As a seasoned researcher with a knack for deciphering economic trends and their impact on financial markets, I find myself intrigued by this latest development in the US Consumer Price Index (CPI). With my fingers permanently etched on the economic keyboard since the Great Recession, I have witnessed firsthand the dance between inflation rates and central bank policy.

As anticipated by many, the U.S. Consumer Price Index rose by 2.5% compared to the same time last year in August. However, this figure represents a decrease of 0.4% compared to the rate recorded in July.

Experts are largely agreeing that it’s highly likely that the Federal Reserve will either decrease its benchmark interest rate by a quarter of a percentage point (25 basis points) or half a percentage point (50 basis points).

As a researcher, I’ve noticed that the Consumer Price Index (CPI) increased by 2.5% in August this year, indicating a moderately decreasing trend compared to the previous year. Interestingly, the Year-over-Year (YoY) growth for August 2023 was at 3.7%. Furthermore, the highest CPI of 2024 was recorded in March at 3.5%.

For August 2024, the Core Consumer Price Index (excluding fluctuating sectors such as food and energy) remained steady at a 3.2% increase compared to July’s figures.

For investors, this CPI report carries significant importance because it’s the one released just prior to the FOMC meeting scheduled on September 18-19. Notably, Federal Reserve Chair Jerome Powell stated in late August that it was now appropriate for the central bank to begin reducing interest rates.

Based on current expert opinions, it’s expected that the Federal Reserve will reduce interest rates by a quarter of a percentage point next week, given the encouraging inflation figures.

If such a scenario unfolds, it’s possible that the price increase might have already been factored into the market, particularly for volatile investments like Bitcoin.

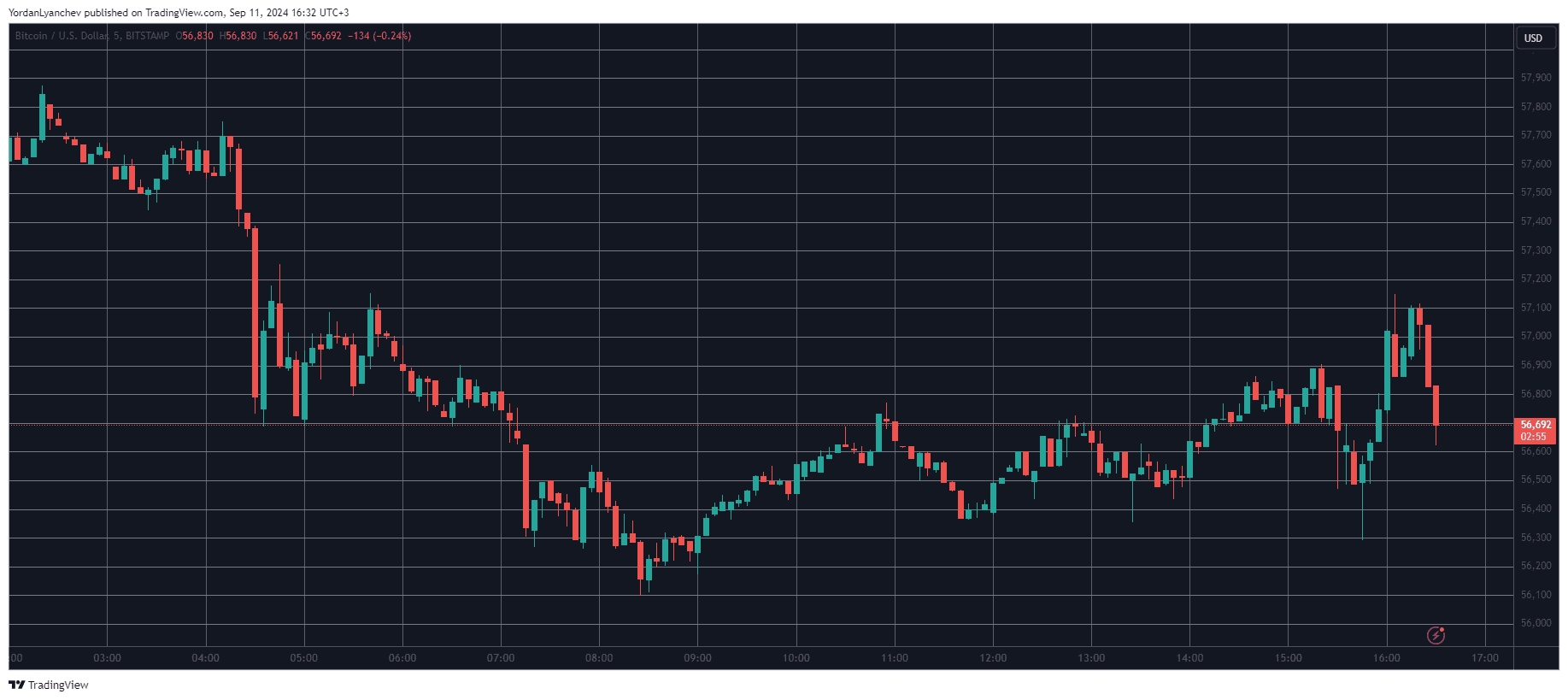

Before the release of the CPI figures, the main cryptocurrency’s value remained fairly consistent. Following the announcement, its price dropped to approximately $56,200 on Bitstamp, but then increased by around $1,000.

Despite the notable fluctuations seen in past instances, today’s drop and surge of $1,000 each appear quite minor compared to them.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- PENDLE PREDICTION. PENDLE cryptocurrency

- W PREDICTION. W cryptocurrency

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- How to Handle Smurfs in Valorant: A Guide from the Community

2024-09-11 16:34