As a seasoned crypto investor, I’ve seen my fair share of market fluctuations driven by major economic developments, and the recent volatility in Bitcoin (BTC) and altcoins is no exception. The past few days have been particularly nerve-wracking as BTC dropped from over $70,000 to $66,000 ahead of the US Consumer Price Index (CPI) data and the Federal Open Market Committee (FOMC) meeting.

The price fluctuations of Bitcoin have been significantly impacted by significant economic events in the United States yet again. It dipped from around $70,000 to $66,000 just prior to the release of the US Consumer Price Index (CPI) data and the Federal Open Market Committee (FOMC) meeting.

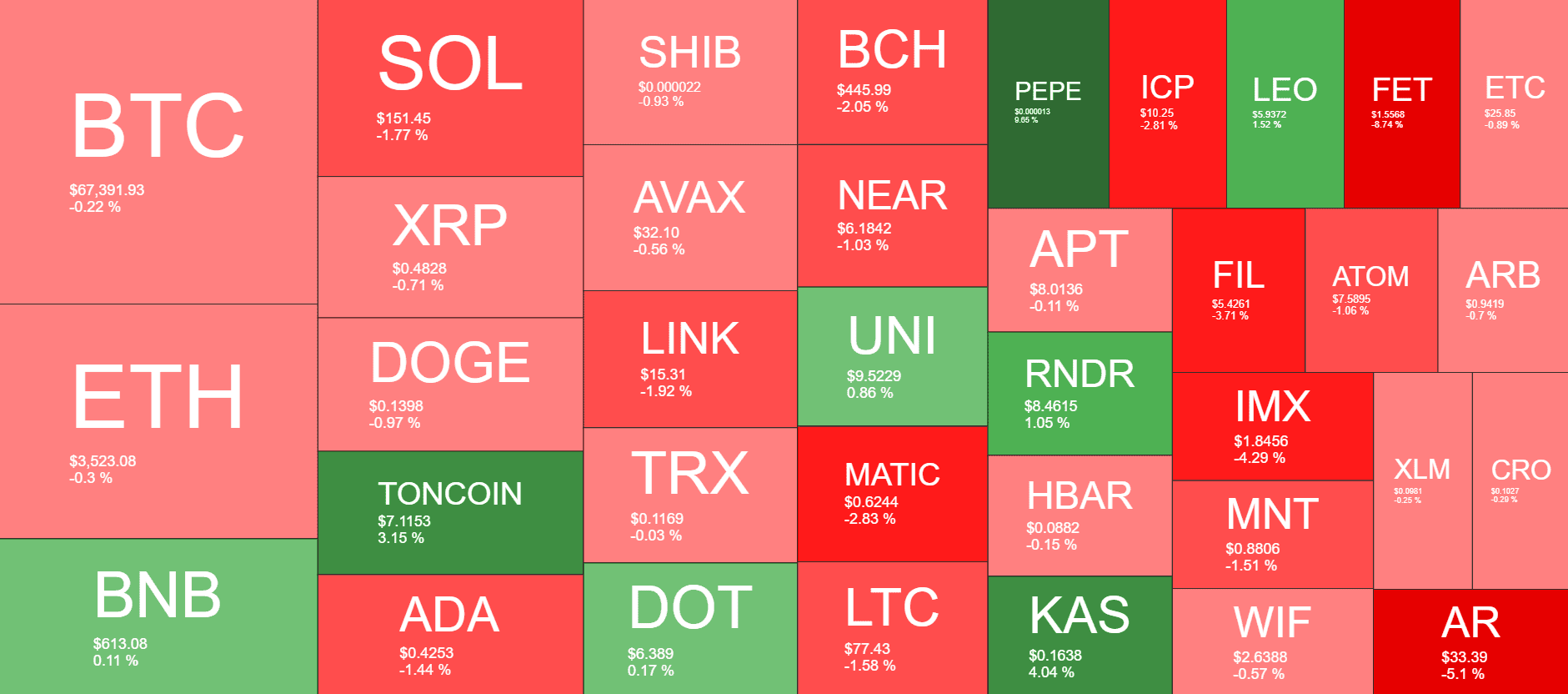

As an analyst, I’ve observed that the altcoin market has been quite volatile recently. Amongst this turbulence, PEPE has stood out by recording a significant gain of over 10%.

BTC Prepares for US Developments

Last week ended dramatically for the leading cryptocurrency as its value plummeted from approximately $72,000 to around $68,600 within hours. The weekend, however, was relatively uneventful with the asset regaining some lost ground and settling above $69,000.

As a researcher studying the cryptocurrency market, I observed an uplifting shift on Monday as bitcoin surged past the $70,000 mark once again. Yet, the conclusion of the extended period of inflows into the Bitcoin Trust ETF brought about turbulence for the asset, causing it to dip toward $68,000 on Tuesday.

I’ve experienced yet another price drop within the last 12 hours that pushed Bitcoin down to a low of $66,000 – its weakest point since May 20th. This unfolded as investors grew anxious about the upcoming US Consumer Price Index (CPI) data and the following Federal Open Market Committee (FOMC) meeting, both scheduled for today.

Bitcoin has recovered from its previous drops and now hovers above the $67,000 mark. Yet, potential fluctuations are imminent following the upcoming US developments, likely leading to increased market turbulence.

Currently, Bitcoin’s market capitalization is under $1.330 trillion, and its supremacy over altcoins amounts to 51.5%.

PEPE Defies Overall Trend

I’ve analyzed the market trends over the past 24 hours, and I notice that larger-cap altcoins have exhibited a subdued performance following significant value losses the previous day. Specifically, coins such as Ethereum (ETH), Solana (SOL), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), Shiba Inu (SHIB), Avalanche (AVAX), Chainlink (LINK), and Tether (TRX) remain in the red, indicating a slight downturn in their value.

In contrast, TON has jumped by 3%, while KAS has added just over 4% in the past day.

Among the group of assets under consideration, PEPE has stood out as the frontrunner, experiencing a gain of over 10%. Its current value surpasses $0.000013.

In contrast, FET has dumped by more than 8%, followed by AR (-5%), IMX (-4%), and FIL (-4%).

The total crypto market cap has shed some more value and now sits below $2.6 trillion.

Read More

- CKB PREDICTION. CKB cryptocurrency

- EUR INR PREDICTION

- PBX PREDICTION. PBX cryptocurrency

- IMX PREDICTION. IMX cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- USD DKK PREDICTION

- ICP PREDICTION. ICP cryptocurrency

- GEAR PREDICTION. GEAR cryptocurrency

- O3 PREDICTION. O3 cryptocurrency

- USD VND PREDICTION

2024-06-12 11:54