As an analyst with extensive experience in the cryptocurrency market, I’ve seen firsthand how volatile and unpredictable this space can be. The recent price action of various digital assets, including meme coins like Beercoin (BEER), is a clear example of the risks involved.

TL;DR

- Major cryptocurrencies like Bitcoin, Ethereum, and Ripple saw minor gains, while AI-related coins like Fetch.ai experienced double-digit pumps.

- On the other hand, the price of one meme coin collapsed by 35% daily and 80% weekly following massive sell-offs by large investors.

The Freefall

In the last 24 hours, the cryptocurrency market has bounced back, recouping a significant portion of its recent losses. Notable digital currencies like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) have experienced modest gains. Meanwhile, Fetch.ai and other artificial intelligence-focused coins have surged by double digits.

Some individuals continue to struggle financially, with significant declines. For instance, the meme coin Beercoin (BEER) suffered a 35% drop on a daily basis and an 80% decrease in just one week.

As a crypto investor, I’ve noticed that the downtrend in the market occurred around the same time that several large investors, or “whales,” decided to sell off their holdings in large quantities. According to the blockchain data analysis platform Lookonchain, one of these whales sold an astounding 8.78 billion BEER tokens, which was almost all of his stash, for just over $1 million. Before this sale, another whale disposed of 5.43 billion assets, worth around $1.13 million. These massive sell-offs could have contributed to the market downturn that we’ve seen recently.

As a researcher studying the cryptocurrency market, I’ve observed that massive token sales can lead to a decrease in price. The reason being, the influx of newly minted tokens can outstrip existing demand, resulting in an oversupply situation. Furthermore, the actions of large-scale investors, or “whales,” can negatively impact the involved asset’s reputation. This reputational damage can trigger panic within the investor community and cause a domino effect, leading to other investors selling off their holdings as well.

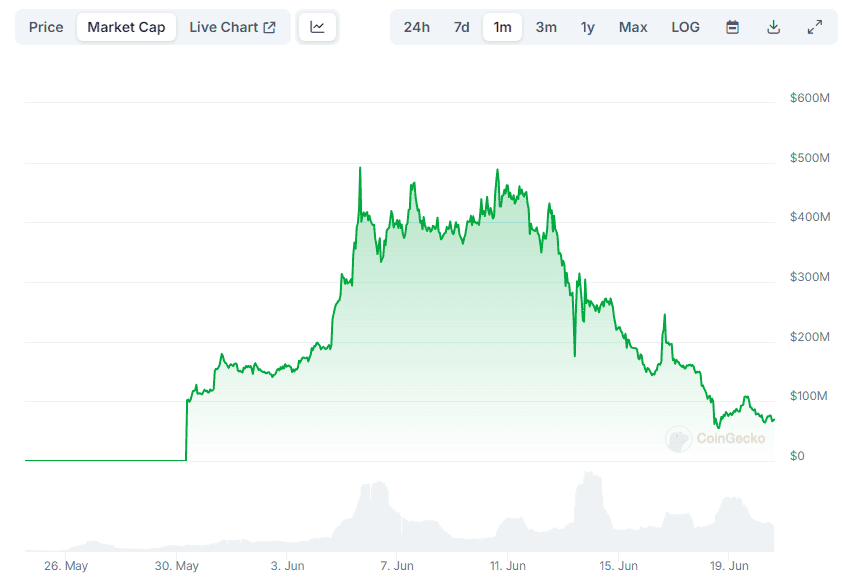

It’s intriguing to note that BEER was a top player in the meme coin segment around early June. The price peaked at around $0.0005 – an all-time high, on the 10th of the month. At that point, its market value had reached over $500 million. However, now its market cap hovers below $70 million.

Remember the Risks Involved

As an analyst, I would caution against jumping on the meme coin bandwagon based on BEER‘s drastic drop in value. The potential risks and losses could be significant for traders.

For individuals intending to join the system, it’s essential to carry out thorough research using credible resources, and only invest an amount they can afford to potentially lose. For further insightful advice, I invite you to watch the informative video we have prepared for you.

Read More

- PENDLE PREDICTION. PENDLE cryptocurrency

- Skull and Bones Players Report Nerve-Wracking Bug With Reaper of the Lost

- Unlocking the Mystery of Brawl Stars’ China Skins: Community Reactions

- SOLO PREDICTION. SOLO cryptocurrency

- Smite 2: Overcoming the Fear of Your First Match in the MOBA Universe

- Understanding the Constant Rain in Pacific Drive: A Reddit Discussion

- Dragon Quest III HD-2D Remake Review: History Repeats

- Team Fight Tactics (TFT) Patch 14.23 Notes: What to Expect from Set 13 Release

- Clash Royale: The Perils of Firecrackers and Cringe Decks

- How to repair weapons & gear in Stalker 2

2024-06-20 15:12