As a seasoned analyst with extensive experience in the cryptocurrency market, I’ve closely monitored Polkadot’s (DOT) price action over the past few months. The consolidation period following the steep decline in early April has left many investors uncertain about the future direction of this promising project.

As a researcher studying the cryptocurrency market, I’ve noticed that Polkadot‘s price has been stabilizing after experiencing a significant drop in early April. However, recent developments could potentially lead to positive changes.

Technical Analysis

By TradingRage

The Daily Chart

The cryptocurrency’s daily chart displays a rising wedge formation, indicating a potential bearish trend. This pattern may be confirmed if the price falls below it. Simultaneously, the market has been fluctuating near its 200-day moving average, exhibiting an uptrend with successive higher peaks and troughs.

As a researcher examining the price movements of DOT, I’ve identified a significant probability that this cryptocurrency could deviate from its current trend and surge towards the $9 resistance level. However, whether or not this occurs ultimately hinges on the direction of the breakout from the pattern.

The 4-Hour Chart

Examining the 4-hour chart, the price movement within the ascending wedge pattern becomes more evident. DOT has touched both the upper and lower lines of the channel several times at this point. Presently, it is bouncing off the lower trendline and picking up speed to head towards the upper trendline.

Should the current trend continue and be successful, there’s a strong likelihood that the pattern will be disrupted, paving the way for a potential new bullish surge. Conversely, if the price takes a turn for the worse and plummets, it could lead to a significant decline toward the $6 mark and possibly even lower.

Futures Market Analysis

By TradingRage

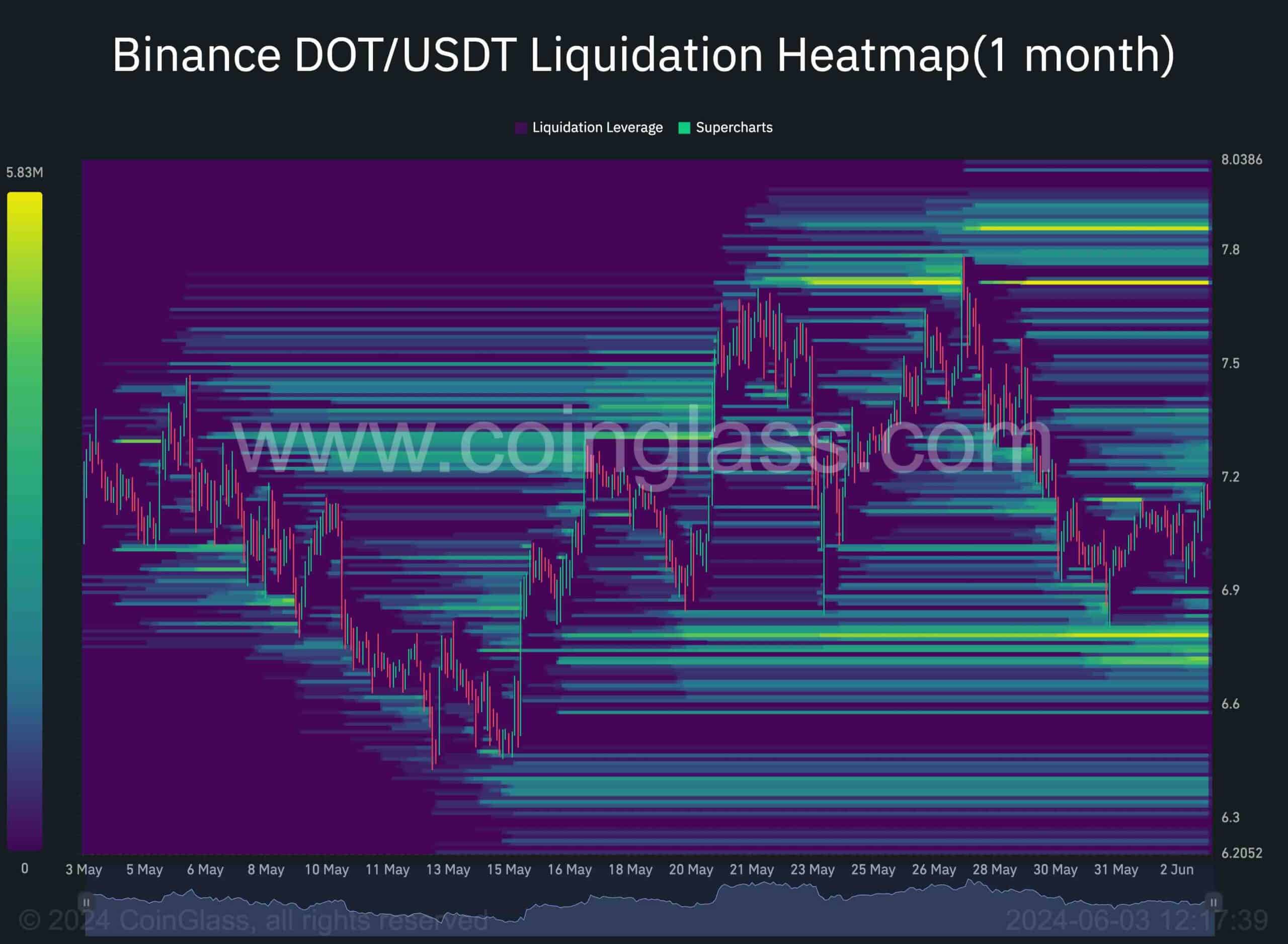

Polkadot Binance Liquidation Heatmap

As a crypto investor keeping an eye on Polkadot’s price movements, I’ve noticed that it has been forming higher highs and lows around the $7 mark. However, delving deeper into the Binance liquidation heatmap provides valuable insights as to why this trend persists.

Based on my analysis of the data presented in the chart, I’ve noticed that the price has not dipped beneath the $6.8 mark. This could be due to several reasons, one of which might be the significant liquidity lurking below this level. It is plausible that stop-loss orders and liquidation prices for large investors, commonly referred to as “whales,” are situated at this price point. Consequently, these investors have been actively intervening in the market to protect their investments by driving up the price.

As a researcher studying market trends, I’ve observed that the $8 zone holds significant liquidity, much like the area around the current price levels. These two zones serve as key resistance and support points, respectively. A breach of either level could have a profound impact on market direction, potentially leading to a chain reaction of sell or buy orders being triggered, intensifying the prevailing trend.

Read More

- ACT PREDICTION. ACT cryptocurrency

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- NBA 2K25 Review: NBA 2K25 review: A small step forward but not a slam dunk

- Aphrodite Fanart: Hades’ Most Beautiful Muse Unveiled

- Destiny 2: How Bungie’s Attrition Orbs Are Reshaping Weapon Builds

- Valorant Survey Insights: What Players Really Think

- Why has the smartschoolboy9 Reddit been banned?

- KEN/USD

2024-06-03 18:12