As a seasoned market analyst with over two decades of experience under my belt, I’ve seen my fair share of market volatility and liquidations. The recent price actions of Bitcoin (BTC) have been nothing short of exhilarating.

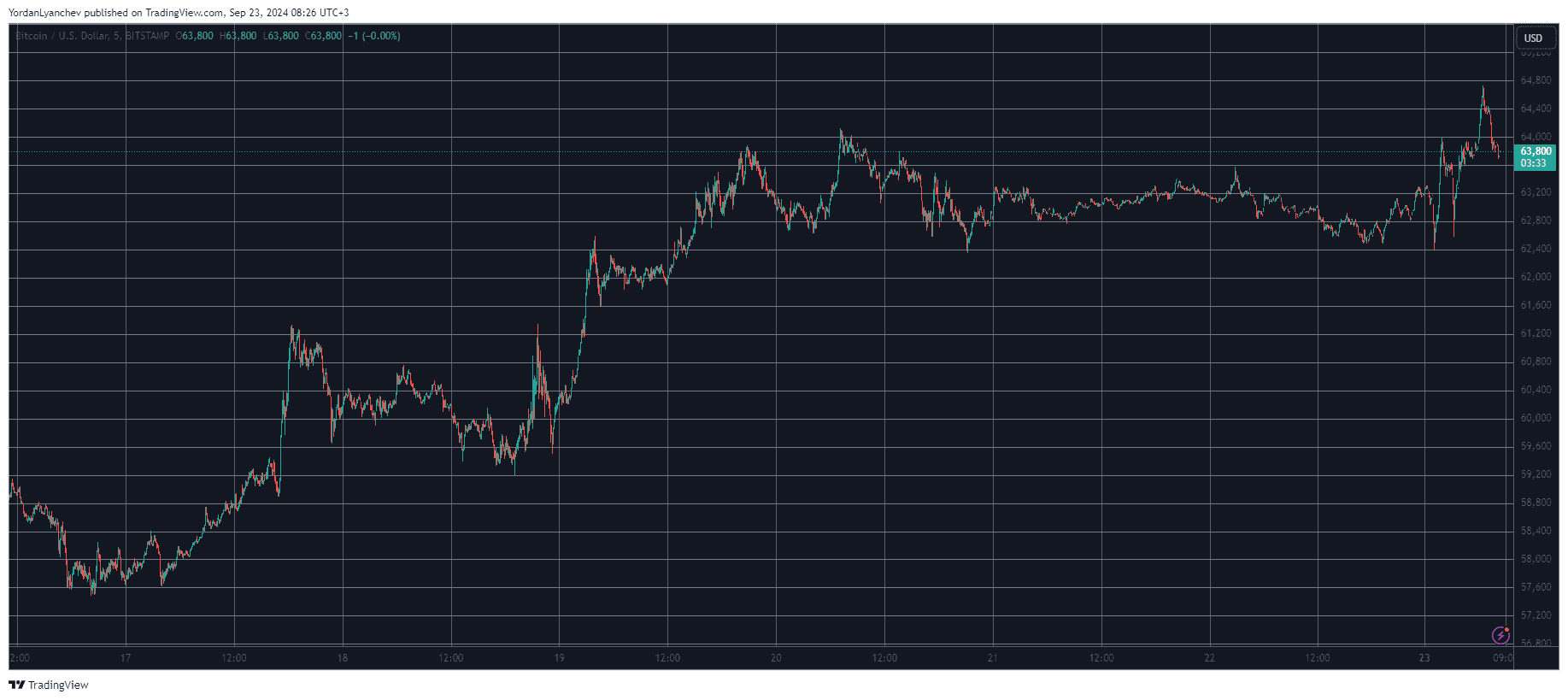

Over the tranquil weekend, Bitcoin generally hovered near $63,000. However, during the early Asian trading hours on Monday, it made an aggressive push, only to be halted slightly short of $65,000.

Following the dismissal, the market experienced increased instability, causing approximately 60,000 traders to be liquidated on a daily basis.

Bitcoin experienced a series of optimistic price movements during the past few days, particularly after the US Federal Reserve reduced its key interest rates by 0.5% on Wednesday. This announcement prompted immediate fluctuations in BTC‘s price, but ultimately, the bullish sentiment took over and propelled the asset upward. The price surge reached over $64,000 by Friday morning.

Over the weekend, the cryptocurrency struggled to maintain its upward trend and experienced a loss of pace, with reports indicating that it primarily traded within a narrow band close to $63,000 throughout.

On Sunday night and early Monday, there was increased price fluctuation for Bitcoin. Initially, it dipped to approximately $62,400, then spiked to around $64,000, fell by roughly $1,500 again, and has recently started a significant upward trend.

As a result, the price peaked at a four-week maximum of $64,800 on Bitstamp. However, the bears swiftly stepped in to halt Bitcoin’s upward trend. At present, the value of the asset hovers around $1,000 less than its peak.

In a similar fashion to Bitcoin, several altcoins followed its lead in performance. However, some notable exceptions like Ethereum and Binance Coin have surpassed a 2% increase on a daily basis. Currently, Ethereum is trading above $2,650, while Binance Coin has almost reached $600.

Excessive price fluctuations have caused significant damage to traders who had borrowed too much, leading to around 62,000 such investors losing their positions each day. As reported by CoinGlass, the total worth of these liquidated trades can reach up to $165 million.

As a crypto investor, I recently experienced a significant event when my largest Ether (ETH) position, valued at approximately $2.73 million, got liquidated on Binance.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- AEVO PREDICTION. AEVO cryptocurrency

- BRISE PREDICTION. BRISE cryptocurrency

- GBP CAD PREDICTION

- WOO PREDICTION. WOO cryptocurrency

- WELT PREDICTION. WELT cryptocurrency

2024-09-23 08:34