As a seasoned analyst with years of experience navigating the tumultuous waters of the crypto market, I find myself intrigued by the latest developments surrounding Bitcoin. The recent drop in price following Iran’s missile strikes is reminiscent of a rollercoaster ride, but the resilience shown by US investor demand is a beacon of hope amidst the chaos.

The value of cryptocurrencies plunged sharply due to heightened global political conflicts, following Iran’s missile attacks on Israel. For example, Bitcoin sank under $60,500 but then made a small comeback.

Contrarily, interest from American investors continues to be robust, as per recent studies. This pattern might offer Bitcoin some relief from bearish pressures.

US Investor Demand Remains Strong

In an October 3 post, CryptoQuant noted the chance of a short-term Bitcoin price increase.

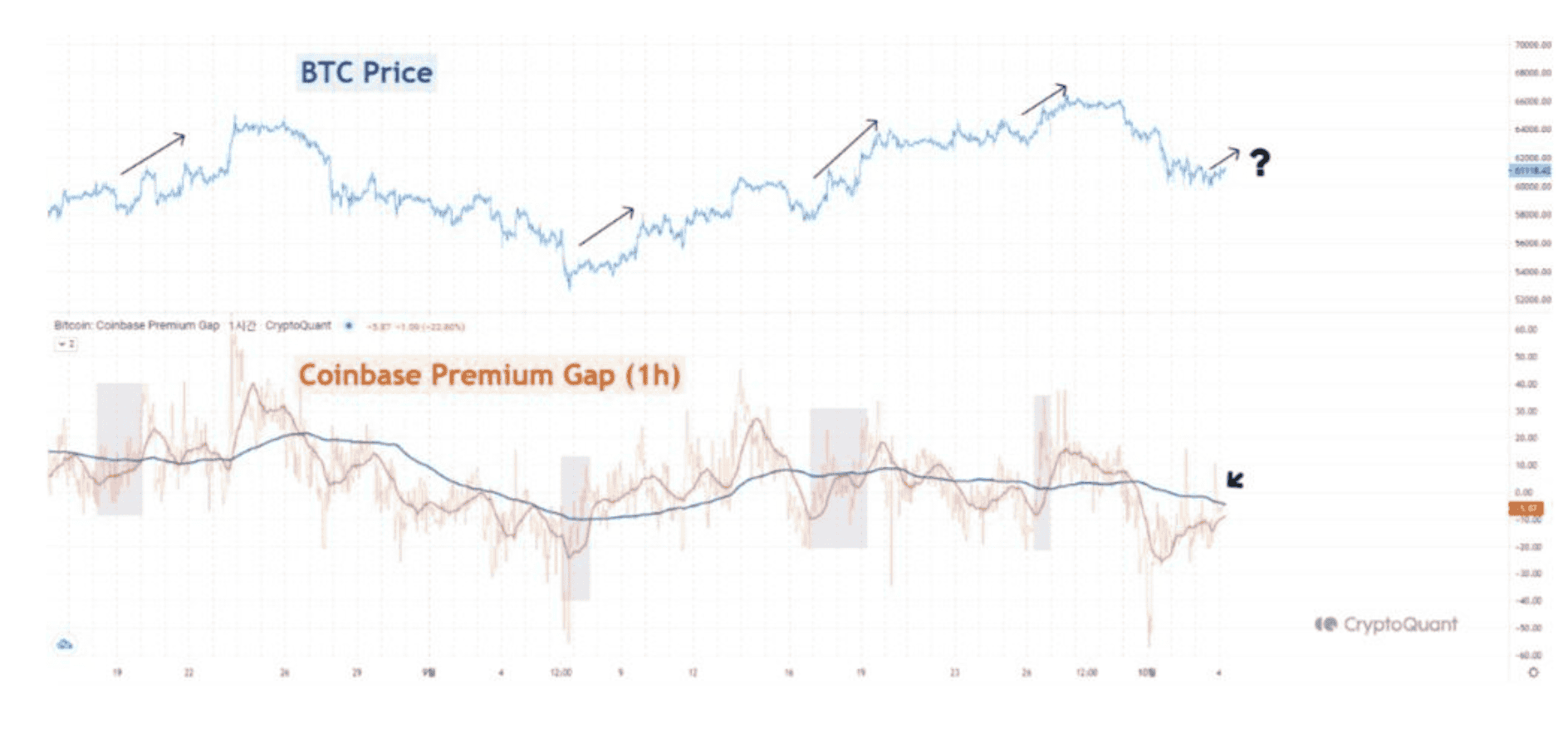

According to CryptoQuant analyst Yonsei_dent’s analysis, the Coinbase Premium Index suggests an upcoming short-term rise in Bitcoin’s price. This conclusion is drawn by examining the 1-hour time frame and noticing when the daily moving average crosses above the weekly one, a phenomenon known as a “golden cross.” This bullish signal indicates a positive trend for Bitcoin prices in the near future.

Currently, my observations show that the daily average is temporarily exceeding the weekly average, and the difference between them is diminishing, which hints at an upward trend. Historically, such a pattern has often preceded short-term price hikes, as was the case on October 1st when robust US investor demand propelled Bitcoin upward, even amid a correction.

A surge in Coinbase Premium might suggest a comparable trend, as increased interest from American investors could signal an uptick in Bitcoin’s value.

Bitcoin Sees Record Outflows from Exchanges

To further support the optimistic viewpoint, a study by CryptoQuant indicates that Bitcoin has recently witnessed its most significant withdrawal from exchanges since November of last year. This trend suggests a change in investor sentiment within the market.

According to blockchain data, there’s been a noticeable rise in Bitcoin withdrawals from exchanges, as suggested by the rising trends in the 30-, 50-, and 100-day moving averages. This substantial withdrawal usually means investors are transferring their Bitcoins to personal wallets, thereby decreasing the circulating supply on trading platforms. Such a decrease can potentially boost the asset’s price due to reduced market liquidity.

Frequently, this pattern implies that investors believe strongly in Bitcoin’s long-term growth, choosing to keep their investments instead of selling and trading. This could potentially signal optimism for future market movements.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- EUR INR PREDICTION

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- USD UAH PREDICTION

- USD ILS PREDICTION

- ETH CAD PREDICTION. ETH cryptocurrency

- VELA PREDICTION. VELA cryptocurrency

- CGPT PREDICTION. CGPT cryptocurrency

2024-10-05 04:46