In summary, to find the best pools to stake Cardano, consider factors such as potential earnings, pool saturation, fees, reputation and history, infrastructure and reliability, and pool operator communication and community engagement. Utilize resources like Cardano community forums, blockchain explorers, experienced stakers, and social media groups to gather information and make informed decisions. Additionally, be aware of the potential risks associated with staking, such as volatility, liquidity risk, running a node, and smart contract vulnerabilities. Diversifying your investments across multiple pools can help offset these risks. Staying informed about the latest developments within the Cardano ecosystem is crucial for making wise decisions. Remember that some of the best pools may saturate quickly, so following due diligence practices is essential before joining a staking pool.

Cardano‘s blockchain ranks among the largest in the crypto world, boasting an extensive decentralized application (dApp) landscape and an energetic community of developers who are consistently active.

At the present moment in July 2024, approximately 70% of all circulating ADA has been staked. This implies that a significant number of Cardano users – millions in total – are holding and participating in the staking process. The result is an enhanced network security and increased earnings for these stakeholders.

In Cardano, there are no set timeframes for staking ADA; instead, you can continue using your tokens for transactions without any restriction during the staking process. This feature sets Cardano apart, making its staking system alluring for both experienced cryptocurrency users and newcomers alike.

As a new crypto investor excited about Cardano’s growing recognition, I’m eager to maximize my returns by staking my tokens in top-tier Cardano staking pools.

Quick Navigation

- What is Cardano Staking?

Staking ADA in a Pool Vs. Staking ADA on an Exchange

How to Stake your Cardano (ADA)

The Best Cardano Staking Pools

Cardanians.io

CardanoCafe

Spire Staking

Rocky Mountain Staking

Nordic Pool

Factors to Consider When Choosing a Staking Pool

Researching and Evaluating Staking Pools

Is Staking ADA Safe?

Final Thoughts on the Best Pools to Stake Cardano

What is Cardano Staking?

As a Cardano crypto investor, I can’t stress enough the importance of staking pools in this proof-of-stake blockchain network. These pools act as my servers, producing blocks and validating transactions for me and other depositors by collectively staking our ADA coins.

Owning ADA cryptocurrency on the Cardano blockchain signifies a pledge to the network, with the magnitude of your commitment reflecting the quantity of staked ADA you have.

As an analyst, I’d put it this way: In Cardano, there’s a unique feature called stake addresses. With these addresses, you can pool all the tokens associated with them for staking purposes. This convenience eliminates the need to re-stake individual funds, but it comes with the caveat that transactions such as sending or receiving payments are not possible using this type of address.

Earning Rewards With ADA

As a crypto investor holding ADA, I have the opportunity to earn rewards in two distinct ways: by entrusting my stake to a pool managed by another individual or by establishing my own pool. The Ouroboros protocol primarily determines the validator who gets to add the subsequent block to the blockchain and receives a reward based on the amount of delegated stake in a pool.

With more assets contributed to the pool, the greater the probability of producing the next block. Consequently, the earnings generated are distributed evenly amongst all contributors, including pool operators, who have assigned their resources.

Public Stake Pools Vs. Private Stake Pools

Note that there are public and private Cardano stake pools.

- Public pools provide an address that enables users to delegate their tokens and receive rewards directly, taking away the complexity of running the pool themselves.

Private pools only provide rewards to their operators and vetted delegators. If you have the time and resources to run the node, you could keep 100% of the stake earnings to your reward address.

More specifically, having sufficient resources means you can run at least one block every epoch (the amount of ADA per block changes based on multiple parameters, and it’s never the same for every pool.)

To sum up, stake pools are managed by reliable operators who have the technical knowledge and resources to run the node consistently. The more delegated stake in a pool, the higher its chances of being chosen as the next block producer.

Staking ADA in a Pool Vs. Staking ADA on an Exchange

One way to rephrase this in clear and natural language is: By participating in a Cardano staking pool, you contribute to network decentralization as it depends on individual operators running nodes. Rewards are distributed according to the amount of ADA you’ve committed and the pool’s success.

Just like with other blockchains, the control over ADA remains with the delegators during Cardano’s staking process. Unlike custodial methods, your funds are not locked away. Instead, you retain the ability to access them whenever you desire.

For experienced crypto users, directly staking on a Cardano pool could be an appealing option. However, this choice comes with additional responsibilities. To ensure success, it’s crucial to research trustworthy pools that have a low number of orphaned blocks and maintain a robust technical infrastructure. Further details regarding other technical aspects will be covered later in this article.

Staking on an Exchange

Instead of using “On the other hand,” you could say “Alternatively,” or “Another option is.” Regarding the first part of your sentence, you might paraphrase it as “Exchanges offer a more convenient interface and handle the complexities of staking for users.” However, be aware that the primary disadvantage is that exchanges are custodial services, implying they control and store your assets.

As a researcher studying decentralized finance, I’ve observed that transactions on automated market-making platforms or yield farming pools managed by intermediaries might incur higher fees compared to independent pools. Additionally, these intermediary-managed pools may provide different reward structures with potentially lower returns than those found in independent pools.

In general, the choice between an exchange and a personal wallet depends on your specific circumstances. For beginners, exchanges may be preferable due to their simpler interface and convenience, but they come with higher transaction fees and the risk of entrusting your assets to a third party.

How to Stake your Cardano (ADA)

Prior to delving into the top-performing Cardano staking pools, it’s essential to cover some prerequisites. To begin, make sure you’re familiar with the process of delegating your Cardano tokens to a staking pool.

Setting up a Cardano wallet

To get started, it’s essential that you have a Cardano wallet capable of staking. You have several choices: Yoroi, Daedalus, or Exodus are popular software wallets. Alternatively, if you prefer hardware wallets, you can still stake Cardano, but you may need to use an external application for this purpose.

The best way to do this is to read our comprehensive guide on the Best Cardano Wallets for 2024.

After selecting a suitable wallet for your needs and filling it with Cardano tokens, you can then explore some top-tier staking pools in the Cardano network.

Choosing a Cardano Pool

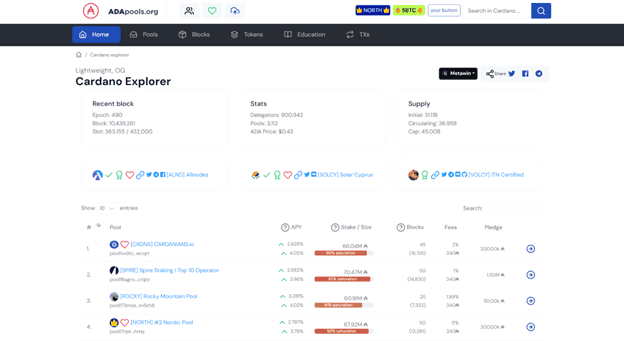

As a researcher studying the Cardano network, I would recommend visiting ADApools.org for an optimal pool selection experience. This platform collects data from approximately 3,000 Cardano pools and provides a user-friendly dashboard with essential metrics to evaluate each pool’s performance.

On the given list, every pool comes equipped with multiple key performance indicators. Among these are the return on investment for stakers (referred to as APY), the size of the stake, the number of blocks produced (with more blocks being better), and the amount of ADA pledged as a commitment. Let’s explore this website in detail:

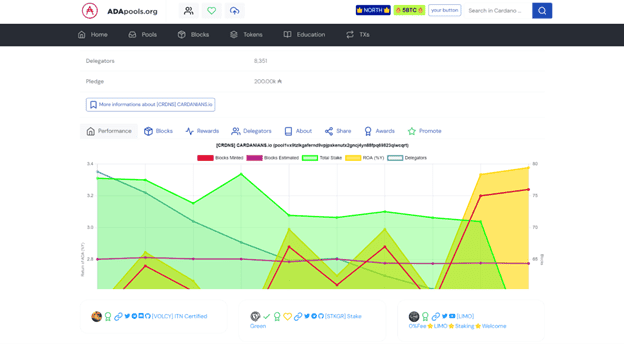

As a researcher, when you click on one of the pools, you’ll uncover essential metrics and their collective performance. Additionally, you can examine the quantity of rewards, present delegators, and sometimes even identify the pool owners or operators. Their profiles often include a biography or social media links for potential contact.

One effective way to remain informed about the recent happenings in the Cardano community is by engaging in conversations on social media forums and participating in discussions within Cardano-specific groups.

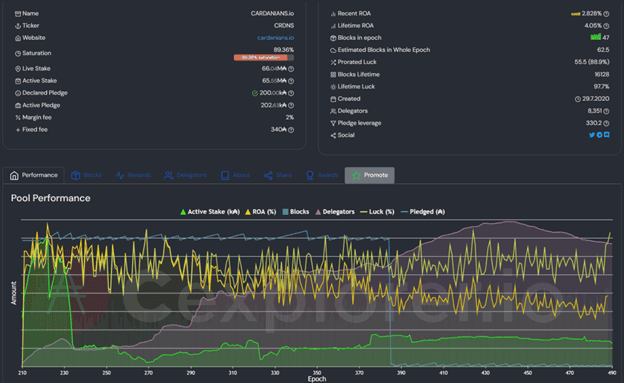

Clicking on the “More Info” tab will take you to cexplorer.io, where you can explore detailed information about the pool. Here, you’ll find key metrics such as the pool’s historical luck, number of delegators, and current saturation level. For instance, the Cardanians pool has a 89.36% saturation rate, processed 47 blocks during the current epoch, and boasts a lifetime luck of 97.7%.

Pool Hopping

As a researcher studying the world of staking, I’ve come across an intriguing practice known as “Pool Hopping.” Given that rewards from stake pools can change from one epoch to the next, a pool with currently low yields might eventually offer more lucrative returns. By implementing this strategy, you continuously shift your stake between different pools in pursuit of maximizing your potential earnings.

Put simply, pool hopping is equivalent to wagering on a pool’s good fortune. Each Cardano pool is assigned a metric called Lifetime Luck. However, keep in mind that this practice comes with additional transaction fees for every switch, which can gradually erode the overall profits and render the approach less profitable over time.

If you’re pressed for time, consider the low-maintenance option of passive crypto staking – reaping the rewards without the continuous need for vigilant supervision.

The Best Cardano Staking Pools

After covering the essential details and fundamental procedures for staking in Cardano, it’s time to explore some of the leading pools within the network.

It’s important to note that the pools fill up rapidly. Consequently, the following list doesn’t follow a particular sequence since pools can grow obsolete rather swiftly.

To effectively conduct research in Cardano, wait for a significant number of new staking pools to emerge and gain popularity. Then, consider employing the listed factors and methods to delegate your ADA to these promising pools.

As a data analyst, I’d like to point out that certain statistics we present hereunder undergo frequent modifications. The ensuing figures pertain to the month of July 2024.

Cardanians.io

Cardanians refer to themselves as a community of passionate advocates and dedicated supporters for the Cardano cryptocurrency. Their primary goal is to strengthen the platform’s security and promote its decentralization.

Cardanians are responsible for overseeing stable, transparent, and dependable staking pools. Furthermore, they engage in community initiatives by composing and localizing articles to foster the Cardano network.

Quick stats:

- Margin fee: 2%

Lifetime ROA: 4%

Blocks produced: 16,135 total.

Amount staked (in ADA): 66M

CardanoCafe

As a researcher focused on the Cardano blockchain, I’d describe CardanoCafe as a respected stake pool operator within this ecosystem. Known for their commitment to sustainability and climate neutrality, they distinguish themselves from other players in the industry.

As a member of the Climate Neutral Cardano (CNC) alliance, I, CardanoCafe, proudly operate using 100% renewable energy sources. By doing so, I underline my dedication to sustainable and eco-friendly business practices.

The staking platform provides three options for delegators: Cafe1, Cafe2, and Cafe3. The first two pools hold 95.14% and 14.05% of the total stake respectively, while the third pool holds less than 1%. As a result, the pool with the highest saturation level charges a higher fee but accommodates more delegators and an increased amount of staked ADA that is more actively participating in the network.

Quick stats:

- Margin fee: 1%

Lifetime ROA: 3.93%

Blocks produced: 11,740

Amount staked (in ADA): 72M

Spire Staking

In the Cardano blockchain community, Spire Staking stands out as a notable staking pool, recognized by the label [SPIRE]. The Cardano Journal highlights it as one of the leading staking pools for its attractive return on investment (ROI) and impressive amount of active staked tokens.

As a researcher studying the Cardano staking pool landscape, I’ve come across Spire Staking, which stands out for its proven track record and impressive performance. With a substantial number of delegators and an impressive output of over 14,000 blocks, this pool is a significant player in the ecosystem.

The pool’s metrics on productivity and block creation show that it is an efficient and effective choice for staking, making it a strong contender in the staking market.

Quick stats:

- Margin fee: 1%

Lifetime ROA: 3.96%

Blocks produced: 14,843

Amount staked (in ADA): 70.39M

Rocky Mountain Staking

Ken Akerley, a skilled IT expert residing in Calgary, Canada, manages the Cardano stake pool called Rocky Mountain Staking (ROCKY). He runs the pool utilizing self-owned infrastructure rather than relying on centralized cloud services.

The pool boasts a substantial size, holding more than 58 million staked ADA. Its growth can largely be attributed to the capable management of a seasoned public operator and their robust, dependable infrastructure, which minimizes the risk of missed blocks.

Despite a higher fee of 1.99%, this pool offers attractive returns with a lifetime ROA of 3.3% and a recent ROA of 4.02%.

Ken strongly supports Cardano’s decentralized structure and actively engages with the community through frequent participation in online forums and social media discussions, particularly those related to Cardano’s pool and the broader ecosystem.

Quick stats:

- Margin fee: 1.99%

Lifetime ROA: 4.02%

Blocks produced: 7339

Amount staked (in ADA): 58M

Nordic Pool

The Nordic Pool stands out as one of the biggest Cardano staking pools, operated by two cryptocurrency businessmen hiding behind pseudonyms in Sweden. Two community moderators manage the pool’s official Telegram channel and social media presence.

Nordic Pool provides access to as many as five identical pools, each labeled with the ticker symbol NORTH. This platform has forged collaborations with notable crypto platforms such as SundaeSwap and several others.

Quick stats:

- Margin fee: 1.99%

Lifetime ROA: 4.02%

Current ROA: 3.3%

Blocks produced: 7339

Amount staked (in ADA): 58M

Factors to Consider When Choosing a Staking Pool

- Return on Stake (ROS): represents the expected annual return from staking in a particular pool. Comparing ROS across different pools can help maximize potential earnings.

Pool Saturation: Pools have a saturation point beyond which additional staking results in diminishing returns. Choosing pools that are not overly saturated ensures optimal rewards.

Pool Fees: Pools might charge a fixed fee (e.g., 340 ADA) and a variable margin fee. Lower fees generally translate to higher net rewards for delegators.

Pool Reputation and History: Evaluating a pool’s track record, including its reliability and performance history, provides insights into its stability and trustworthiness.

Pool Infrastructure and Reliability: Reliable infrastructure ensures the pool can consistently produce blocks and earn rewards. Look for pools with minimal orphaned blocks and robust technical setups.

Pool Operator Communication and Community Engagement: Active communication and engagement from pool operators can indicate a well-managed pool. Operators who contribute to the community and

Researching and Evaluating Staking Pools

Here are a few research and evaluation practices to follow before staking on Cardano.

Using Cardano Community Resources

Utilize the Cardano Foundation’s website and community discussion platforms to collect data on various pools.

Exploring Pool Metrics on Cardano Blockchain Explorers:

As a data analyst, I would recommend utilizing platforms like ADApools and Cardano Journal for accessing comprehensive metrics regarding pool performance. These resources offer valuable insights into various aspects such as pool saturation, fees, lifetime luck, blocks produced, and more. By reviewing the information on these websites, you can make informed decisions to optimize your pool’s efficiency.

Seeking Advice from Experienced Stakers

As a researcher exploring the world of Cardano staking, engaging with seasoned stakers in community forums and social media groups is an invaluable source of knowledge and guidance. Furthermore, many Cardano staking pools are spearheaded by operators who generously share updates on their pool progress through public Telegram channels.

Joining Cardano Community Forums and Social Media Groups

As a dedicated researcher in the field of Cardano, engaging in communities such as r/Cardano is an essential practice to keep abreast of the most recent advancements and insights into pool performance. Additionally, it provides a valuable platform for seeking advice from knowledgeable members within the community.

Additionally, interacting with the Cardano community via forums and social media platforms is essential to obtain valuable knowledge and guidance from ADA holders.

Is Staking ADA Safe?

Staking allows me to earn passive income from my cryptocurrency holdings by contributing them to the validation process of a blockchain network. Essentially, I’m putting my funds to work and helping secure the network at the same time. This compounded income results from receiving rewards for validating transactions on the blockchain.

As a crypto investor who’s considering staking my ADA tokens, it’s important to acknowledge the potential risks involved in this process. Unlike some cryptocurrencies, ADA does not require a lockup period for staking. However, there are still inherent risks that come with participating in any staking pool.

Potential risks associated with staking

- Volatility: The value of the staked token can fluctuate significantly, even overnight. High annual percentage yields (APYs) may be offset by sharp asset price declines.

- Liquidity Risk: Low liquidity in some cryptocurrencies can make it difficult to sell or convert staking rewards into stablecoins, posing challenges, especially for micro-cap altcoins.

- Running a node: Running your own pool requires a certain level of technical expertise and constant uptime. This translates into time and resources to run a Cardano pool.

- Smart contract vulnerabilities: Staking platforms and cryptocurrencies are susceptible to hacking and smart contract exploits.

The Importance of Diversification

From a research perspective, I’ve observed that people follow the age-old advice of not relying on a single source for their investments. Instead, they spread their funds across various pools and engage in multiple staking activities. This approach helps mitigate risks and potential losses.

Diversifying your investments into various assets or sectors can mitigate the negative effects of a poor-performing investment. In essence, this approach aims to strike a balance between risk and reward.

Staying Informed and Adapting to Ecosystem Changes

Similar to a previous suggestion, keeping abreast of the newest advancements in the Cardano community allows for more intelligent and knowledgeable choices to be made. Gaining knowledge on unfamiliar subjects is equally essential.

Final Thoughts on the Best Pools to Stake Cardano

As a Cardano analyst, I recognize the importance of conducting thorough research and staying informed about the most recent advancements within the Cardano ecosystem to make an informed decision when selecting a staking pool.

It’s worth mentioning that popular Cardano staking pools fill up quickly. To ensure a smooth experience when you decide to join one, please refer to the guidelines provided in this manual.

Read More

- PENDLE PREDICTION. PENDLE cryptocurrency

- W PREDICTION. W cryptocurrency

- FIO PREDICTION. FIO cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- BONE PREDICTION. BONE cryptocurrency

- WALV PREDICTION. WALV cryptocurrency

- Bitcoin’s Unreliable Death Cross Is Looming Again

- Did the Megalopolis Trailer Make Up All Those Movie-Critic Quotes?

- Ethereum Suffers $61M Outflows, Worst Performance Since August 2022

- Decoding the Cosmic Conundrum in Honkai: Star Rail – Why So Serious?

2024-07-01 17:17