As a seasoned crypto investor with a keen interest in market trends and economic data, I find the correlation between Bitcoin’s price and Consumer Price Index (CPI) data intriguing. Based on my experience and analysis of the market, I agree with Markus Thielen’s assessment that higher-than-expected CPI has been bearish for Bitcoin, while lower-than-expected CPI has been bullish.

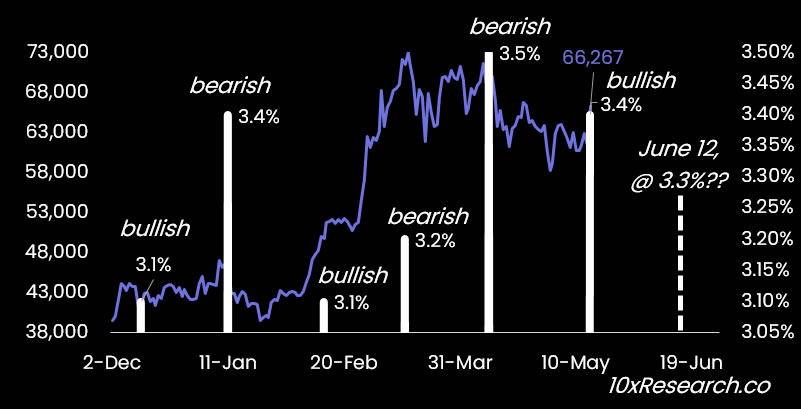

The price of Bitcoin tends to react significantly to new CPI (Consumer Price Index) figures, as stated in a May 29 analysis by Markus Thielen from 10x Research.

As an analyst, I’ve observed that unexpectedly high Consumer Price Index (CPI) figures have had a negative impact on the value of cryptocurrencies. Conversely, when CPI data comes in lower than anticipated, it tends to boost the crypto market.

Correlations With CPI Data

After analyzing Bitcoin ETF data, it was observed that inflows increased noticeably following the release of Consumer Price Index (CPI) data, particularly when the data indicated a decrease in inflation compared to the preceding month.

As a researcher studying the relationship between Bitcoin (BTC) prices and U.S. inflation data over the past six months, I observed an intriguing pattern. Specifically, when the Consumer Price Index (CPI) showed higher-than-anticipated figures, BTC tended to exhibit bearish behavior. Conversely, if the CPI reading came in lower than expected, Bitcoin displayed bullish tendencies.

Traders well-versed in Bitcoin’s response to Consumer Price Index (CPI) data can approach trades with assuredness, considering they understand the market trends and may consider implementing transactions oppositely to the monthly CPI variation compared to the preceding month.

Based on current research, it’s expected that Bitcoin Exchange-Traded Fund (ETF) investments will continue to flow in generously during the subsequent two weeks prior to the June 12 Consumer Price Index (CPI) data announcement. This trend could potentially propel Bitcoin to fresh record peaks.

According to the projected pricing model, there will be a slight decrease in prices instead of the anticipated higher inflation rate for May 15 as per consensus expectations. The forecast suggests that inflation could remain relatively stable over the next two months, with a potential trend towards decreasing prices emerging.

“If inflation prints 3.3% or lower, bitcoin should make a new all-time high.”

Based on recent analysis, it appears that inflation may no longer be a significant issue, and could even benefit Bitcoin’s growth as we move through the summer months. The Consumer Price Index (CPI) reported an inflation rate of 3.4% for April in the United States.

On comingFriday, May 31st, we will receive an update on the Core Personal Consumption Expenditures (PCE) price index – a key measure of inflation favored by the Federal Reserve.

BTC Price Outlook

Currently, Bitcoin is experiencing a 1% decrease in value and is hovering around the price point of $68,000. Its lowest point during Thursday’s trading was at $67,122, but it rebounded during the Asian trading hours in the morning.

Over the last two weeks, Bitcoin has shown little change and currently stands 7.7% lower than its record peak in mid-March. The price stabilization persists.

Most altcoins are experiencing greater declines today, leading to a collective market downturn of 1.3%, reducing the total cryptocurrency market capitalization to $2.68 billion.

Read More

- ACT PREDICTION. ACT cryptocurrency

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- NBA 2K25 Review: NBA 2K25 review: A small step forward but not a slam dunk

- Aphrodite Fanart: Hades’ Most Beautiful Muse Unveiled

- Destiny 2: How Bungie’s Attrition Orbs Are Reshaping Weapon Builds

- Valorant Survey Insights: What Players Really Think

- Why has the smartschoolboy9 Reddit been banned?

- KEN/USD

2024-05-30 09:22