As a seasoned crypto investor with a deep understanding of the market, I’m keeping a close eye on the latest developments surrounding cryptocurrency-based exchange-traded funds (ETFs) in the US. The recent news that VanEck has filed for an ETF based on Solana (SOL), the fifth-largest digital asset, is particularly noteworthy.

In the United States, exchange-traded funds (ETFs) backed by cryptocurrencies remain a significant focus, with the most recent application from VanEck proposing to include Solana as the fifth-largest digital asset in its fund.

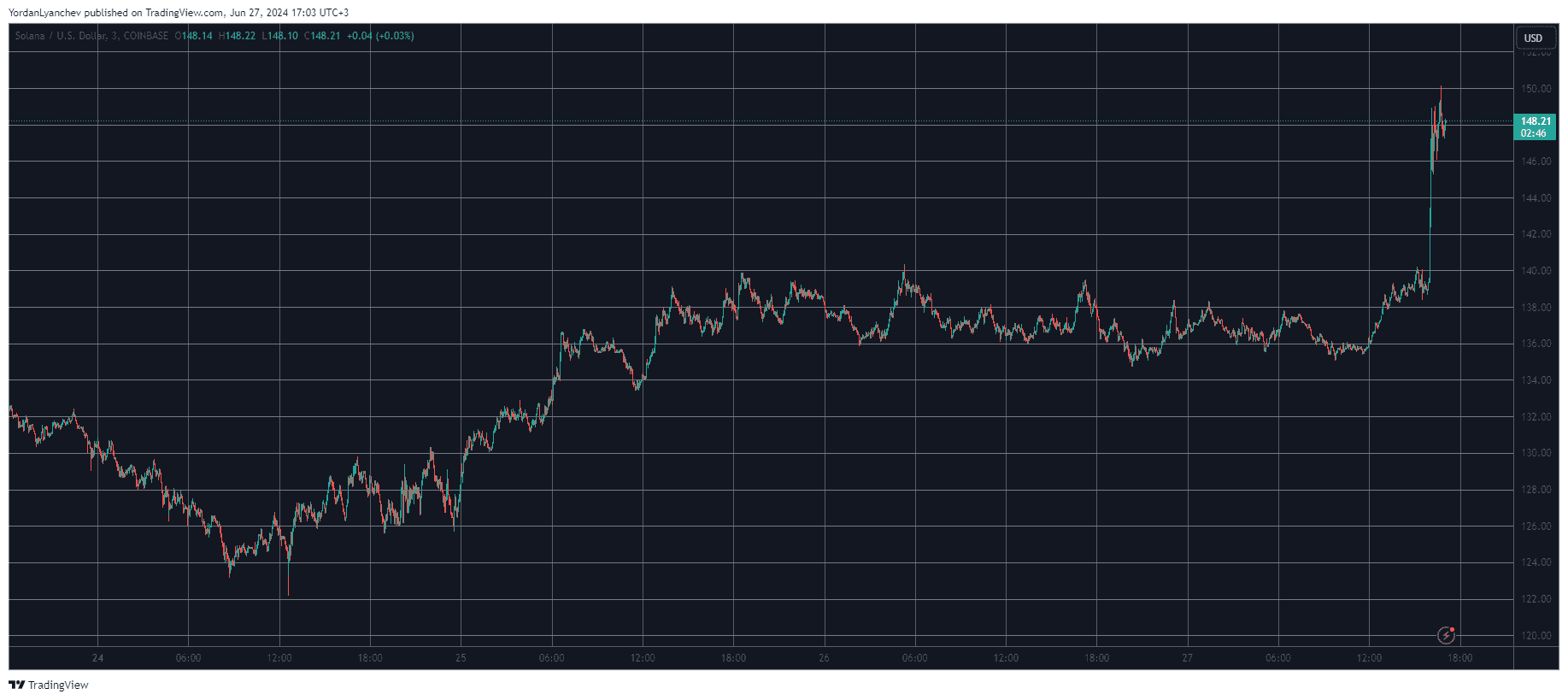

Shortly after the news broke, the native token’s price shot up by 7% to $150.

Matthew Sigel, the Head of Digital Assets Research at the company, brought attention to the recent advancements in X. He pointed out that Solana is perceived to be much like Ethereum as it functions as an open-source blockchain platform capable of supporting a range of applications such as transactions, trading, gaming, and social engagements.

“He noted that unlike Ethereum, Solana functions with a ‘unified global state machine’ instead of utilizing sharding or layer-2 networks.”

As a researcher studying the developments in the financial sector, I can tell you that in January of this year, the United States Securities and Exchange Commission (SEC) finally gave its approval for spot Bitcoin Exchange-Traded Funds (ETFs). This was the result of a long-standing debate that had lasted for over a decade. Notably, the SEC holds the view that Bitcoin, the underlying asset for these ETFs, is classified as a commodity.

Last month, the securities regulatory body granted approval for Ethereum Spot ETFs with hesitation. However, the SEC has yet to initiate their launch due to Ethereum’s unclear status.

From my perspective as a crypto investor, Solana’s standing in the market remains uncertain. Nevertheless, according to VanEck, there are compelling reasons that classify Solana as a commodity similar to Ether and Bitcoin. Here’s how they argue their case:

As a crypto investor, I see Solana’s native token, SOL, functioning in a manner comparable to other digital commodities like Bitcoin and Ethereum. I use it primarily to cover transaction fees and access computational services on the blockchain. Similar to Ether on the Ethereum network, SOL can be traded on digital asset exchanges or employed in peer-to-peer transactions.

As a crypto investor, I’ve noticed that SOL‘s price is particularly sensitive to news. When I heard about VanEck’s latest announcement, I was thrilled to see an instant reaction from the market. The asset had taken a hit and dropped down to $135 due to the general market correction, but in just minutes, the price surged upwards by 7%. This exciting jump brought SOL back up to $150.

Read More

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- EUR AUD PREDICTION

- EUR INR PREDICTION

- AAVE PREDICTION. AAVE cryptocurrency

- COTI PREDICTION. COTI cryptocurrency

- FLX/USD

- KUJI PREDICTION. KUJI cryptocurrency

- NBLU/USD

- TURBOS/USD

2024-06-27 17:04