As an experienced financial analyst, I’ve witnessed the ups and downs of the cryptocurrency market for years. The recent turbulence in Bitcoin ETFs at the end of April and beginning of May was a reminder of the volatility that comes with this asset class. However, the trend seems to have changed now, with 10 consecutive days of positive flows.

Bitcoin ETFs faced challenges towards the end of April and specifically on May 1st. However, the situation has since improved, with a consistent inflow of funds for the past ten days.

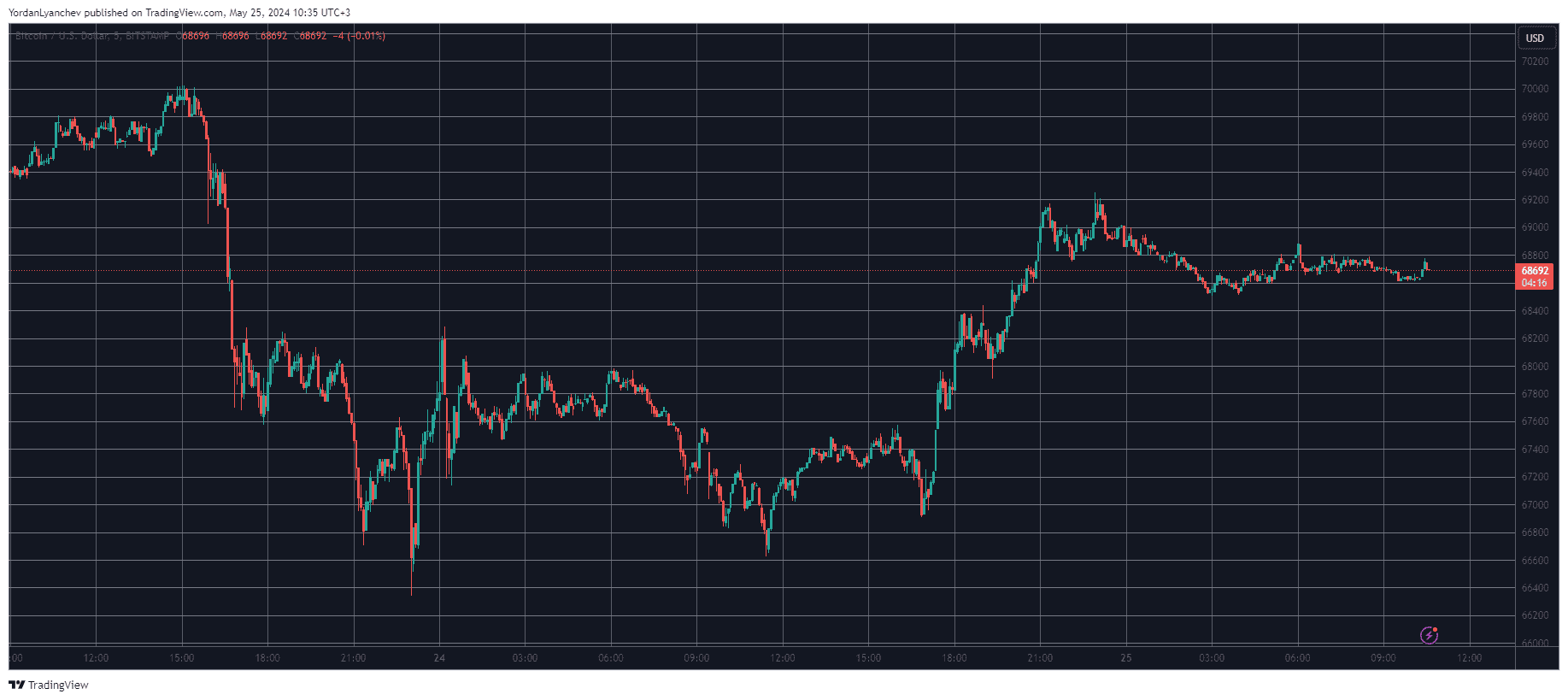

The price of Bitcoin experienced significant volatility due to Ethereum ETF-related news, and it’s currently trending towards reaching a new high of $69,000.

In January, the US Securities and Exchange Commission (SEC) approved several Bitcoin exchange-traded funds (ETFs) for the first time in a decade, marking a significant achievement for the cryptocurrency industry.

As a crypto investor, I’ve witnessed firsthand how these new products instantly drew in massive investments, totaling billions within the first few months. However, things took a turn for the worse in April. The market experienced several consecutive red days, indicating a significant shift in trends.

On May 1st, the total withdrawals exceeded $560 million, making it the day with the highest pain in terms of outgoings.

The situation shifted once more during the ensuing weeks, most notably following the release of encouraging US Consumer Price Index figures in April. By May 10, large ETFs had recorded their most significant negative figures.

As a financial analyst, I’ve noticed an impressive run for our financial products since then. This streak has matched the record set in March with ten consecutive days of inflows totaling over $9 billion. Specifically, we experienced inflows over $300 million on May 15th and 21st, and surpassed $250 million on May 24th.

BlackRock’s IBIT continues to top the list in terms of accumulated inflows, amounting to an impressive $16,350 billion. Although Grayscale currently holds the title with $20 billion in assets under management according to SoSovalue, the significant outflows from Grayscale indicate that BlackRock’s IBIT is likely to surpass it imminently.

In summary, approximately $13.7 billion has been invested in all ETFs collectively. Additionally, Ethereum supporters experienced some favorable news this week as the US Securities and Exchange Commission (SEC) approved eight Ethereum spot ETF applications. Nonetheless, the launch dates for these ETFs remain undetermined.

Bitcoin showed significant price fluctuations in response to recent Ethereum developments. It surged from $67,000 to an intraday high of $72,000, only to drop back down below $66,000 within the week. However, the past 24 hours have seen more favorable trends, potentially due to substantial inflows, with Bitcoin hovering around $69,000 currently.

Read More

- CKB PREDICTION. CKB cryptocurrency

- EUR INR PREDICTION

- PENDLE PREDICTION. PENDLE cryptocurrency

- PBX PREDICTION. PBX cryptocurrency

- USD DKK PREDICTION

- IMX PREDICTION. IMX cryptocurrency

- ICP PREDICTION. ICP cryptocurrency

- TANK PREDICTION. TANK cryptocurrency

- GEAR PREDICTION. GEAR cryptocurrency

- BSW PREDICTION. BSW cryptocurrency

2024-05-25 10:50