As an experienced technical and sentiment analyst, I’ve closely observed Polkadot’s price action over the past few weeks. The daily chart reveals a significant resistance zone encompassing the $7.5 mark, the 100-day moving average, and critical Fibonacci levels. This formidable range has prevented Polkadot from advancing in the short term.

Polkadot encounters a formidable hurdle in regaining control over the $7.5 price level, the 100-day moving average, and vital Fibonacci retracement points. Overcoming this resistance zone could temporarily thwart any further gains.

Technical Analysis

By Shayan

The Daily Chart

As an analyst, I’ve conducted an in-depth analysis of Polkadot’s daily price chart, and I’ve noticed that for several weeks, the cryptocurrency has been battling to surmount a significant resistance area. This obstacle, which has proven challenging to overcome, consists of:

- The static resistance level at $7.5

- The 100-day moving average at $7.6

- The price range between the 0.5 ($7.4) and 0.618 ($7.8) Fibonacci levels

As a researcher studying this market, I believe the extensive price range we’re observing comes with substantial buying and selling forces that can hinder any potential advance by buyers. In case of a price rejection, it is expected that the consolidation phase will expand, causing a slight retreat in price towards the $6.5 support area.

As a researcher studying market dynamics, I would describe it this way: If buyers manage to gain the upper hand against sellers, there’s a possibility of a short squeeze occurring. This situation could lead to a sudden and powerful price surge, pushing the value towards the $8 mark.

The 4-Hour Chart

On the 4-hour chart, Polkadot’s price has taken the shape of an ascending triangle during the current extended period of sideways trading. Such a configuration usually signals a resumption of the downward trend once broken below its support line.

After hitting a roadblock at the notable $7.5 resistance, the price took a downturn and touched the support level at the pattern’s bottom. Yet, the energy for price movement subsided, resulting in a phase of limited fluctuation. Nevertheless, the price is teetering on the edge of breaching the pattern’s lower boundary. A successful breakout could set off a chain reaction, potentially pushing the price down to the $6.5 target.

Instead of “Conversely, continuing the current consolidation phase within the pattern is the most likely scenario, with the price aiming for the wedge’s upper boundary around $8,” you could say:

Sentiment Analysis

By Shayan

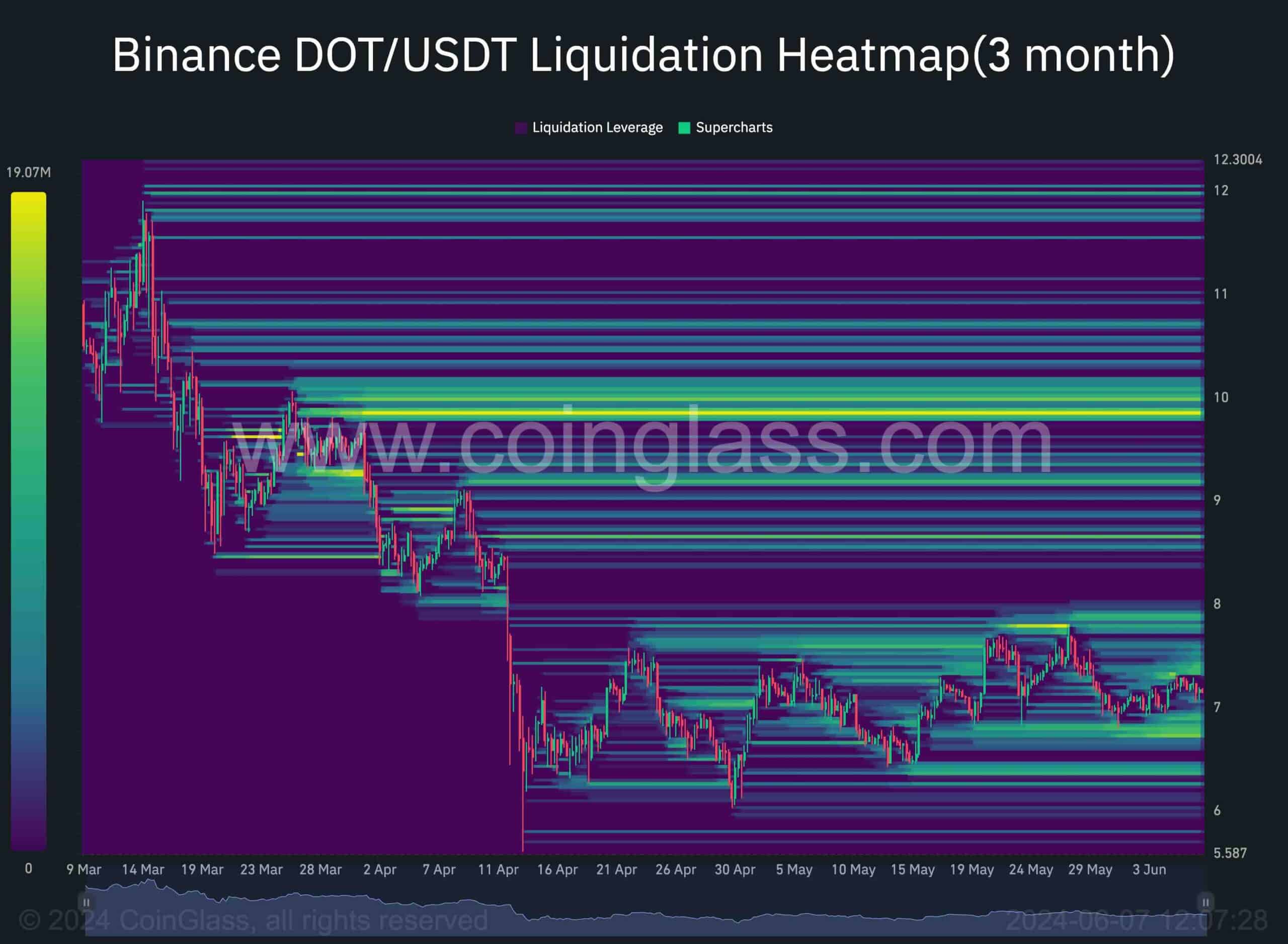

Polkadot is presently holding steady near the $7 price point. Analyzing data from the futures market, specifically the DOT/USDT Binance liquidation map, can offer useful information regarding forthcoming price shifts and pockets of liquidity.

Below the $7 mark on the heatmap, there’s a sizeable concentration of stop-loss orders and liquidation prices, signaling potential significant selling activity. The $8 region, meanwhile, boasts considerable liquidity and serves as a resistance level. As the price nears this zone, traders may look to offload their positions or lock in profits, resulting in added selling pressure.

As a researcher studying market trends, I’ve observed that the $10 price range holds significant trading activity, which might be indicative of the levels at which short sellers may have set their stop-loss orders or liquidated their positions during the initial bearish trend before the current consolidation phase.

The price of Polkadot is currently sandwiched between the strong support at $7 and the resistance level at $8. These levels are significant due to substantial liquidity pools present in the market at these price points. A breach of this price range could result in sizeable price fluctuations, with the $10 mark emerging as a potential intermediate objective if there is a bullish resurgence.

Read More

- CKB PREDICTION. CKB cryptocurrency

- EUR INR PREDICTION

- PBX PREDICTION. PBX cryptocurrency

- IMX PREDICTION. IMX cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- USD VND PREDICTION

- TANK PREDICTION. TANK cryptocurrency

- USD DKK PREDICTION

- ICP PREDICTION. ICP cryptocurrency

- GEAR PREDICTION. GEAR cryptocurrency

2024-06-07 20:37