As a seasoned analyst with extensive experience in the cryptocurrency market, I have closely monitored Bitcoin’s price action and identified several key factors influencing its current consolidation phase.

As a Bitcoin market analyst, I’ve noticed that the cryptocurrency’s price has been facing challenges in reaching its previous record high of $75,000. Instead, it’s been trading within a range, indicating consolidation in the market.

As a crypto investor, I’ve noticed that the value of my digital assets took a hit on Friday, dropping below the $70,000 mark. If this current support level fails to hold, we might be in for a more significant correction, potentially pushing prices even lower.

Technical Analysis

By TradingRage

The Daily Chart

As a researcher studying Bitcoin’s price action on the daily timeframe, I observe that the price has been consistently touching the upper boundary of a large descending channel without managing to push above it with sufficient momentum. The crucial support area at $69,000 is currently keeping BTC afloat, preventing any significant downtrend that could potentially lead us back inside the channel towards the $60,000 level.

Should the market manage to surpass the $72K resistance point, a significant surge towards the previous record high of $75K and potentially beyond could follow.

The 4-Hour Chart

On the 4-hour Bitcoin chart, an ascending channel is taking shape near $70,000. The price has attempted to breach the upper trendline and the $72,000 resistance twice but has faced rejections each time. Now, it’s hovering around the support at $69,000.

If this trend were to falter at this point, it could lead to greater complications. Should the price take a turn for the worse, a significant decline towards the $60,000 mark is a strong possibility within the near future.

With the RSI also below 50%, the bearish scenario seems probable.

Sentiment Analysis

By TradingRage

Open Interest

As an analyst, I’ve noticed that despite Bitcoin’s price not reaching a new record high, some investors are searching for explanations. While the indicators in the spot market appear robust, it’s essential to consider the role of the futures market.

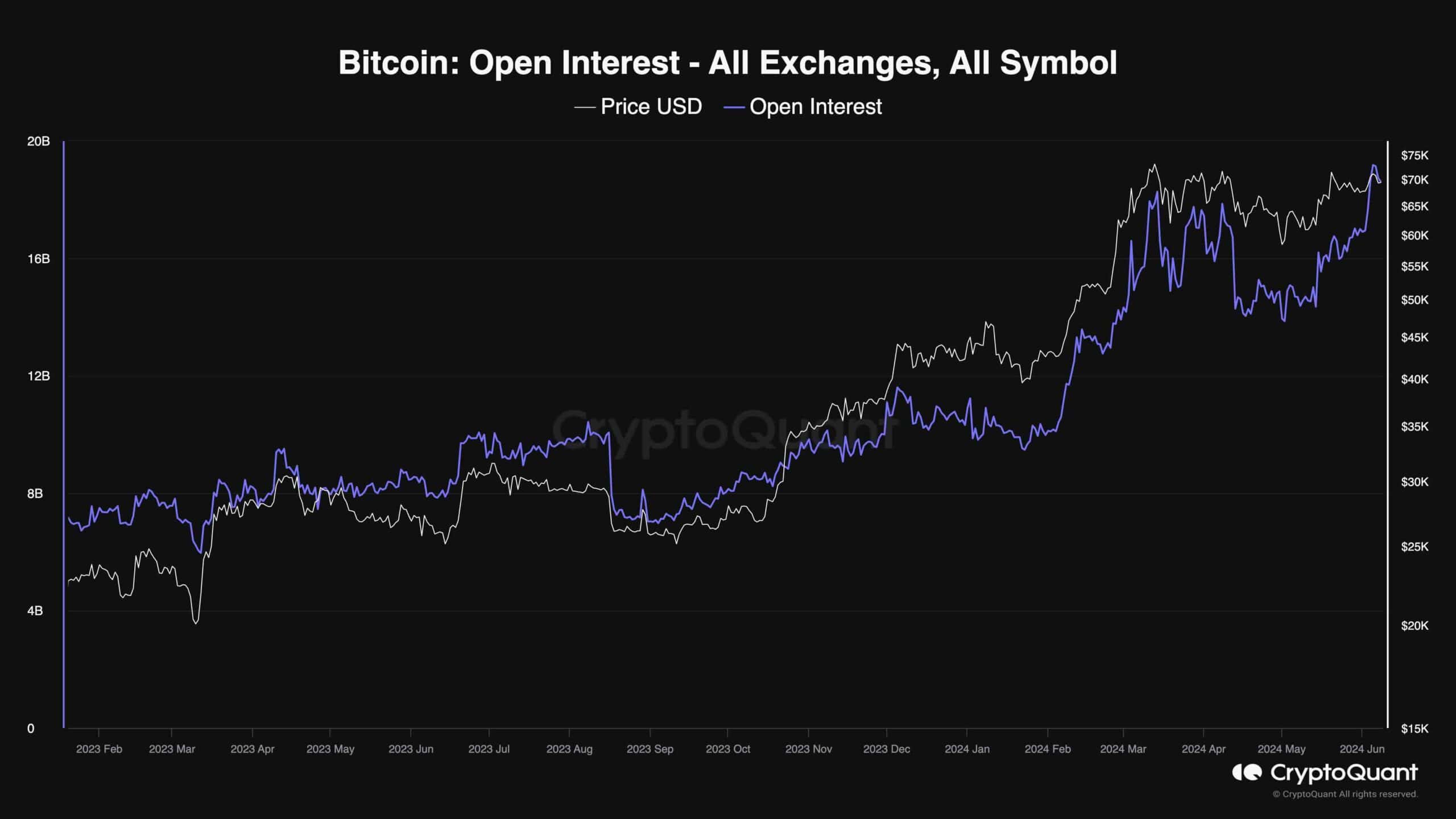

A chart displays the current number of open Bitcoin futures contracts across all trading platforms, denoted as Bitcoin open interest. An increase in open interest signifies a larger pool of active positions. Consequently, this heightened activity may lead to a potential chain reaction of liquidations.

As an analyst, I’ve noticed a bearish divergence emerging in the market. Open interest reached a new all-time high not too long ago, while the price itself has yet to follow suit and set a new high. This discrepancy between open interest and price led to the correction we experienced yesterday. Although it remains uncertain if the price will continue to decline or attempt to rise further, historically high open interest values tend to be bearish indicators for the market.

Read More

- CKB PREDICTION. CKB cryptocurrency

- EUR INR PREDICTION

- PBX PREDICTION. PBX cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- IMX PREDICTION. IMX cryptocurrency

- TANK PREDICTION. TANK cryptocurrency

- W PREDICTION. W cryptocurrency

- ICP PREDICTION. ICP cryptocurrency

- USD DKK PREDICTION

- GEAR PREDICTION. GEAR cryptocurrency

2024-06-09 18:06