As a researcher with a background in cryptocurrencies, I’ve seen my fair share of market volatility over the past few years. And this past week has been no exception. The cryptocurrency market underwent significant changes, with bitcoin leading the charge. Last Friday, BTC was struggling to remain above $60,000, but by Monday, it had pumped to over $63,000.

In the volatile world of cryptocurrencies, a week can bring significant shifts. Last week was no exception, with bitcoin‘s struggle to stay above $60,000 on Friday contrasting sharply with the current market scene.

During the weekend, BTC stayed above the mentioned price and rose slightly to approximately $61,000, marking the beginning of changes. Nevertheless, the significant surge occurred on Monday, pushing the cryptocurrency beyond $63,000.

The rally could not be maintained on Tuesday due to some problems with Coinbase and possibly because of the anticipated US CPI announcement. However, once the CPI data was released and it aligned with predictions, Bitcoin experienced a significant surge in value.

I experienced an impressive surge in value, breaking through the $66,500 mark as investments into Bitcoin ETFs picked up pace. Yesterday saw a minor pullback with BTC dipping below $65,000, but today it bounced back and exceeded $66,000 once again. This strong performance marked Bitcoin’s best weekly gain since early March, leaving many investors feeling a renewed sense of excitement and anticipation.

In terms of the past week, noteworthy surgeons among the larger-cap alternatives are Solana, which experienced a significant rise early in the week, and Chainlink, which reached a peak of more than $16 that had not been seen for several months.

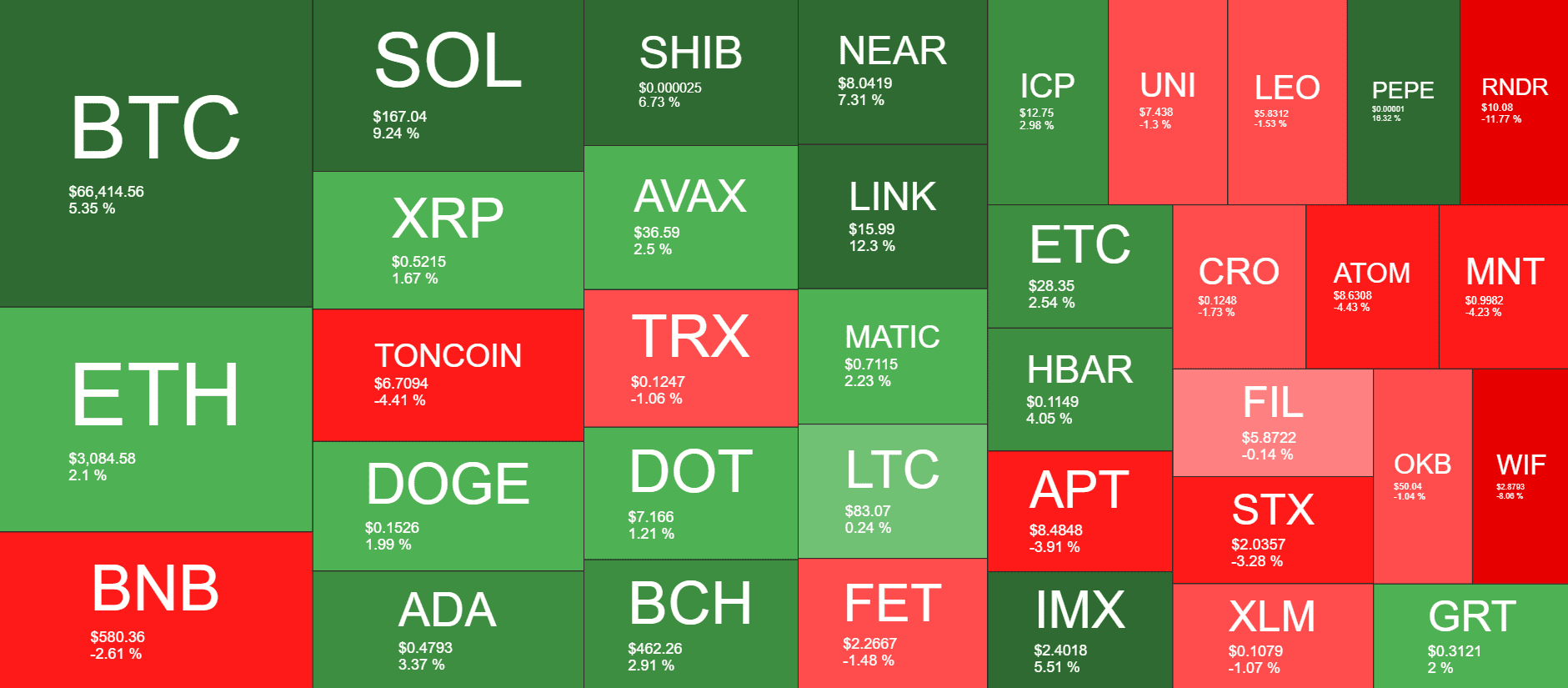

Market Data

Market Cap: $2.533T | 24H Vol: $78B | BTC Dominance: 51.6%

BTC: $66,455 (+5.35%) | ETH: $3,086 (+2.1%) | BNB: $580 (-2.61%)

This Week’s Crypto Headlines You Can’t Miss

Despite Bitcoin’s recent price drop at the end of last week, Bitfinex reported on Monday that the digital currency’s fundamental aspects have remained robust. The slight decrease in mining difficulty was noted, but overall, the network’s strength has persisted.

ETH’s Struggle to Keep Up with Bitcoin: The Flopped ‘Flippening’

Morgan Stanley Discloses $269 Million Investment in Grayscale’s GBTC as Part of Their Q1 SEC Filings. Major US corporations, including Morgan Stanley, reported substantial Bitcoin ETF purchases totaling millions of dollars in their first-quarter financial disclosures to the US Securities and Exchange Commission (SEC).

The investment made by Wisconsin State Investment Board (SWIB) in Bitcoin Exchange-Traded Funds (ETFs), amounting to $164 million, could potentially trigger a domino effect among other comparable institutions.

As a researcher studying the latest trends in the financial sector, I’ve come across intriguing news that CME Group is considering entering the spot Bitcoin trading market. Known for its deep roots in traditional finance, this esteemed organization has previously shied away from directly engaging with cryptocurrencies. However, with increasing demand for Bitcoin trading on Wall Street, CME Group might be reconsidering its stance. This potential move could bring significant competition to existing players such as Coinbase and Binance.

As a researcher exploring the dynamic world of blockchain and cryptocurrencies, I’m thrilled to report that Shiba Inu‘s ecosystem has recently made a significant leap forward with the launch of ShibaSwap 2.0 on their Layer 2 solution, Shibarium. Over the past year or so, this community has been buzzing with activity, and this latest development is yet another testament to their relentless innovation.

Read More

- W PREDICTION. W cryptocurrency

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- PENDLE PREDICTION. PENDLE cryptocurrency

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- How to Handle Smurfs in Valorant: A Guide from the Community

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

2024-05-17 18:16