. The inability to set a new high suggests that sellers currently hold the upper hand in the market.

At present, the cryptocurrency is nearing an important support area approximately $2.1K, a point that coincides with a significant historical price trough. It appears to be heading into a prolonged period of sideways movement (consolidation) for the near future, gradually decreasing towards this critical level.

The 4-Hour Chart

On a 4-hour scale, Ethereum struggled to sustain its rise around the 0.5 (approximately $2,600) and 0.618 (around $2,800) Fibonacci levels, which led to the formation of a bearish three-part move.

As a researcher, I noticed a familiar reversal pattern alongside a bearish divergence between the price and the RSI indicator, indicating that sellers were regaining control in the market. This insight led to Ethereum’s sudden drop, moving towards the lower boundary of the ascending flag at approximately $2.3K.

As a crypto investor, I’m seeing a push from sellers trying to drive Ethereum’s price below the lower boundary of the current flag formation. If this downward breakout happens, Ethereum might initiate a new bearish trend with the $2K psychological support serving as its primary target. However, the $2.1K level is where buyers are standing strong, ready to defend their position.

Onchain Analysis

By Shayan

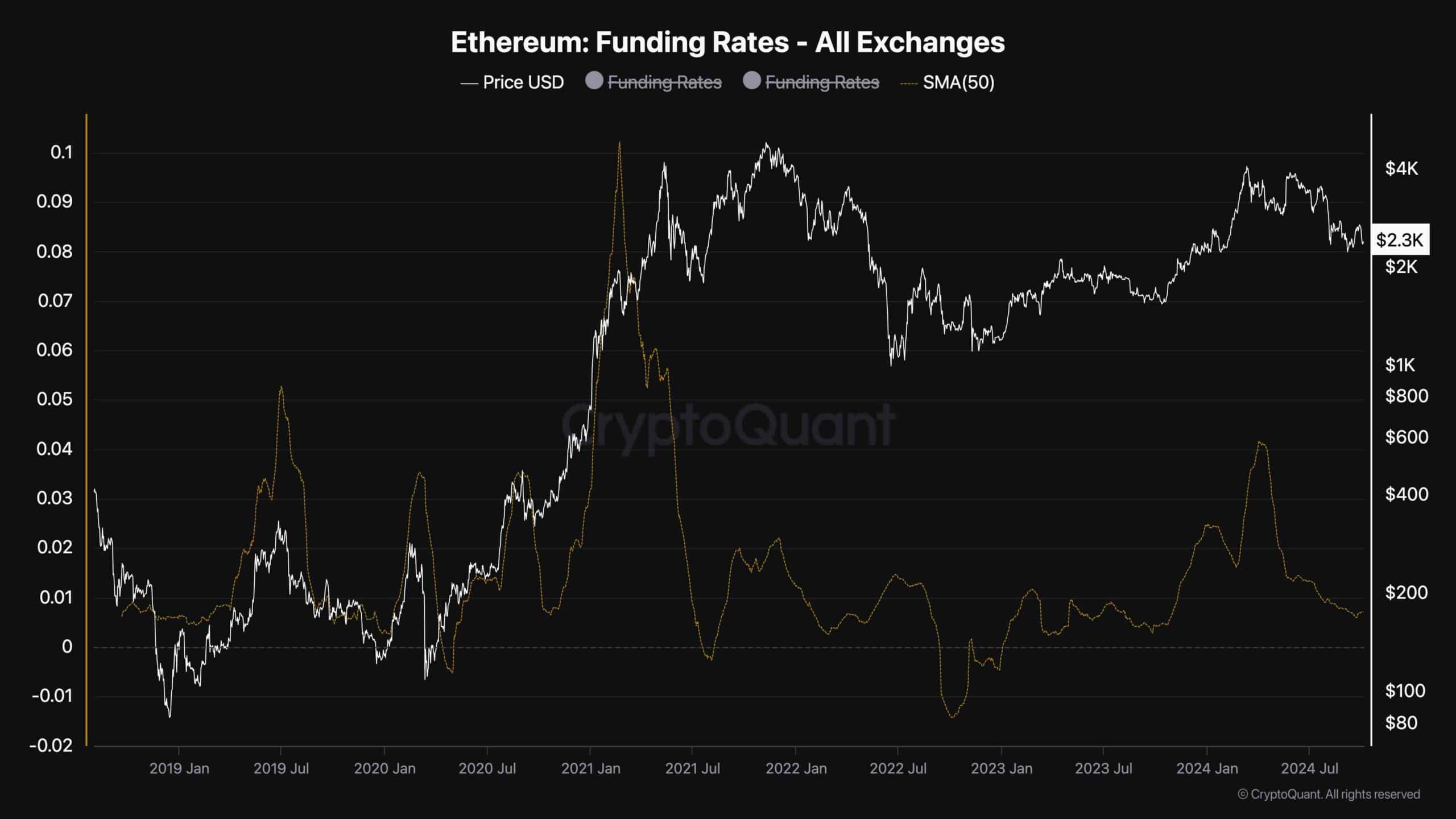

In this examination, we delve into the trends of Ethereum’s 50-day moving average for its funding rates. This helps us gain a more distinct understanding of the overall attitude in the futures market.

Lately, the funding rate for ETH‘s 50-day moving average has consistently dropped, hitting its lowest point in 2024. This persistent decrease suggests that futures traders are feeling pessimistic, which could mean reduced interest in buying ETH. Typically, such a situation coincides with falling prices as more traders are shorting the market.

To see Ethereum bounce back and reach higher value points, it’s crucial that demand rises within the perpetual futures market. The persistent decrease in funding rates indicates that sellers are being more assertive than buyers, indicating a predominantly bearish outlook for ETH in the near future.

While low return rates on investments often indicate a bearish market, they might also hint at an upcoming market shift or reversal.

This occurs as a result of quick sell-offs (liquidation cascades), where strong selling forces (aggressive short positions) are forced to sell, leading to a swift increase in price. However, for this to happen, there must be significant purchasing pressure from the main market (the spot market) that backs up the recovery.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- EUR INR PREDICTION

- USD UAH PREDICTION

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- AKRO PREDICTION. AKRO cryptocurrency

- FIDA PREDICTION. FIDA cryptocurrency

- MCADE PREDICTION. MCADE cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

2024-10-05 08:02