As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles. The current trend of Ethereum (ETH) has been particularly intriguing due to its volatile nature.

Over the last few months, the cost of Ethereum has been dropping, but it’s currently holding steady at an important resistance point.

Meanwhile, the market is yet to demonstrate a bullish shift.

Technical Analysis

By Edris Derakhshi

The Daily Chart

Lately, the value of this asset has failed to break through the $2,700 barrier on a day-to-day basis and has instead trended downwards, moving towards the $2,200 area where it’s currently finding support.

Although the price in this region has stayed steady, the market hasn’t shown a strong bounce back yet. With the Relative Strength Index (RSI) still under 50, the trend seems to favor a downtrend continuing. This suggests that dropping below the $2,200 level could still be likely.

The 4-Hour Chart

On a 4-hour scale, it’s clear that the market has consistently been trending upward. This is indicated by the repeated formation of both higher peaks (high highs) and troughs (high lows), following its recovery from the $2,200 support point.

Yet, the bullish momentum is still lacking, and the market should at least break above the $2,700 level before a long-term bullish reversal could be expected. As a result, whether the recent consolidation is an accumulation or a distribution phase remains to be seen.

Sentiment Analysis

By Edris Derakhshi

Ethereum Exchange Reserve

Even though Ethereum’s price has dropped quite a bit, many traders aren’t convinced it will rebound quickly. However, examining the balance between supply and demand in the market could prove advantageous.

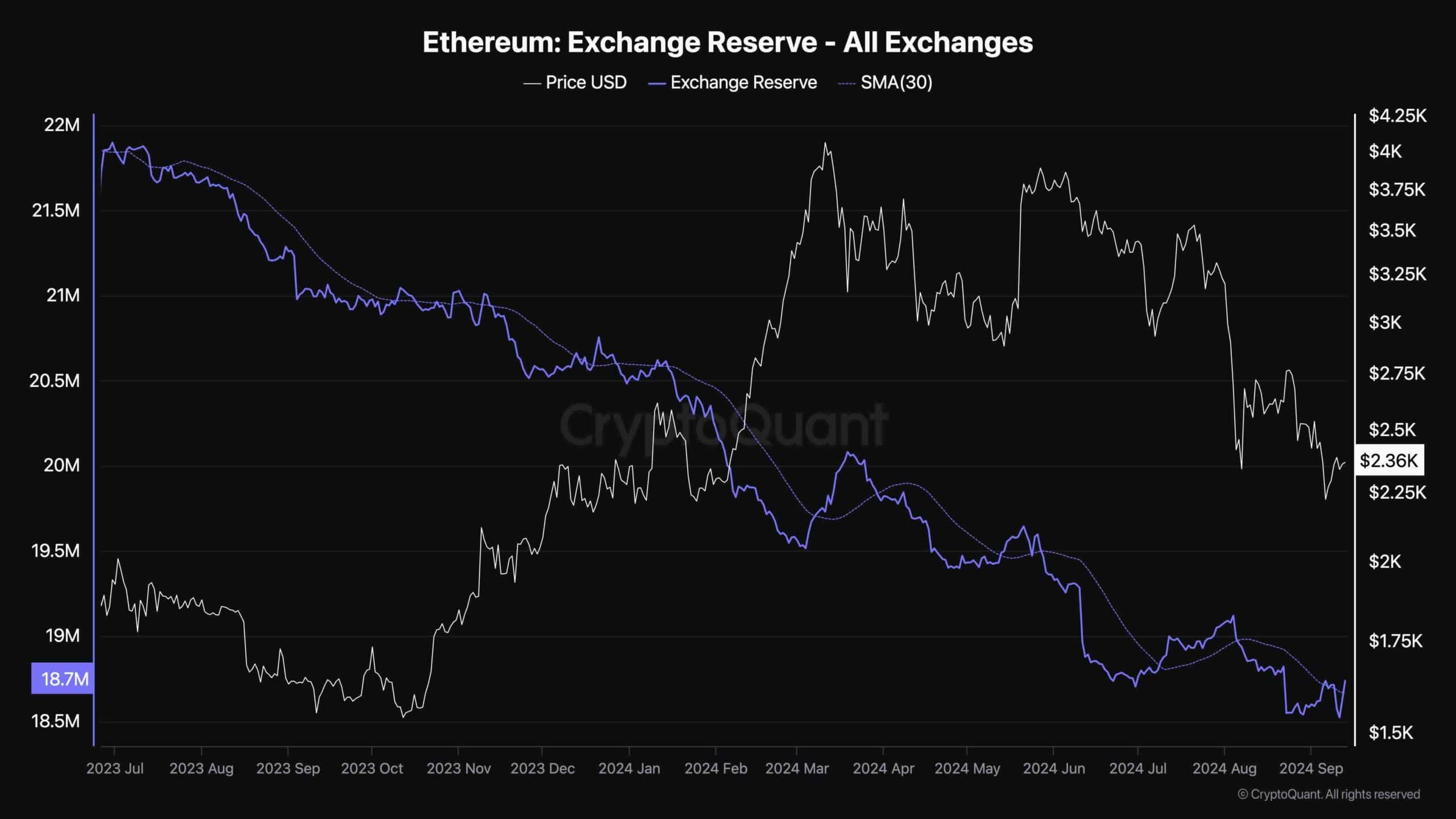

This graph shows the exchange reserve indicator (together with its 30-day moving average), a measurement that quantifies the Ethereum stored in exchange accounts. These Ethereum coins are considered part of the supply since they can be swiftly sold, thus putting pressure on selling.

As the chart suggests, the Ethereum exchange reserve metric has declined consistently over the past few months. However, it is currently rising above its 30-day moving average, which indicates a potential rise in selling pressure and could lead to a further drop in the short term if not met with sufficient demand.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- W PREDICTION. W cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- Destiny 2: How Bungie’s Attrition Orbs Are Reshaping Weapon Builds

2024-09-13 16:39