As a researcher with a background in cryptocurrency analysis, I’ve been closely monitoring the price movements of Polkadot (DOT) over the past month. The asset has exhibited a rangebound pattern following its significant decline in April, and more recently, it has declined by over 3% in the last 24 hours. This downward trend seems to be fueled by developments around the Securities and Exchange Commission (SEC) and the approval of spot Ethereum ETFs.

As an analyst, I’ve noticed that Polkadot‘s price remains confined within a range after experiencing a substantial drop in April. More specifically, there has been a decline of over 3% in the last 24 hours, which might be linked to the latest regulatory news and the approval of the spot Ethereum ETFs.

Meanwhile, the broader market is currently in a critical spot.

Technical Analysis

By TradingRage

The Daily Chart

Over the past month, the DOT price has been confined within a flag formation and has remained close to its 200-day moving average. The support at $6 has kept the price in check as it attempts to surpass the resistance at approximately $7.5, which is also the location of the 200-day moving average.

The upper limit of the trend is being put to the test. Should the price manage to surpass these hurdles, a fresh bullish surge toward the $9 mark and possibly beyond could ensue.

DOT came close to doing so this week, but the bears provided strong resistance at the $7.5 level.

The 4-Hour Chart

On examining the 4-hour chart, the previous compression of prices within the large flag formation is now more evident. The value has lately encountered resistance at the upper limit of this pattern.

As a researcher observing the financial markets, I’ve noticed that the Relative Strength Index (RSI) for the asset under consideration has dipped below the 50% threshold on the 4-hour chart. This indicator shift indicates a potential change in momentum towards bearish territory. Consequently, a retest of the lower trendline appears to be a plausible scenario in the near future.

Futures Market Analysis

By TradingRage

Polkadot Binance Liquidation Heatmap

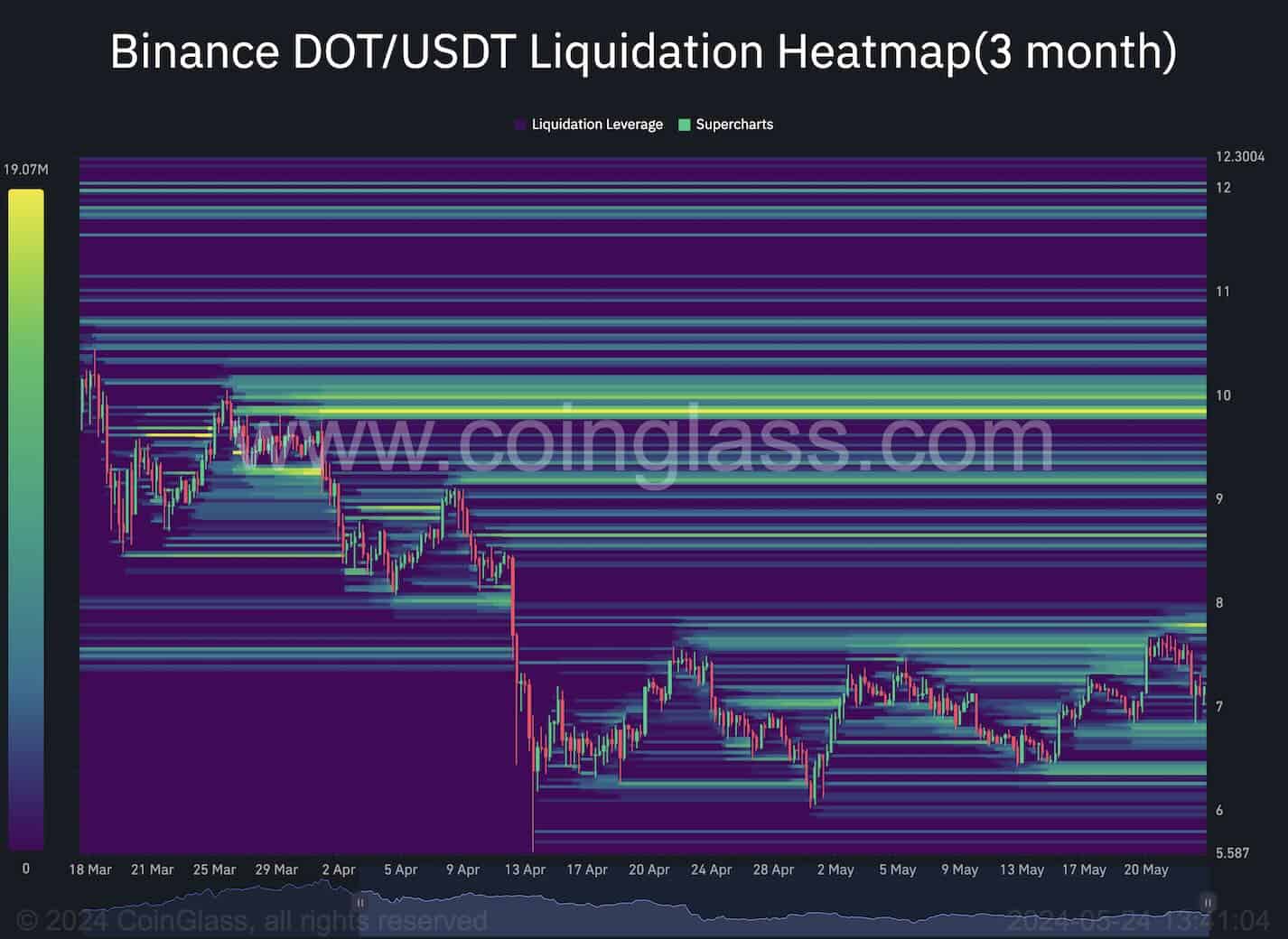

During the prolonged consolidation of Polkadot’s price, examining metrics from the futures market can provide useful insights. The following chart showcases the DOT/USDT Binance Liquidation Heatmap, which depicts significant liquidity pockets that may potentially influence the price movement.

The graph indicates that the $6.5 and $8 price points have the highest volume of trading activity near the current market price. Consequently, a price breach from either point could trigger a mass sell-off or buy-in, intensifying the trend. At present, the largest amount of liquidity is located at the $10 level. Thus, it represents a pivotal area if the price starts to rise.

Read More

- ACT PREDICTION. ACT cryptocurrency

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- NBA 2K25 Review: NBA 2K25 review: A small step forward but not a slam dunk

- How to Handle Smurfs in Valorant: A Guide from the Community

- Mastering Destiny 2: Tips for Speedy Grandmaster Challenges

- Rainbow Six Siege directory: Quick links to our tips & guides

- Exploring Izanami’s Lore vs. Game Design in Smite: Reddit Reactions

- Overwatch Director wants to “fundamentally change” OW2 beyond new heroes and maps

- League of Legends: Saken’s Potential Move to LOUD Sparks Mixed Reactions

2024-05-24 15:42