As a seasoned analyst with extensive experience in cryptocurrency markets, I’ve been closely monitoring Bitcoin’s price action. The technical analysis shows that the price is poised to create a new all-time high, with only one significant resistance zone standing in its way. Based on the daily chart, the $69K resistance level and the upper boundary of the descending channel are the last obstacles before BTC reaches the $75K ATH. The RSI reading above 50% also indicates a bullish momentum.

The price of Bitcoin is nearly reaching a new record high, with just one major obstacle left to overcome.

Technical Analysis

By TradingRage

The Daily Chart

In simpler terms, the cost has reached the upper limit of the extensive downward trendline channel on the daily chart, as well as the $69,000 resistance level. If it manages to surpass this area, the market could potentially soar towards the all-time high ($75,000) and even establish a new record peak.

Using the Relative Strength Index, which has surpassed the 50% threshold, suggests that the upward trend for Bitcoin may persist further. A potential rally could be imminent.

fThe 4-Hour Chart

On a four-hour basis, the situation is more complicated. The price has had difficulty staying above the $69,000 resistance mark and has been confined within an equally balanced triangle formation.

As an analyst, I’ve noticed that the trendline indicating the overall upward direction of the data has been breached in recent times. Consequently, it seems increasingly likely that a new record-breaking peak will soon materialize.

As a crypto investor, I believe that a significant drop in price might push us toward the $60K support level, which could mark a deep decline if the price falls back within the triangle pattern on the chart. However, the bullish outlook seems more probable given current market conditions.

On-Chain Analysis

By TradingRage

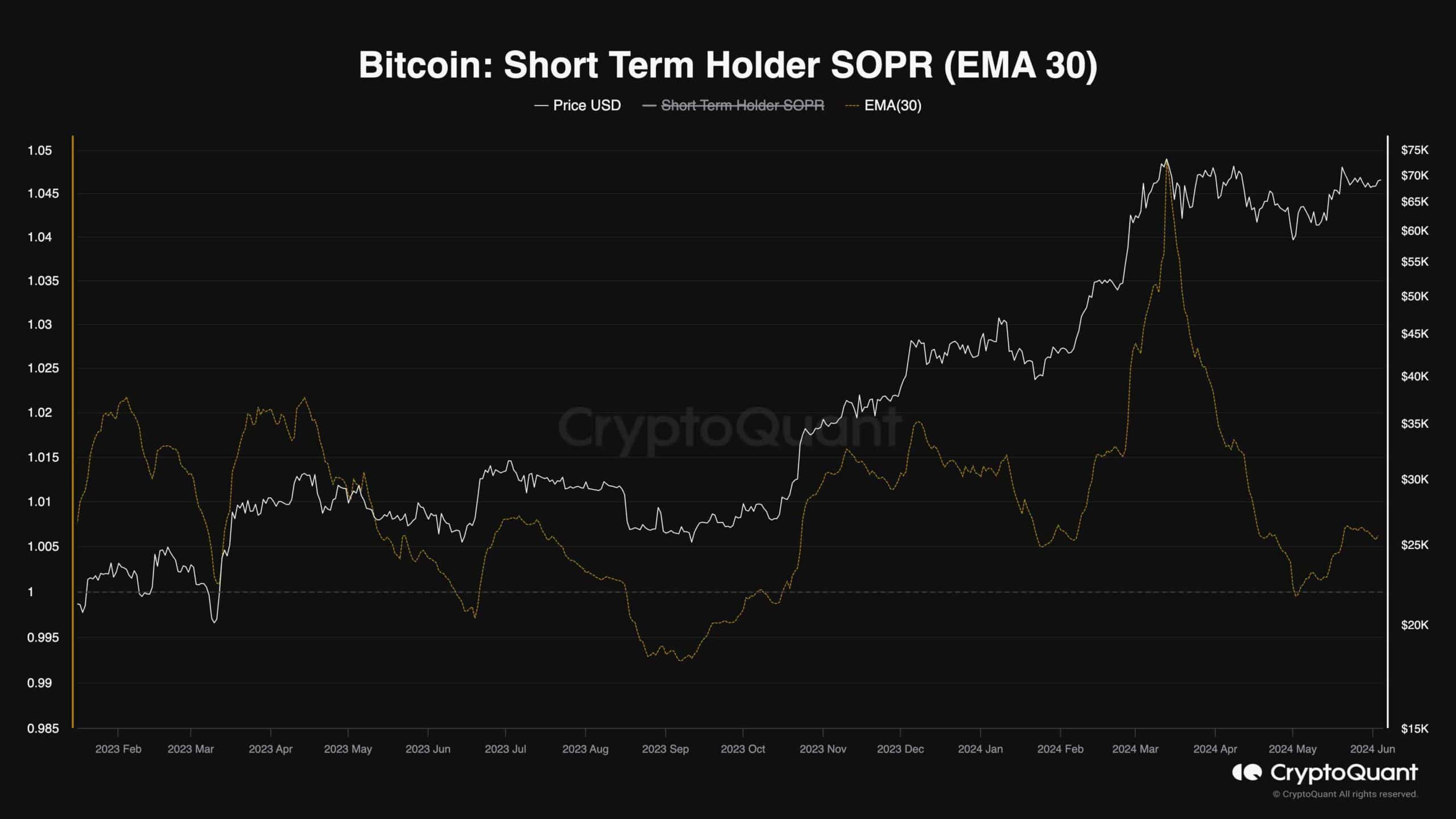

Bitcoin Short-Term Holder SOPR

As Bitcoin’s price nears its record high of roughly $75,000, some investors ponder if the market is heating up once more. Examining the Short-Term Holder SOPR (Spend Output Proximity Ratio) might provide insight into this concern.

The Short-Term Holder SOPR is a metric derived from on-chain analysis that calculates the ratio of profits and losses for brief Bitcoin tenures. A figure above one signifies net profit realization, whereas a value below one indicates more losses than gains collectively among short-term investors. These investors are defined as those who have owned their coins for fewer than 155 days.

This chart demonstrates the 30-day exponential moving average of the STH SOPR metric. As evident, the metric shows values above one, pointing to profit realization by investors. However, these values are much smaller than those witnessed during the $75K all-time high. Therefore, the market has cooled down compared to March, and a sustainable rally could be shaping up soon.

Read More

- Finding Resources in Palworld: Tips from the Community

- UFO PREDICTION. UFO cryptocurrency

- The Last Epoch Dilemma: Confronting the Gold Dupe Crisis

- BONE PREDICTION. BONE cryptocurrency

- W PREDICTION. W cryptocurrency

- EUR HKD PREDICTION

- Michelle Yeoh Will Not Appear in ‘Avatar 3,’ Says James Cameron: ‘She’s in 4 and 5’

- TANK PREDICTION. TANK cryptocurrency

- Skull and Bones: Gamers’ Frustrations with Ubisoft’s Premium Content Delivery

- Last Epoch: Why Keystroke Registration Issues Are Frustrating Players

2024-06-05 15:53