As a seasoned crypto investor, I’ve seen my fair share of market ups and downs, and Ethereum’s recent price action has been no exception. While it’s disappointing that ETH hasn’t been able to break above the $4,000 resistance level yet, I’m encouraged by its relative resilience compared to other coins during this correction phase.

As a crypto investor, I’ve noticed that Ethereum‘s price hasn’t been able to surpass the $4,000 resistance mark again, and it still hasn’t set a new record high for me.

As a researcher observing the cryptocurrency market, I’ve noticed that despite the ongoing correction phase, the coin’s performance remains relatively stronger compared to other digital assets in the market.

Technical Analysis

By TradingRage

The Daily Chart

In the daily chart, ETH‘s value has retreated to $3,500 following another unsuccessful attempt to surmount the $4,000 resistance. At present, $3,500 is acting as a support level, keeping the price from falling any lower toward $3,000.

Should the market dip below the $3,500 mark, it’s expected that the price could swiftly approach the $3,000 support level and the adjacent 200-day moving average.

As an analyst, I would identify the $3,500 level as a significant point of interest given the overlapping factors at play. The price action around this level could provide valuable insights into the market’s direction in the near term.

The 4-Hour Chart

In the past four hours on the chart, the price has remained stable near the $3,500 mark without significantly rising or falling. Additionally, a classic chart pattern has emerged in this region, but so far, the price has been unable to breach this zone from above or below.

As a researcher analyzing market trends, I would say that the future course of action hinges upon the orientation of the impending breakout from this particular pattern.

The Relative Strength Index (RSI) hovers around the 50% mark, indicating that the market’s momentum is roughly balanced and providing limited insight into potential price movements.

Sentiment Analysis

By TradingRage

Open Interest

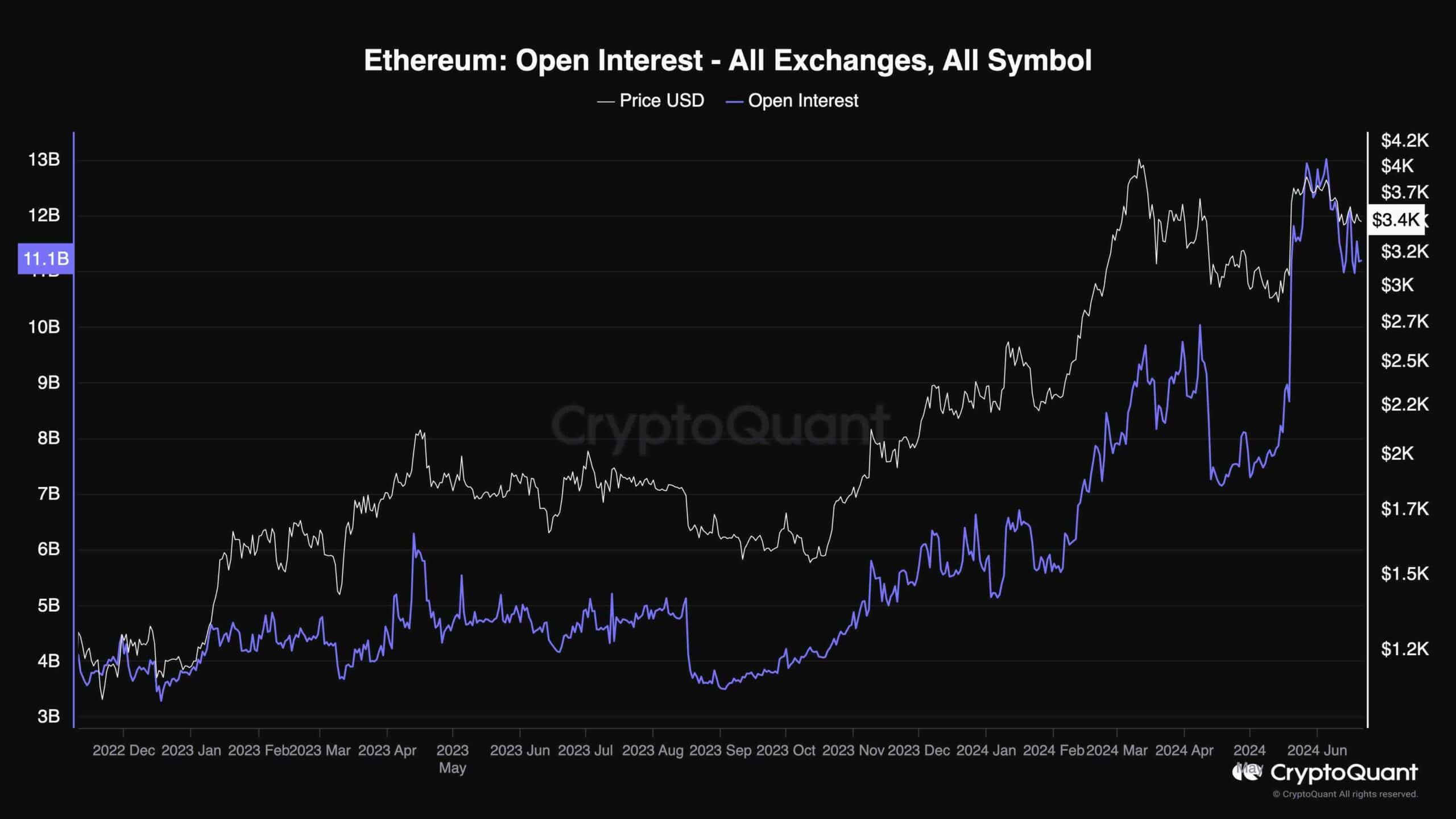

As a data analyst, I can tell you that this chart showcases the total value of Ethereum futures contracts across all exchanges, representing the open interest in the market. When these figures are substantial, they often result in heightened volatility as a consequence of potential liquidation cascades.

As an analyst, I’ve observed a notable surge in open interest for Ethereum (ETH) since its price bounced back from the $3,000 support level. The open interest, which was previously hovering around 7 billion, has skyrocketed to nearly 13 billion.

The recent market recovery may be attributable to this price surge, as certain heavily indebted investments have been sold off and added to the selling frenzy. However, further declines are a distinct possibility given that Open Interest remains significantly greater than it was in March when ETH hovered around similar price points.

Read More

- ACT PREDICTION. ACT cryptocurrency

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- NBA 2K25 Review: NBA 2K25 review: A small step forward but not a slam dunk

- KEN/USD

- Destiny 2: How Bungie’s Attrition Orbs Are Reshaping Weapon Builds

- Valorant Survey Insights: What Players Really Think

- Why has the smartschoolboy9 Reddit been banned?

- Unlocking Destiny 2: The Hidden Potential of Grand Overture and The Queenbreaker

2024-06-21 15:00