As a seasoned analyst with extensive experience in cryptocurrency markets and price analysis, I have seen Bitcoin’s volatile nature numerous times. The recent recovery from a bearish month is not surprising to me, as Bitcoin often exhibits such price swings during its bull market cycles.

The price of Bitcoin has bounced back after a month of downturn, and given the present bullish trend, there’s a strong possibility that a new record high could be set in the market.

Technical Analysis

By TradingRage

The Daily Chart

As a researcher analyzing the daily price chart, I’ve noticed that the price has encountered support at the $56K level. Additionally, both the 200-day moving average and the $60K level have been recaptured. The 200-day moving average now lies around the $60K region.

Despite facing challenges in surpassing the $65,000 resistance, Bitcoin’s market has yet to succeed in the past three attempts. On the other hand, the Relative Strength Index (RSI) indicates a robust bullish trend. As such, it may not be long before BTC rises above $70,000 once more. However, this optimistic outlook would be invalidated if Bitcoin’s price dips below $60,000 again.

The 4-Hour Chart

On the 4-hour chart, the market has initiated a strong uptrend after breaching the bearish trendline. However, efforts to surpass the resistance at $65,000 have failed thus far. A pullback is not unlikely.

Additionally, the RSI (Relative Strength Index) indicates a noticeable bearish divergence and an overbought warning, potentially leading to a drop down to around $60K. However, the broader market trend remains positive for now in the near term.

On-Chain Analysis

By TradingRage

Bitcoin Short-Term Holder SOPR

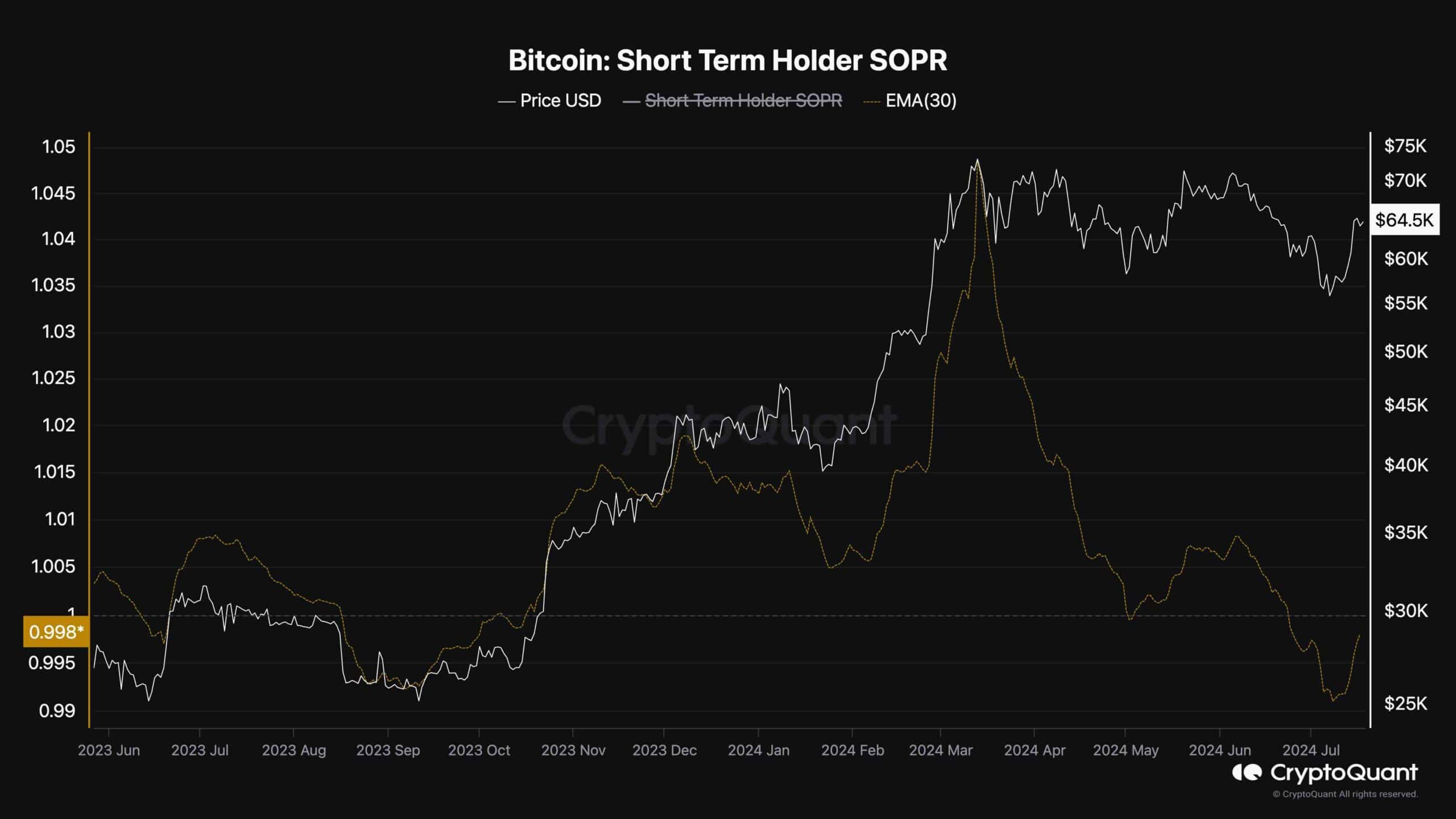

The actions of investors holding Bitcoin for short periods significantly influence the market’s price movement in the short term. Consequently, examining the Bitcoin Short-Term Holder SOPR (Spend Output Probability Ratio) indicator can help forecast price trends over the next few weeks.

The Short-Term Holder SOPR indicator, as shown in the graph, helps distinguish if coin holders with a time frame under 6 months have incurred profits or losses. A figure greater than 1 signifies selling at a profit, while values less than 1 suggest realizations of losses.

As I scrutinize the data presented in the graph, I notice that the STH SOPR’s 30-day exponential moving average has dipped below 1 recently. This observation suggests that short-term holders have been selling their coins at a loss. Historically, this pattern is a common indicator of correction bottoms during a prolonged bull market. Therefore, should the metric rebound above 1, we can anticipate a price surge leading to new record highs within the ensuing weeks.

Read More

- W PREDICTION. W cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- REF PREDICTION. REF cryptocurrency

- PLASTIK PREDICTION. PLASTIK cryptocurrency

- CSIX PREDICTION. CSIX cryptocurrency

- GAMMA PREDICTION. GAMMA cryptocurrency

- MCB PREDICTION. MCB cryptocurrency

- ALD PREDICTION. ALD cryptocurrency

2024-07-18 17:19