As an experienced analyst, I’ve seen my fair share of market fluctuations in the cryptocurrency industry. This past week has been particularly intriguing with Bitcoin and Ethereum leading the charge.

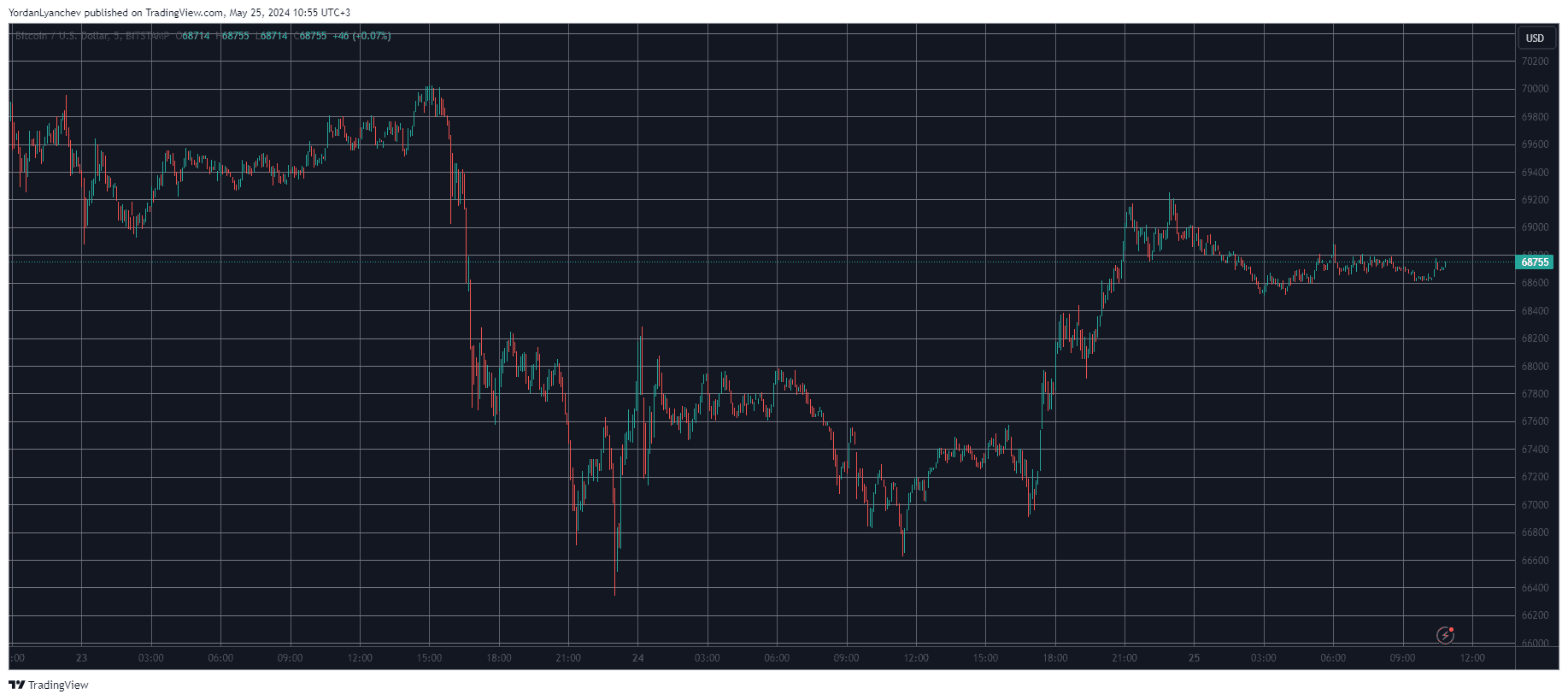

As a crypto investor, I’ve noticed some significant volatility in Bitcoin‘s price recently. It dipped below the $66,500 mark a few days ago, but then made a surprising leap up to around $69,000 last night.

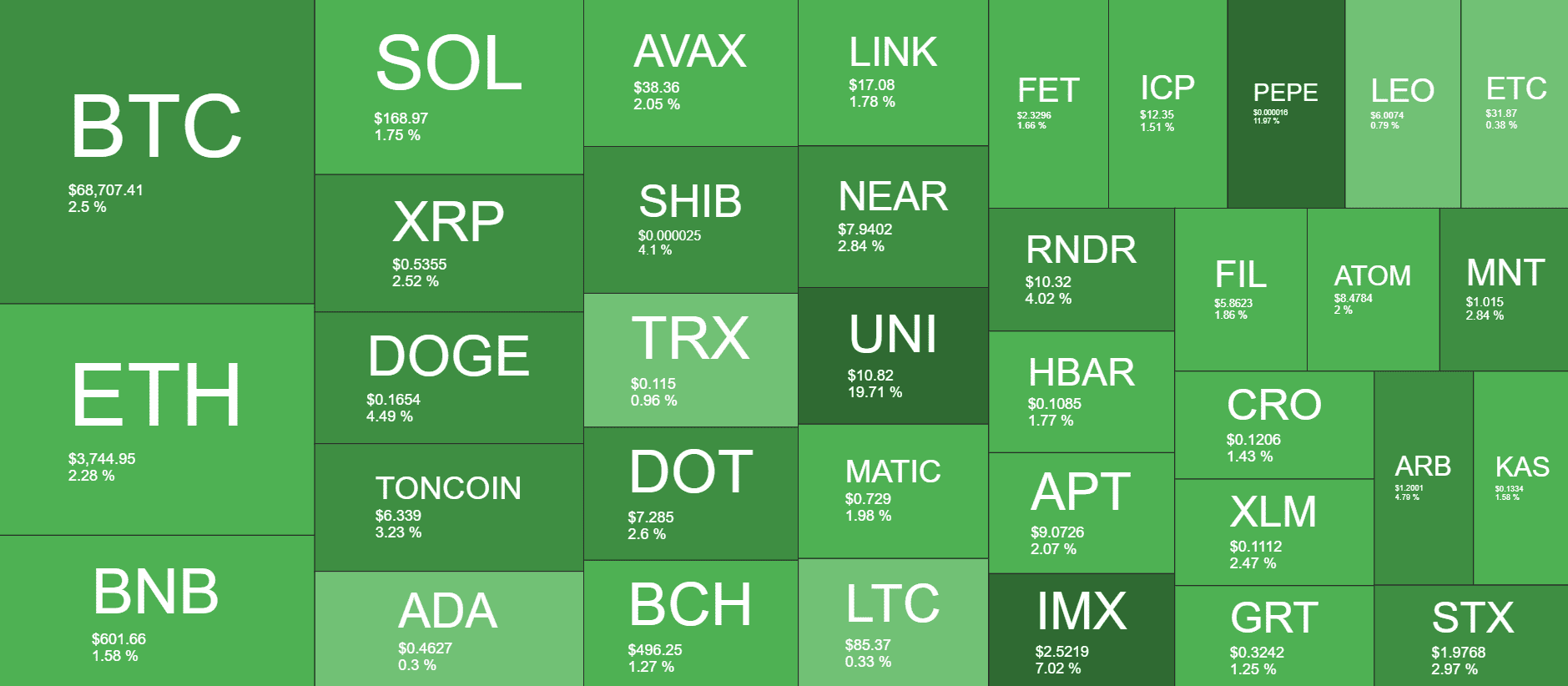

On a daily basis, some alternative coins are experiencing modest gains. Notably, UNI has significantly soared by approximately 20%, pushing its price above $10. Simultaneously, PEPE has reached a new high point.

PEPE New ATH, UNI Skyrockets

In the realm of cryptocurrencies, the US Securities and Exchange Commission (SEC) made headlines this week with a significant decision that primarily impacted Ethereum (ETH). The SEC approved eight spot Ethereum Exchange-Traded Funds (ETFs) on Thursday, sparking widespread excitement and leading to a substantial surge in ETH’s value. ETH’s price climbed from around $3,100 on Monday to over $3,900 mid-week before experiencing a slight pullback, now trading at approximately $3,750.

As an analyst, I’ve observed a noteworthy surge in several alternative coins throughout the week. Among them, PEPE, the well-known meme coin, experienced a significant boost. In just the previous day, PEPE soared by approximately 12%, reaching another unprecedented peak of $0.00001538 an hour ago.

Uniswap’s native token, UNI, has experienced a remarkable surge of 20% today, reaching a trading price near $11. Additionally, XRP, DOGE, TON, SHIB, DOT, IMX, and NEAR have all seen significant gains.

Since yesterday, the overall value of the cryptocurrency market has rebounded by more than $60 billion and currently hovers around $2.7 trillion according to CoinMarketCap.

BTC Aims for $69K

The price of the leading cryptocurrency was influenced by the Ethereum ETF announcement as well. It surged from $67,000 to hit a multi-peak of $72,000 on Monday and Tuesday. However, it experienced a significant decline in the days that followed.

As an analyst, I’ve observed that the most significant price drop for Bitcoin occurred on Thursday, mere hours before the US Securities and Exchange Commission (SEC) made their announcement, causing BTC to plummet below $66,500. Nevertheless, the asset exhibited some volatility in the subsequent hours and began recovering last night, moving northward once again.

As a crypto investor, I’ve witnessed an exciting development in the market recently. The price of bitcoin soared past $69,200 due to robust investments in spot Bitcoin Exchange-Traded Funds (ETFs). However, the bears swiftly took control and halted any further price growth. Currently, bitcoin hovers around $68,900, barely missing the $69,000 mark.

The market capitalization of the cryptocurrency now totals $1.350 trillion, but its control over alternative coins remains unchanged at 50.2%.

Read More

- CKB PREDICTION. CKB cryptocurrency

- EUR INR PREDICTION

- PENDLE PREDICTION. PENDLE cryptocurrency

- TANK PREDICTION. TANK cryptocurrency

- USD DKK PREDICTION

- IMX PREDICTION. IMX cryptocurrency

- ICP PREDICTION. ICP cryptocurrency

- PBX PREDICTION. PBX cryptocurrency

- W PREDICTION. W cryptocurrency

- GEAR PREDICTION. GEAR cryptocurrency

2024-05-25 11:04