As a researcher with a background in technical and on-chain analysis, I have been closely monitoring Bitcoin’s price action lately. The lack of upward momentum above the $75K level has left me with a sense of caution, and I believe that even a deeper correction is probable.

The price of Bitcoin has lost steam in its climb and hasn’t managed to surpass the previous peak of $75,000. With the recent market trend, a more significant downturn could be on the horizon.

Technical Analysis

By TradingRage

The Daily Chart

In simpler terms, the daily price chart showed that the cost dipped beneath the $68,000 support a few days back. Since then, it has retreated and is now back within the larger downward trendline, meaning the previous price breakout was misleading.

In simpler terms, the price of $60,000 appears to be a reasonable goal for the coming weeks based on current market trends. On the downside, the 200-day moving average hovering around $56,000 could potentially serve as the next target in unfavorable market conditions.

The 4-Hour Chart

From my perspective as a crypto investor, the four-hour chart provides clearer insights. The price action has been constructing an uptrend channel around the $70,000 resistance level. However, the trendline of this channel appears to be breaking downwards, which is a bearish sign and often serves as a warning for potential price reversals.

Currently, the Relative Strength Index (RSI) has moved into the oversold territory, suggesting a possible false signal of further price declines, also known as a “bear trap.” Consequently, if the market recovers swiftly and re-enters its established trendline, the bearish forecast may be invalidated, giving way to an uptrend or bullish reversal.

On-Chain Analysis

By TradingRage

Exchange Reserve

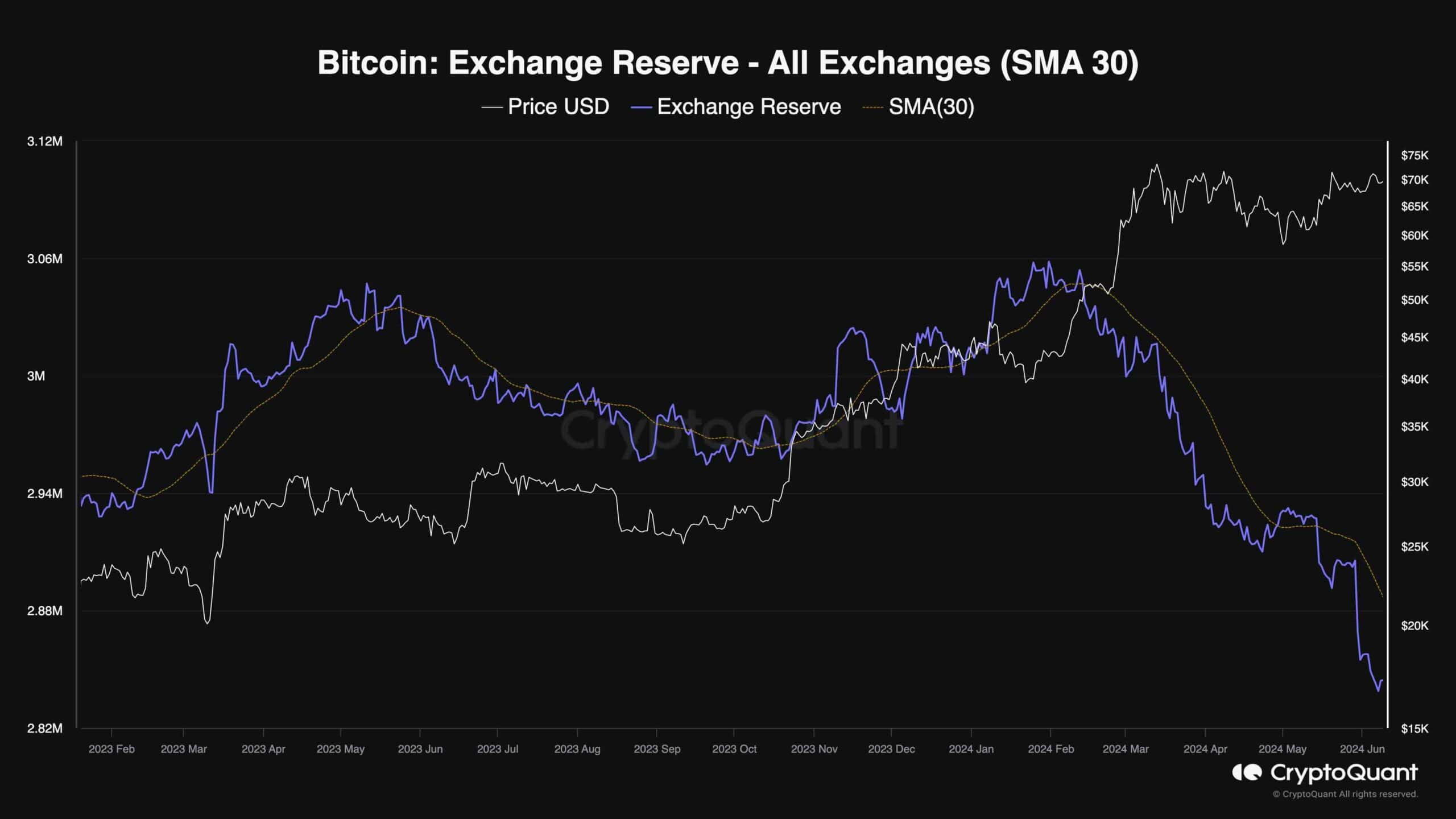

Although Bitcoin’s bullish trend may appear to be weakening on the surface, there’s considerable activity happening beneath the radar. The enclosed chart showcases the Bitcoin exchange reserve metric – an indicator that reveals the quantity of Bitcoin kept in wallets linked to exchanges.

As a financial analyst, I would interpret a decrease in exchange reserves as a sign of strong demand for a currency in the market, outpacing the supply. Conversely, an increase in exchange reserves implies that there is more supply of the currency than demanded, which could suggest excessiveness in the supply side.

As a researcher studying the cryptocurrency market, I’ve noticed that the exchange reserve for Bitcoin has been decreasing at an alarming rate lately, particularly since it bounced back from the $60K mark in early May. Despite the bearish technical indicators, the underlying fundamentals of Bitcoin’s supply and demand appear robust and could potentially trigger a price surge in the near future.

Read More

- PENDLE PREDICTION. PENDLE cryptocurrency

- CKB PREDICTION. CKB cryptocurrency

- PBX PREDICTION. PBX cryptocurrency

- USD DKK PREDICTION

- GEAR PREDICTION. GEAR cryptocurrency

- W PREDICTION. W cryptocurrency

- USD VND PREDICTION

- ICP PREDICTION. ICP cryptocurrency

- EUR INR PREDICTION

- LDO PREDICTION. LDO cryptocurrency

2024-06-11 17:56