As a researcher with a background in cryptocurrencies and market analysis, I find the recent price movements of Bitcoin (BTC) and altcoins disheartening. The underwhelming performance of BTC, which just last week surged past $70,000, has left investors feeling the pain of rejections and subsequent declines toward $64,000. This volatility is not uncommon in this asset class but can be challenging for those new to the market.

As a crypto investor, I’ve noticed that Bitcoin‘s price action has been disappointing lately. The cryptocurrency encountered resistance at $66,400 and took a hit, dipping back towards $64,000 – a move we’ve seen three times this week.

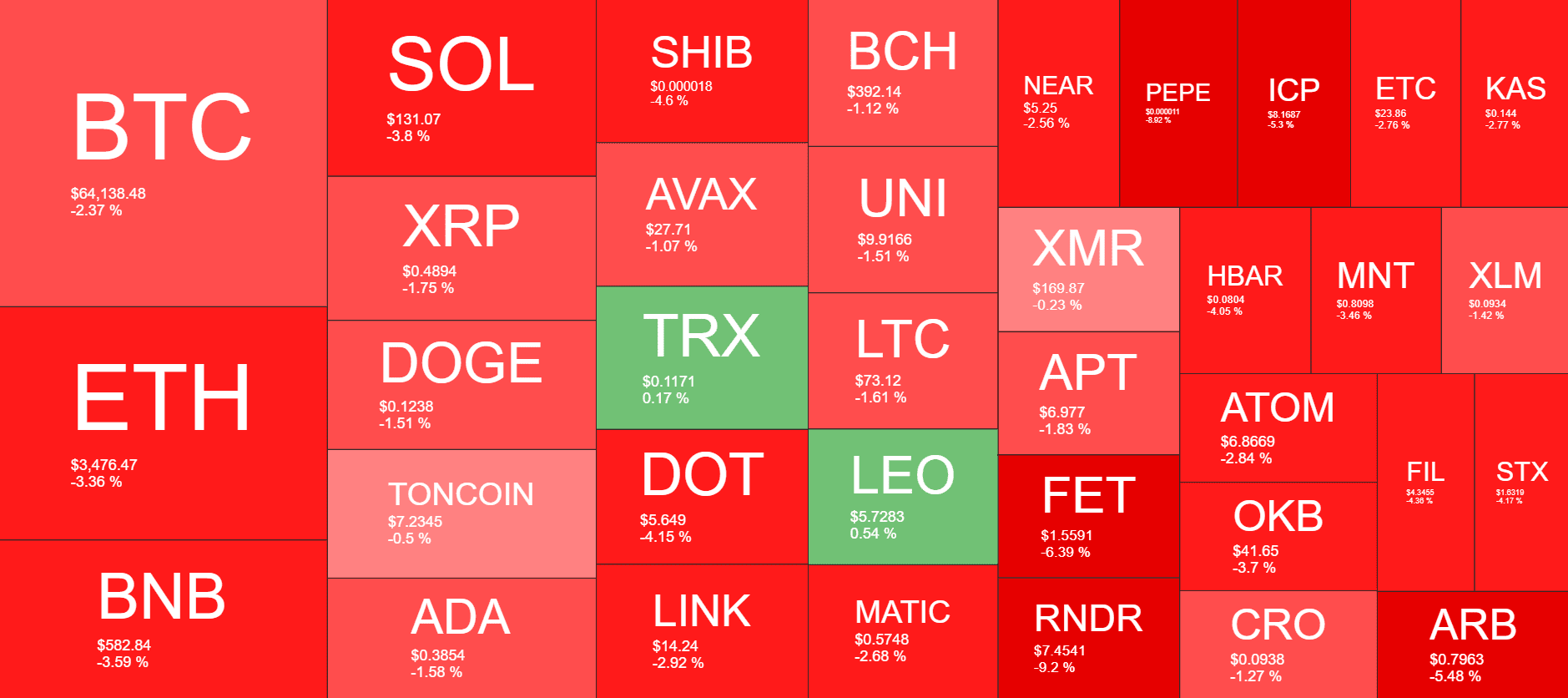

The red tide has spread to the altcoin market, causing significant drops and even agonizing declines, particularly for meme coins.

BTC Slips Toward $64K

The leading cryptocurrency has experienced price declines recently, with setbacks including drops below the $70,000 mark last week, only to be rejected and fall below $65,000 by the end of the week.

Over the weekend, the asset regained some lost ground, bringing its value to slightly over $66,000. As we entered the new business week, there was initial momentum toward reaching $67,000. However, this progress came to a halt, and the bears managed to push Bitcoin down to a monthly low of approximately $64,000.

Yesterday, after being rejected, Bitcoin made a strong push and nearly reached $66,500 on Bitstamp. However, another rejection ensued, causing Bitcoin to battle to stay above $64,000 once more.

The decrease in prices occurs concurrently with significant withdrawals from Bitcoin spot ETFs. Following a brief halt on June 19th, withdrawals reached approximately $140 million the next day. For the first time in a while, GBTC surpassed FBTC in terms of outflows.

The price of Bitcoin has dipped 2% today, resulting in a reduced market capitalization of approximately $1.265 trillion. Despite this decline, Bitcoin’s control over the altcoin market has grown slightly, now standing at 51.5%.

Meme Coins Suffer

The condition of most altcoins is significantly worse than Bitcoin’s. For instance, Ethereum has dropped over 3%, landing below the psychologically significant price point of $3,500. Binance Coin (BNB) has experienced a comparable decline, reaching $583.

More losses come from SOL, SHIB, DOT, LINK, XRP, DOGE, ADA, and others from the larger-cap cohort.

In contrast, some coins from the meme sector experienced significant losses on a daily basis. Notably, WIF touched a multi-month low, joined by JASMY, BONK, BRETT, PEPE, and FLOKI, which all declined by over 8% within a day.

The cumulative market cap of all crypto assets has seen about $50 billion gone in a day.

Read More

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- W PREDICTION. W cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- Valorant Survey Insights: What Players Really Think

2024-06-21 11:44