As a seasoned crypto investor with a few years of experience under my belt, I’ve seen my fair share of market fluctuations and learned to read between the lines when it comes to BTC price movements. The recent dip in Bitcoin’s price, down around 8% from its all-time high, has left some investors feeling uneasy. However, I remain optimistic based on the analysis and insights from industry experts.

TL;DR

- Bitcoin’s price has dropped over 8% in the past two weeks to around $65,200, but analysts expect a rebound to $72,000-$74,000 and potentially above $100,000 by late 2024.

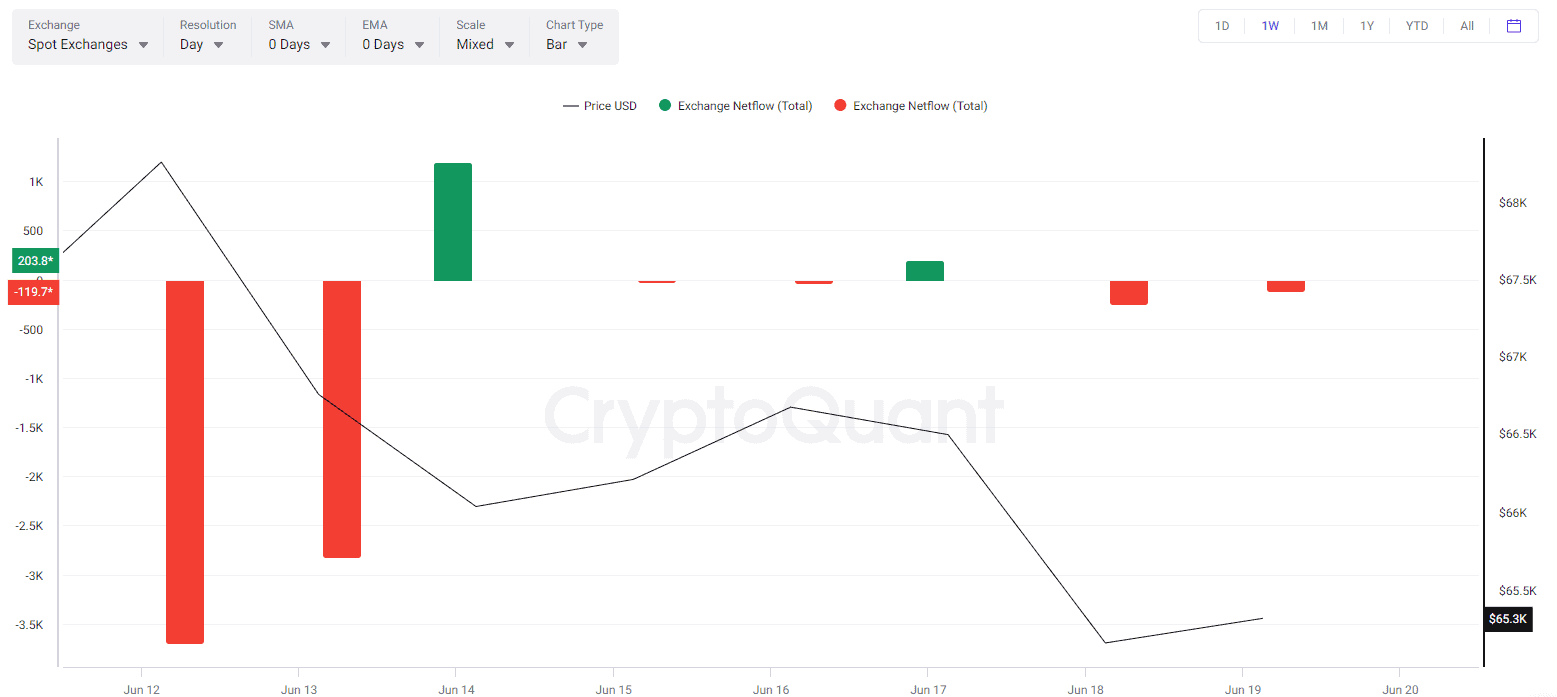

High BTC open interest and negative exchange netflow suggest increased volatility and a potential bull run.

BTC’s Next Possible Move

The number one cryptocurrency by market value has struggled recently, experiencing a drop of more than 8% over the past two weeks. At present, its price is approximately $65,200 based on CoinGecko’s figures, representing a 12% decrease from its peak hit in mid-March this year.

Despite the recent setbacks, notable figures in the industry and experts remain optimistic about a recovery. For instance, Crypto Rover, an influential X user with nearly 800,000 followers, believes that Bitcoin has reached its lowest point and is now ready to surge towards $72,000 to $74,000.

Recall that the asset’s price tumbled to as low as $64,000 on June 18 but recovered some of the losses the following day.

A prominent figure in the crypto sphere also shared their perspective, predicting a possible surge past the $100,000 mark before 2024 comes to an end. This prediction is rooted in the analyst’s belief in the impact of the Bitcoin halving that occurred in April this year.

#Bitcoin It’s about time.

After the halving #BTC takes a few months before pulverizing its previous ATH.

This time is no different.

Patience my friends.

— Titan of Crypto (@Washigorira) June 18, 2024

Every four years, the production of new Bitcoin is reduced by half. Historically, this event has been preceded by significant price increases for Bitcoin and a revival of the cryptocurrency market as a whole.

As a crypto investor, I’ve been following the market closely and I can’t help but notice the similarities between Bitcoin’s current bull run and those of the past. Based on this analysis, I believe we might be approaching the cycle top for Bitcoin. This is assuming its price behavior continues to mirror previous bull markets. If this holds true, we could see the peak price around December 2024 or as late as October 2025.

Taking a Closer Look at Some Major Indicators

“Key metrics related to the Bitcoin blockchain, including open interest and exchange inflows, suggest an uptick in volatility that could lead to a bull market. Open interest represents the current count of unresolved derivative contracts, such as Bitcoin futures or options, waiting to be settled.”

The rise in this metric often signifies that new capital is entering the ecosystem, suggesting that traders are either initiating new positions or enhancing their existing ones. Yet, it may also point towards the opening of fresh short positions, which could potentially lead to a price decrease due to heightened selling activity.

At the beginning of June, the open interest for Bitcoin on various derivatives exchanges reached an all-time record high. Although there was a pullback in the subsequent days, the open interest level remains relatively close to its peak based on CryptoQuant’s data.

The BTC exchange net flow has predominantly been negative over the past week, implying a trend toward self-custody methods from centralized platforms. This shift is viewed as bullish because it decreases immediate selling pressure.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- APFC PREDICTION. APFC cryptocurrency

- FUFU PREDICTION. FUFU cryptocurrency

- TFUEL PREDICTION. TFUEL cryptocurrency

- ETC PREDICTION. ETC cryptocurrency

2024-06-19 16:48