As a seasoned crypto investor with over a decade of experience in this volatile market, I’ve seen Bitcoin soar and plummet like a rollercoaster ride without seatbelts. The current price action at $64K is reminiscent of a high-stakes poker game where every player is holding their breath, waiting for the dealer to reveal the next card.

As a crypto investor, I find myself standing at a pivotal juncture where Bitcoin‘s price seems to be making or breaking the game. The immediate response of this digital currency could well set the course for the broader crypto market in the coming months.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Over the past day-by-day progression, the asset has been surging ever since it bounced back from the crucial $52K support point. It’s managed to breach both the $56K and $60K resistance levels, indicating a strong upward trend. Yet, it’s now approaching the 200-day moving average, which lines up with the significant $64K barrier for potential resistance.

A strong upward trend might push the price even higher following a breakout. Conversely, if the cryptocurrency experiences a rejection and falls, the $60K mark could act as a supportive base, possibly causing it to rise again.

The 4-Hour Chart

On the 4-hour scale, Bitcoin’s price pattern appears challenging due to its current consolidation within a narrowing downward trend around the $64,000 mark.

If it drops significantly (bearish move), this could form a typical bearish reversal pattern in price action. On the other hand, if the asset surges past its current position, the pattern might not materialize, and a swift increase towards the $70K region could ensue instead. Additionally, with the Relative Strength Index (RSI) reading above 50%, there’s still a stronger likelihood of a bullish trend continuation.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

Bitcoin Short-Term Holder SOPR

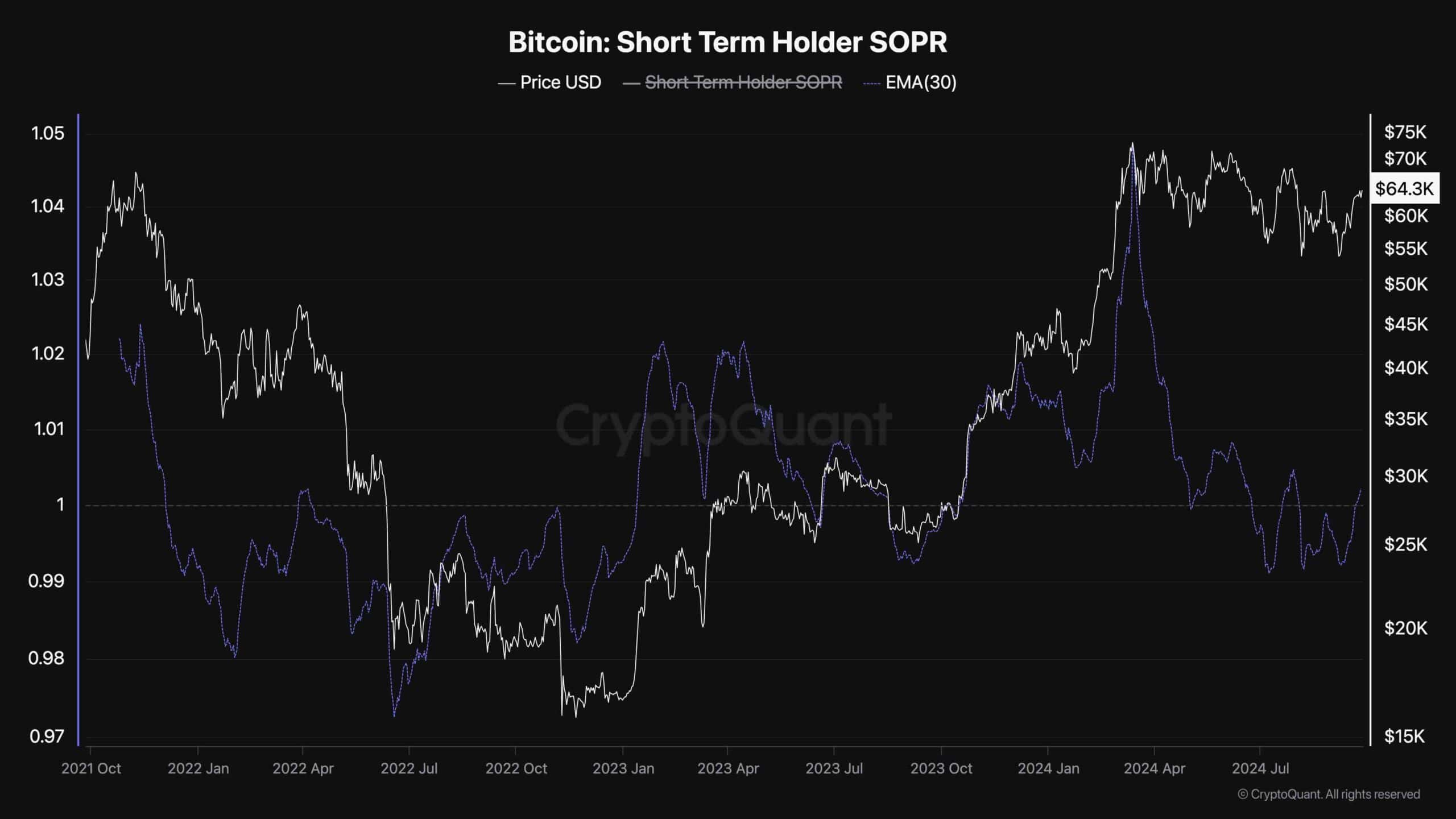

Over the latest period of Bitcoin price stabilization and slight drop, numerous short-term investors have been alarmed and unloaded their assets, some even without making a profit. The graph presented illustrates the Short-Term Holder SOPR, which quantifies the proportion of gains or losses reaped by brief-term traders.

Looking at the graph, it’s clear that when Bitcoin hit $70K for the first time, the STH SOPR reached an all-time high. But over the last few months, it’s plummeted significantly. In fact, short-term investors have been in the red since July, as the metric has dipped below 1. However, with the recent surge in price, these investors are now seeing profits once more.

While this is a natural behavior in bull markets, if the selling pressure resulting from this profit-taking is not met with sufficient demand, the market could be overwhelmed and drop lower again.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- Honkai: Star Rail’s Comeback: The Cactus Returns and Fans Rejoice

2024-09-26 17:18