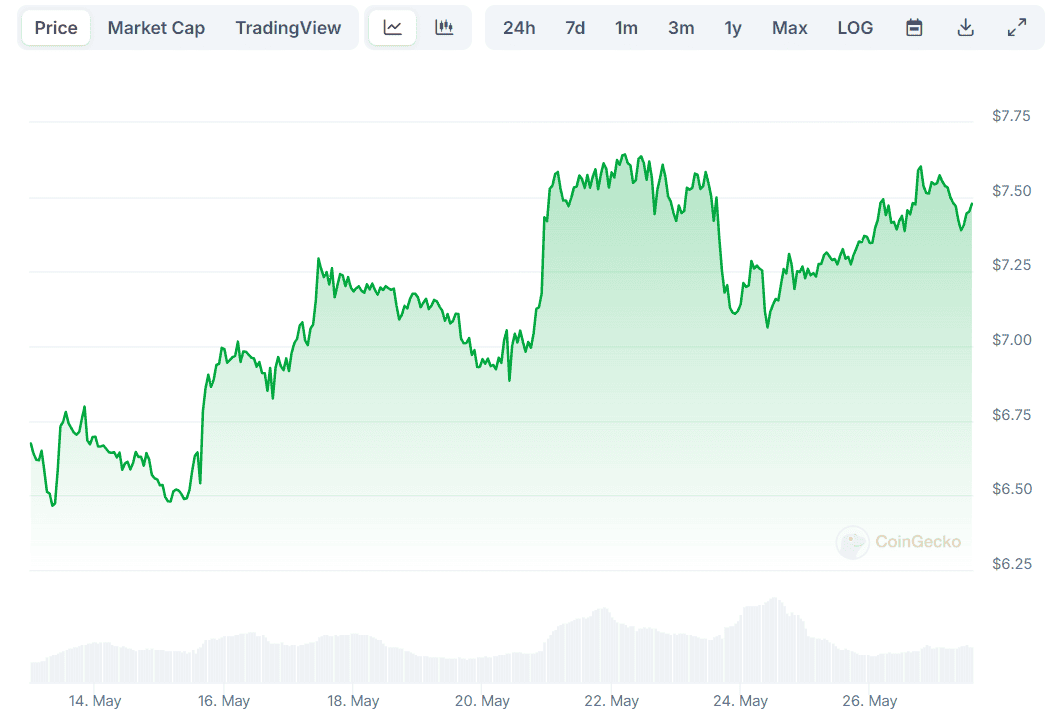

As a researcher with a background in cryptocurrency analysis, I have closely monitored Polkadot’s (DOT) recent price movements and market sentiment. Based on my findings, I believe that DOT is poised for further growth beyond its current trading price of around $7.50.

TL;DR

- Polkadot (DOT) has risen 10% over the past two weeks, currently trading around $7.50, with expectations for further growth.

Key metrics suggest moderate momentum, indicating potential for continued price increases.

DOT’s Next Potential Move

The price of Polkadot’s native cryptocurrency has risen by 10% over the past two weeks, and it now sits at roughly $7.50 according to CoinGecko’s latest figures. Several analysts are optimistic about further price increases in the near term.

One example is the cryptocurrency enthusiast, Crypto Yapper, who expressed confidence that DOT‘s price had broken free from a particular consolidation trend. He described this occurrence as “a beautiful retest,” implying a return to test the strength of the new trend. Additionally, he noted that DOT’s previous resistance level had transformed into support, indicating potential for further gains.

“I expect Polkadot to be trading around the $10 soon,” the analyst forecasted.

The user of X, contributing to Block Diversity’s prediction, anticipates a price surge close to $14 for DOT as long as it maintains trading above the significant resistance threshold of $6.90.

Other analysts have weighed in on this topic more recently, among them being Crypto Thanos and Crypto Tony. The former believes that the $6-7.50 price range is suitable for amassing holdings, with a target of $10 as the next achievement.

Last week, Crypto Tony discussed DOT‘s value being under $7. At that time, he mentioned they were waiting for a suitable entry point once the asset broke through the $7.40 resistance level. A few days ago, this mark was surpassed. It will be intriguing to observe if the analyst decides to invest in DOT based on his previous statement.

Observing Some Important Metrics

As a crypto investor, I strongly believe in keeping a close eye on key price indicators when it comes to making informed decisions about my DOT investments. One such indicator is the Relative Strength Index (RSI), which helps me understand the momentum and potential turning points of DOT’s price movements. The RSI ranges from 0 to 100, with readings above 70 indicating that the cryptocurrency may be overbought and due for a correction. At present, the DOT RSI stands at 54.

As a crypto investor, I’ll explain how the stochastic oscillator works as a valuable tool in our analysis. This momentum indicator contrasts a digital asset’s current closing price with its price range over a specified time frame.

Just like the Relative Strength Index (RSI), this metric ranges from 0 to 100. A reading above 80 indicates that a correction may be imminent. The current value of this metric, as indicated by CryptoQuant, is 74.

Read More

- ACT PREDICTION. ACT cryptocurrency

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- NBA 2K25 Review: NBA 2K25 review: A small step forward but not a slam dunk

- ESO Werewolf Build: The Ultimate Guide

- Mastering Destiny 2: Tips for Speedy Grandmaster Challenges

- Rainbow Six Siege directory: Quick links to our tips & guides

- KEN/USD

- Exploring Izanami’s Lore vs. Game Design in Smite: Reddit Reactions

- Overwatch Director wants to “fundamentally change” OW2 beyond new heroes and maps

2024-05-27 16:44