As a researcher with several years of experience in the crypto market, I’ve witnessed the recurring bull markets and their accompanying altcoin cycles firsthand. The theory that major bull markets occur every four years, preceded by Bitcoin halvings, has held true so far. However, within these larger cycles, there are numerous mini-cycles where certain altcoins can deliver impressive gains, but they also come with the risk of holding on too long and missing out on potential profits from other projects.

For several years, the concept of crypto market cycles has been widely discussed among traders and analysts. According to this theory, approximately every four years, a significant bull market occurs in the cryptocurrency sector, often triggered by the Bitcoin halving event.

So far, that has been the case.

During the larger market cycles, numerous smaller cycles exist where specific altcoins may outperform Bitcoin, potentially providing greater returns for investors. However, there’s a risk involved: if an investor misses the optimal moment to sell their altcoin holdings, they could be left with assets that might never regain value.

Is that the case for Cardano (ADA) holders?

The Opportunity Cost of Holding Cardano

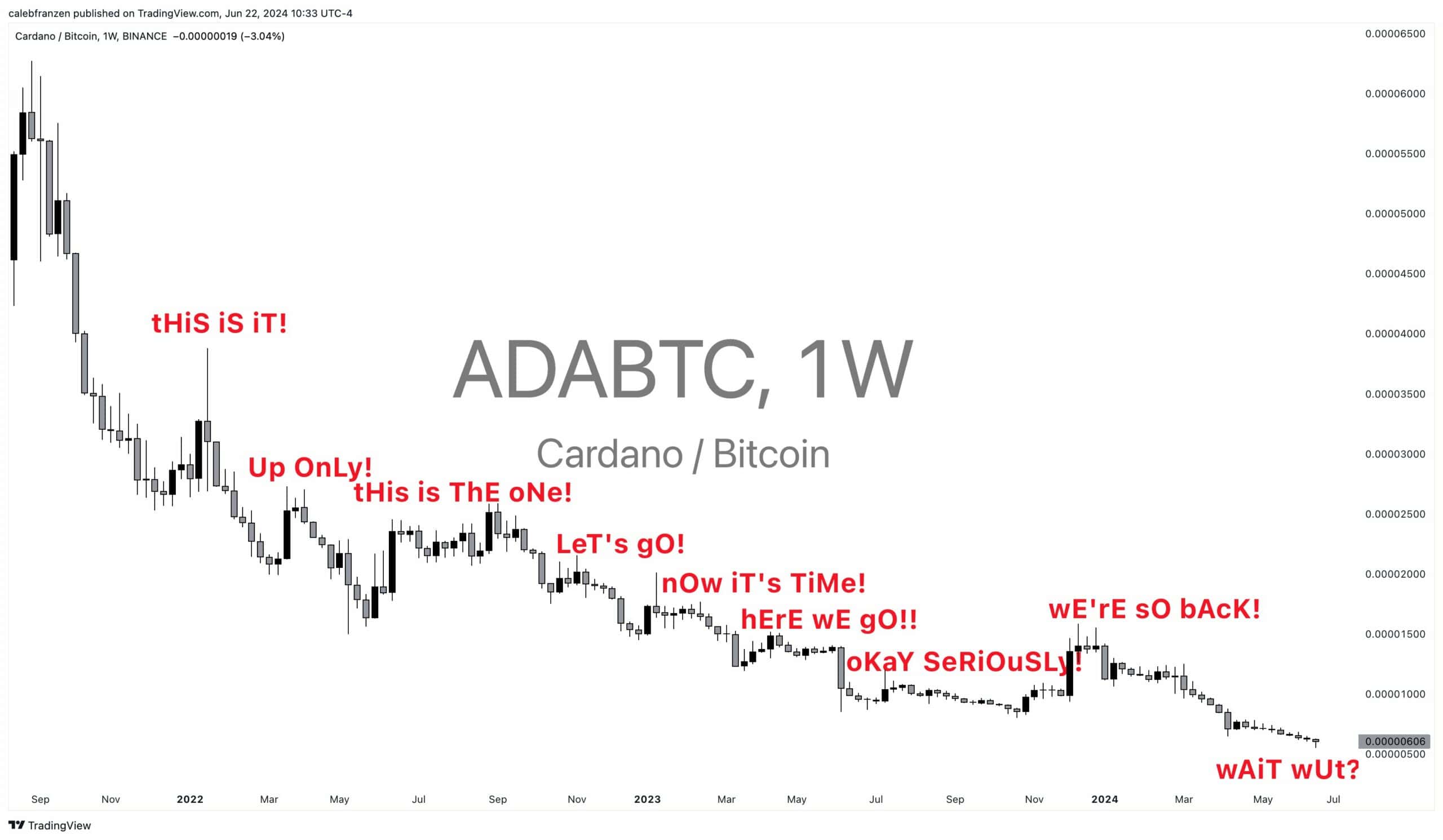

The popular analyst Caleb Franzen recently took it to X to outline a painful truth about ADA.

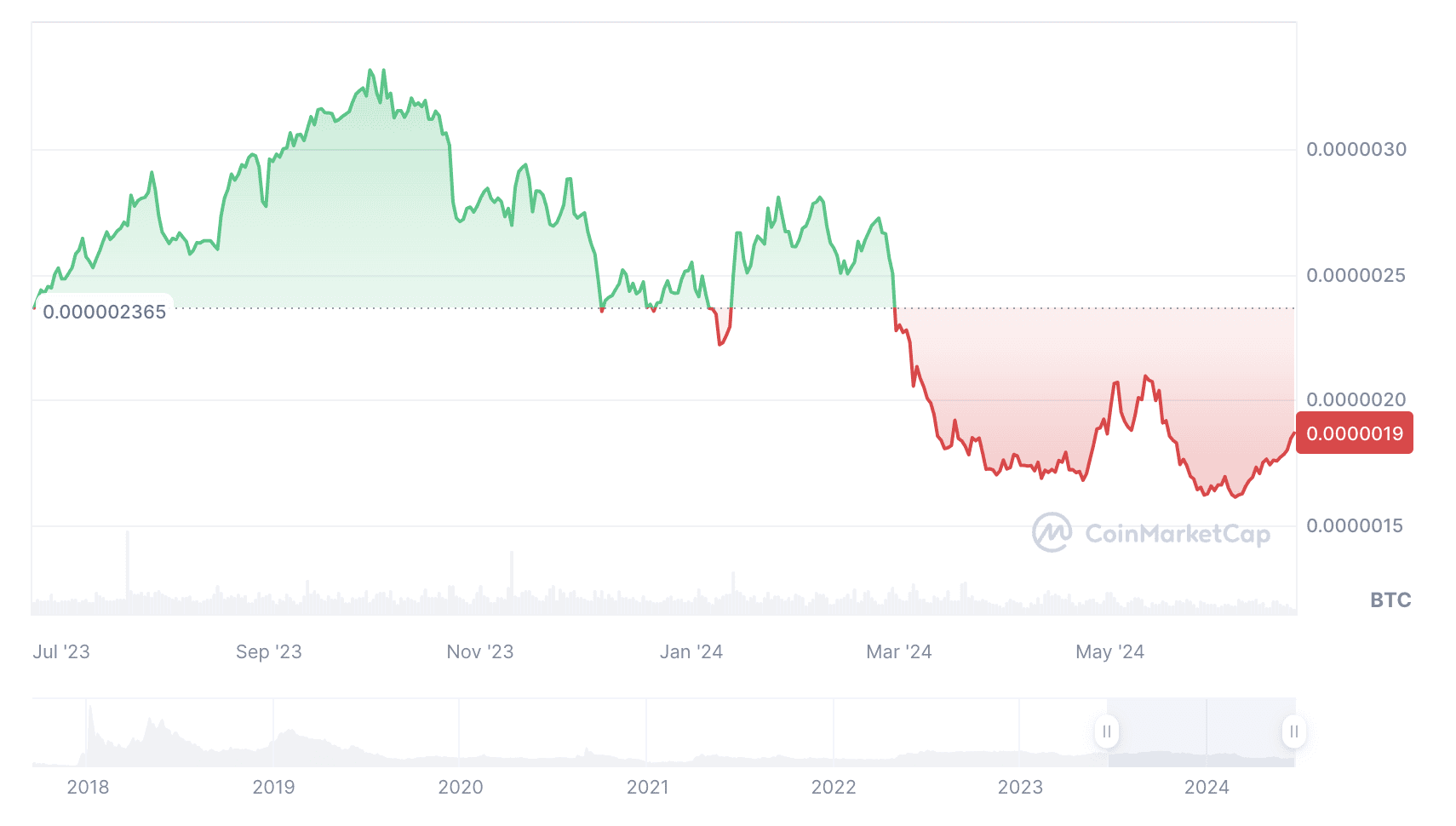

Over the past 34 months, Cardano has lost 90% of its value relative to Bitcoin.

Don’t ignore opportunity cost… it’s costing ADA holders a lot of money.

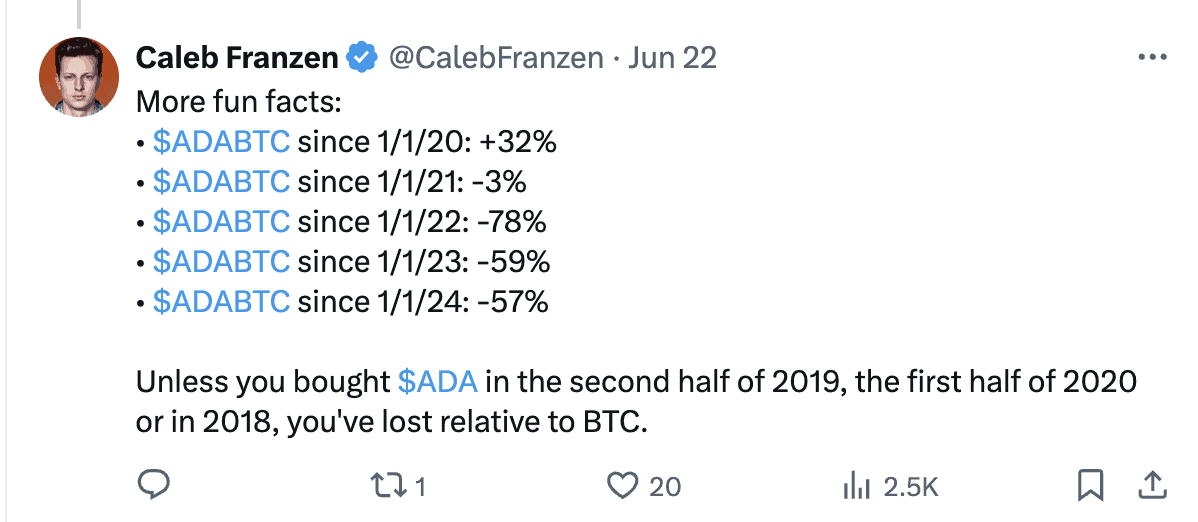

I’ve been keeping a close eye on the market, and I can’t help but notice that ADA‘s current price is at its lowest since last year, December 2020 to be precise.

In addition, ADA’s performance is shaky for many who’ve entered the market in the past few years:

The analyst also made an important conclusion:

As a researcher studying the cryptocurrency market, I’ve come to observe that my experience with trading altcoins contrasts significantly from investing in them. This chart serves as a vivid representation of this trend. Over extended periods, altcoins typically underperform relative to Bitcoin (BTC).

It’s Not Just Cardano (ADA)

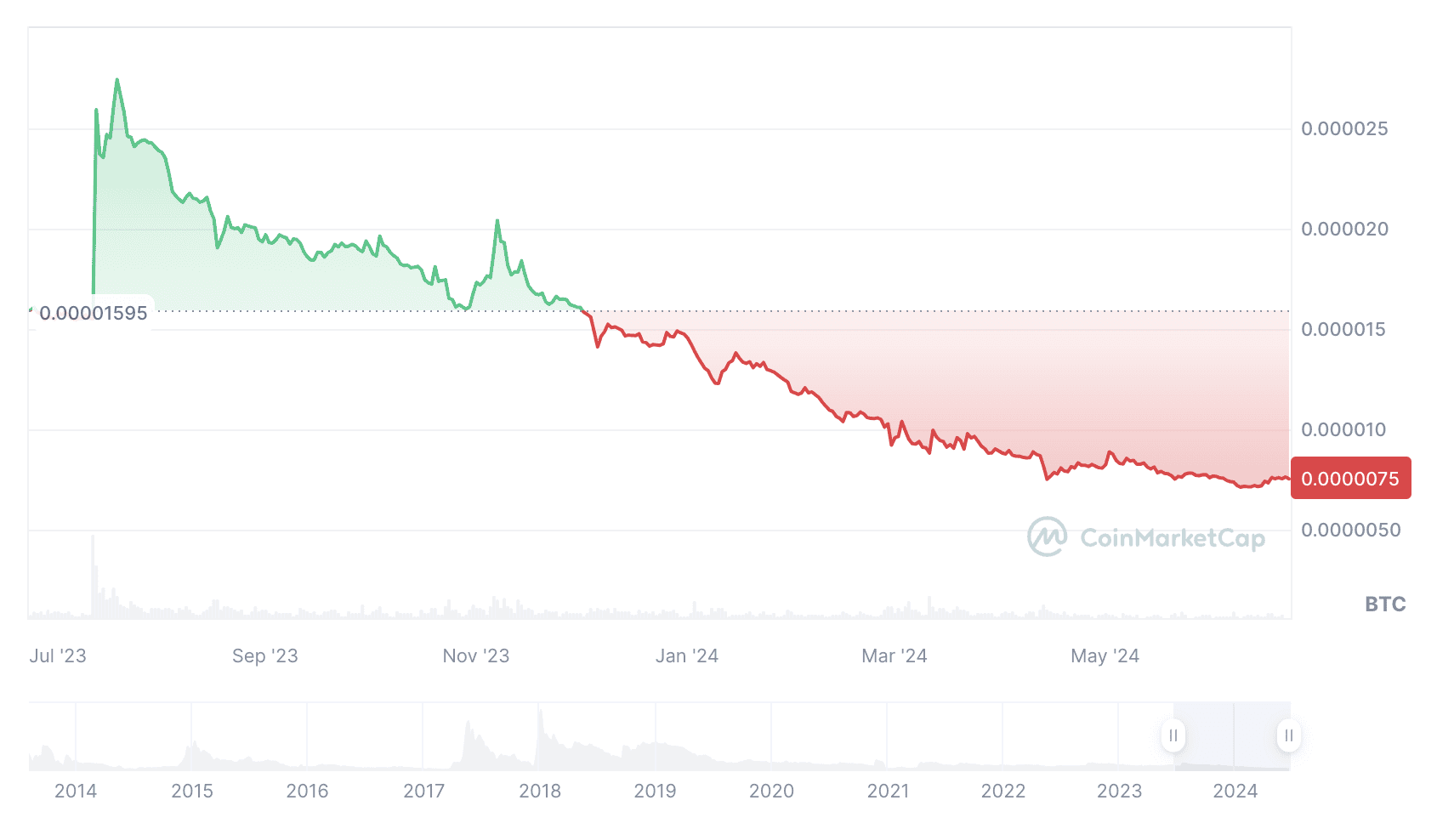

Of course, other altcoins also display similar patterns when compared against Bitcoin.

This is XRP’s chart against BTC in the last year:

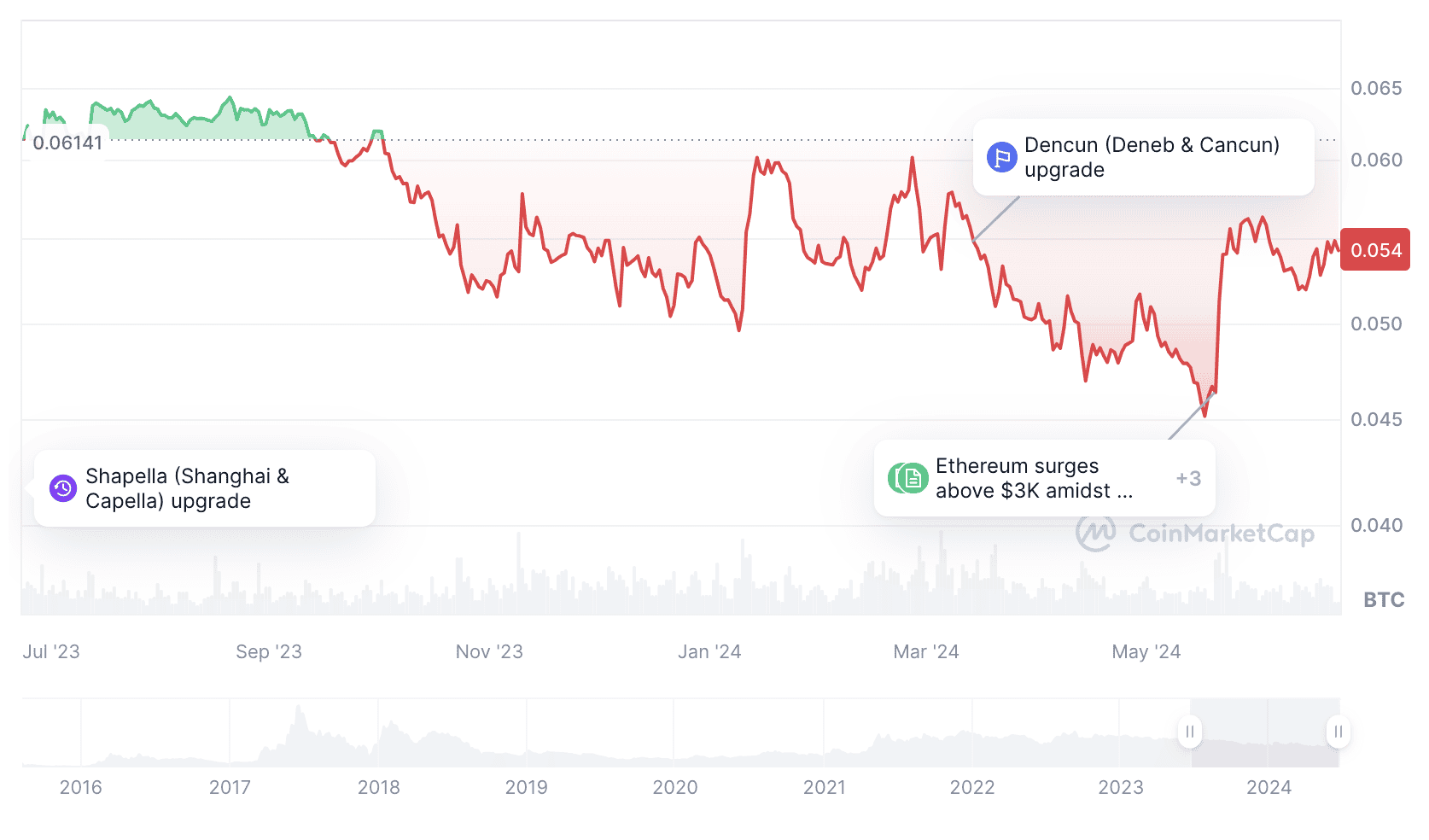

This is ETH’s:

And this is TRX’s:

Certainly, there are several altcoins that have surpassed Bitcoin’s performance in the year 2024. For instance, Solana (SOL) and Binance Coin (BNB) have shown impressive growth. However, this dynamic shifts when we broaden our perspective on the graph.

Read More

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- REF PREDICTION. REF cryptocurrency

- PROM PREDICTION. PROM cryptocurrency

- ETC PREDICTION. ETC cryptocurrency

- CEL PREDICTION. CEL cryptocurrency

- VR PREDICTION. VR cryptocurrency

- ISP PREDICTION. ISP cryptocurrency

2024-06-23 19:02