As a seasoned researcher with over two decades of experience in the financial markets, I find myself intrigued by the current state of Ethereum (ETH). Having closely observed market trends and patterns across various asset classes, I must admit that predicting cryptocurrencies can be as unpredictable as trying to forecast the weather in a hurricane.

TL;DR

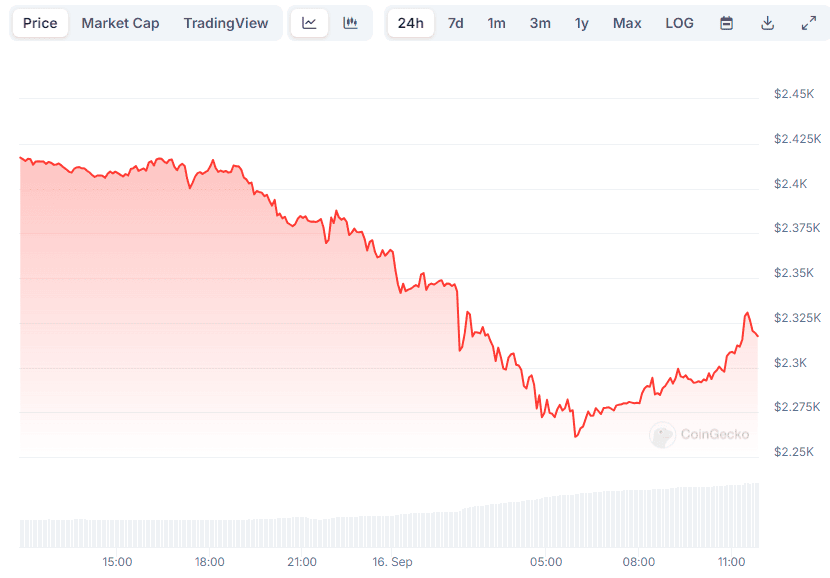

- ETH has dropped 11% over the past month, with analysts warning of a possible further decrease to $1,800 if key support levels fail.

Others predict a potential rebound, citing a “bear trap” pattern and historical trends.

Further Pain for ETH Bulls?

Recently, Ethereum (ETH) has been one of the underperformers from the top ten cryptocurrencies, experiencing a 11% decrease in price over the past month. In the last day, it has dropped by 4%. Currently, according to CoinGecko’s data, its value is approximately $2,300.

As a crypto investor, I’m keeping an eye on ETH and one analyst who catches my attention is Ali Martinez. He believes that ETH’s downward trend might not have run its course yet. He identifies the $2,290-$2,360 range as a crucial support level, which is where roughly 1.9 million addresses are holding around $52.3 million of Ethereum.

A cryptocurrency advocate thinks ETH might drop by approximately 20% to around $1,800 if its price falls beneath that level. Keep in mind that just a short while ago, its value had momentarily dipped to $2,260.

It appears that certain metrics related to Ethereum’s blockchain may signal a potential further decrease in its value in the upcoming days. One such metric is the “In the Money” indicator, which has dropped by 0.19% daily. This indicator reflects the shift in the number of Ethereum investors currently enjoying profits on paper. Currently, approximately 54% are making a profit, while about 39% are experiencing losses.

The Bullish Scenario

Despite Ali Martinez’s belief, many other analysts are hopeful that Ethereum will make a comeback. The user Phoenix believes the asset’s graph has created a “bear trap,” which could indicate a possible upsurge in the upcoming months.

Javon Marks suggests that Ethereum’s current trend appears similar to the one observed in 2023, potentially leading to a rise of up to 165%.

2023 might serve as the foundation for a significant surge in the cryptocurrency market, potentially happening soon. The predicted peak is at around $4,723.5, and surpassing this could open the door for $8,100 and beyond, indicating a potential doubling of the price, with the possibility of even greater increases. This was the analyst’s assertion.

Last but not least, ETH’s RSI has recently plummeted to a bullish ratio of around 30. The Relative Strength Index (RSI) helps traders assess overbought or oversold conditions and thus predict possible price reversals. Readings below 30 generally indicate that ETH is oversold, which could be a precursor of a rally. Conversely, a ratio above 70 could be interpreted as bad news for bulls since it can be followed by a correction.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- How to Handle Smurfs in Valorant: A Guide from the Community

- Brawl Stars: Exploring the Chaos of Infinite Respawn Glitches

- W PREDICTION. W cryptocurrency

2024-09-16 13:28