As a researcher with experience in cryptocurrency and mining, I find these developments quite intriguing. The recent decrease in the Bitcoin network hash rate, which is a key indicator of miner activity, could potentially signal miner capitulation. This means that less efficient miners are quitting due to decreased profitability following the latest Bitcoin halving.

As a cryptocurrency analyst, I’ve observed that about a month after the latest Bitcoin halving event, early indications of declining miner revenues have started to surface. One telling sign is the noticeable decrease in the Bitcoin network’s hash rate.

The current drop in this measurement might signal miner surrender, with less productive miners leaving the scene as they face reduced profits.

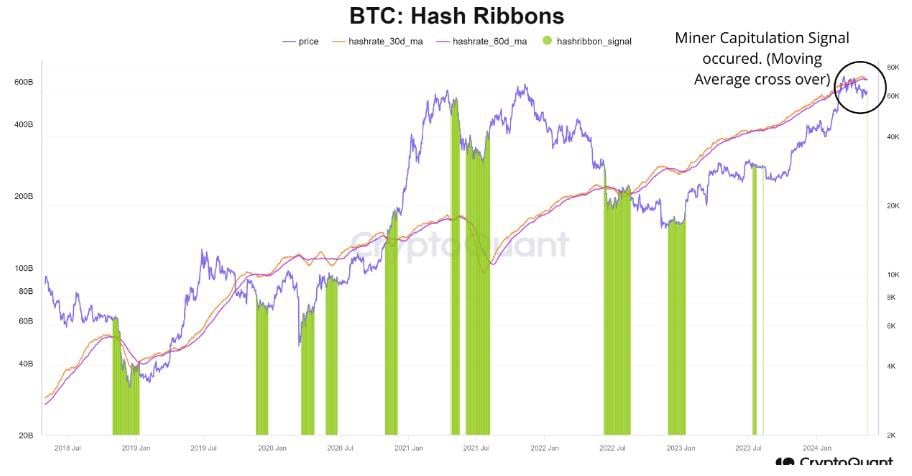

Hash Ribbons Shows Signs of Capitulation

As a researcher observing the cryptocurrency market, I previously noted that the 30-day moving average of the hash rate peaked at an impressive 630 exahashes per second (EH/s). However, my latest findings reveal that this figure has now dropped slightly to 606 EH/s. Although this decrease is minor and short-lived, it’s worth mentioning as it signals a potential shift in the usual upward trend of the hash rate.

According to CryptoQuant’s analysis, sudden decreases in hash rate could indicate miner surrender or withdrawal from the Bitcoin mining industry.

As a crypto investor, I would explain “miner capitulation” as follows: When less productive miners can no longer sustain the costs of running their operations, they choose to exit the mining process. This withdrawal results in a decrease in overall computational power for mining new coins. These miners may either move their rigs to more cost-effective locations or sell the recently mined bitcoins to meet their operational expenses.

According to CryptoQuant’s analysis, the Hash Ribbons indicator plays a significant role in their assessment. This tool operates on the hypothesis that certain market conditions often precede sizeable price decreases for Bitcoin. As such, it offers an opportunity to capitalize on these price drops.

Yet, it’s crucial to keep in mind that Hash Ribbons’ capitulation signal doesn’t trigger an immediate response. Instead, the miner exit process proceeds gradually over a period of several days or even weeks. Less productive miners are the first to depart from the market.

Miner Profitability Plunges

As a researcher studying the Bitcoin market, I’ve discovered that the halving event on April 20 significantly impacted the mining sector. Specifically, the block reward was reduced by half to 3.125 BTC, resulting in a daily mining output decrease from approximately 900 BTC to around 450 BTC. Consequently, major Bitcoin miners including Bitfarms, Cipher, CleanSpark, Core Scientific, Riot, and Terawulf reported production drops ranging from 6% to 12% in April, as detailed by The Miner Mag.

The reduction in output has aligned with a significant decrease in profitability, or hash price, reaching approximately $0.049 per terahash per second daily as reported by HashRateIndex. This is a considerable drop of more than 73% compared to the roughly $0.182 TH/s/day level that was common around the halving event.

In this situation, Bitcoin’s value may be negatively impacted due to heightened selling worries among investors, as mining pressures mount.

Read More

- CKB PREDICTION. CKB cryptocurrency

- EUR INR PREDICTION

- PENDLE PREDICTION. PENDLE cryptocurrency

- PBX PREDICTION. PBX cryptocurrency

- USD DKK PREDICTION

- IMX PREDICTION. IMX cryptocurrency

- ICP PREDICTION. ICP cryptocurrency

- TANK PREDICTION. TANK cryptocurrency

- GEAR PREDICTION. GEAR cryptocurrency

- BSW PREDICTION. BSW cryptocurrency

2024-05-15 21:28