As a seasoned crypto investor with several years of experience under my belt, I’ve grown accustomed to the volatility that comes with investing in digital assets. However, Monday’s market movements were particularly harsh, leaving many traders, including myself, reeling from the losses.

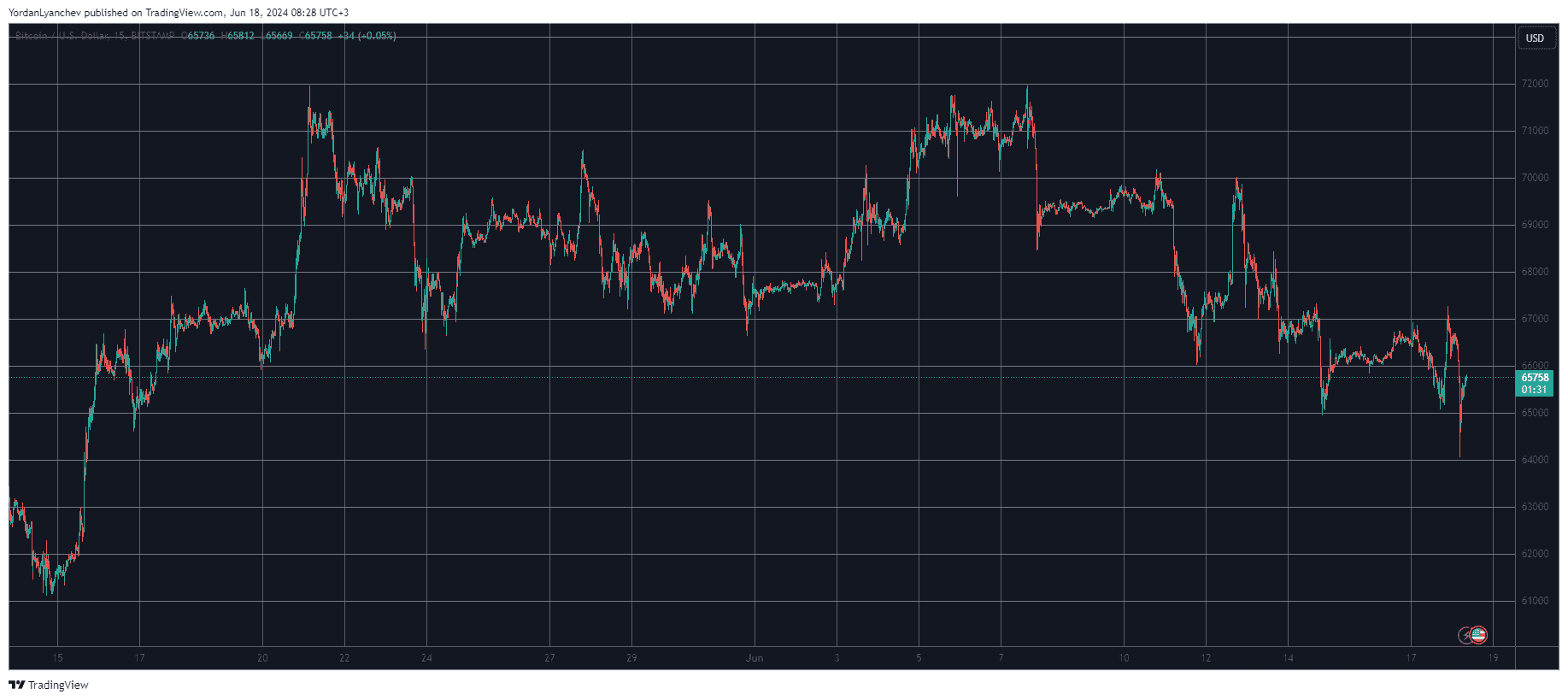

On Monday, Bitcoin experienced significant price fluctuations, with particularly intense movement during the night. The cryptocurrency reached a new low for the month at $64,000.

The daily losses for the altcoin traders were nearly identical, marked by frequent significant price drops that left approximately 190,000 investors suffering.

Over the past weekend, the leading digital asset maintained a relatively low profile, hovering around the $66,000 mark. The beginning of Monday saw minimal activity as well. However, the cryptocurrency picked up momentum throughout the day and gained significant traction.

The price reached a high of approximately $67,200 in the local market before bears gained full influence, causing a significant decline.

In just a short time, the price of bitcoin dropped more than $3,000 and reached its lowest point since May 15th, at approximately $64,000 on Bitstamp. However, it has since rebounded and is now hovering around $66,000.

As a researcher studying the cryptocurrency market, I’ve observed that the altcoins’ price actions have shown striking resemblances, with notable declines across many of them. SHIB and DOGE, in particular, have experienced considerable losses, leaving both coins approximately 10% lower than their previous day’s closing prices. On the other hand, SOL, AVAX, LINK, ADA, and DOT have suffered more substantial blows, plunging by 7-9%.

The price of Ethereum (ETH) has dropped to around $3,450 following a decline to $3,330 earlier today. Additionally, there have been significant losses in the prices of Near Protocol (NEAR), Uniswap (UNI), Polygon (MATIC), Waves (WIF), Filecoin (FIL), and Fetch.ai (FET), among others.

As a crypto investor, I’ve experienced firsthand the tumultuous swings in the market that have left over-extended traders reeling. In just the past day, more than 190,000 of us have seen our positions liquidated due to this volatility. The financial toll is significant, with over $480 million in total value wiped out within this timeframe.

On Binance, the biggest recorded single trade resulting in a settlement occurred, valued at approximately $6.44 million. This transaction centered around the Ethereum-USD Coin trading pair, as reported by CoinGlass.

Read More

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- PROM PREDICTION. PROM cryptocurrency

- QNT PREDICTION. QNT cryptocurrency

- MAGIC PREDICTION. MAGIC cryptocurrency

- GST PREDICTION. GST cryptocurrency

2024-06-18 08:36