As an experienced analyst, I’ve witnessed numerous market trends and events over the years. Based on the information provided, it seems that we have another significant Bitcoin and Ethereum options expiry event coming up on May 10. With around $1.15 billion notional value in Bitcoin options and $840 million in Ethereum options set to expire, there’s a potential for increased market volatility.

In the recent past, cryptocurrency markets have exhibited modest declines in the middle of the week, but overall have displayed limited activity and have been fluctuating within a narrow range.

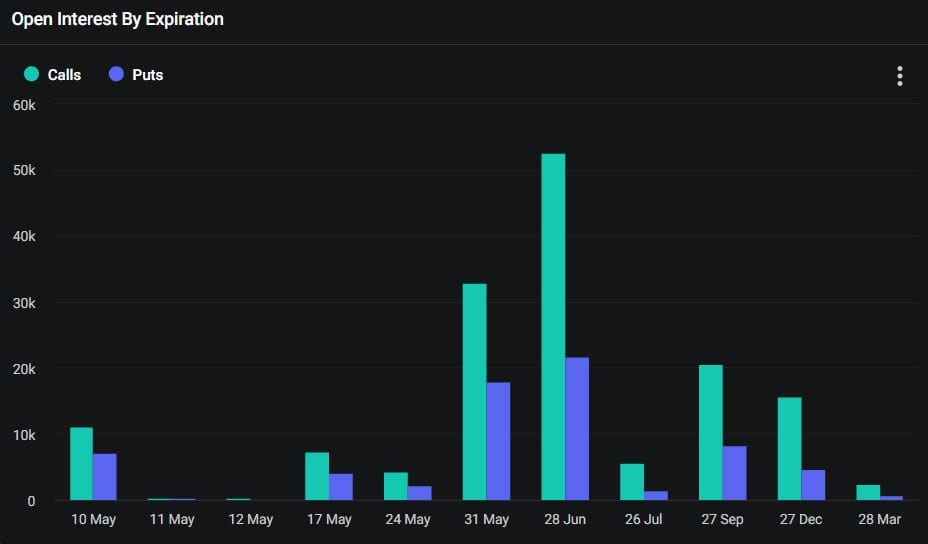

Approximately 18,280 Bitcoin options contracts are scheduled to expire on May 10, potentially introducing volatility into the market.

As a crypto investor, I’m keeping an eye on the upcoming expiration of Bitcoin (BTC) contracts on Deribit. The notional value for this week’s batch is approximately $1.15 billion. That’s slightly less than last week’s expiry event.

Bitcoin Options Expiry

As a researcher studying the Bitcoin options market, I’ve observed an intriguing trend: the current put/call ratio stands at 0.64. This figure signifies that a greater number of call options, representing long positions, are set to expire in comparison to put options, which represent short positions.

As an analyst, I can tell you that long positions hold a significant dominance in open interest with approximately $700 million invested at the $70,000 and $100,000 strike prices. Open interest signifies the total number or value of contracts still unfilled and pending settlement.

At Deribit, over $360 million worth of option contracts are accumulating for the $50,000 strike price on Open Interest (OI) for Bitcoin.

The ratio of open interests for Bitcoin call options to put options is approximately twice as high, reflecting a stronger appetite among traders for betting on price increases rather than decreases.

With call options, you are granted the privilege to buy a particular asset at a fixed price prior to or on a specified expiration date.

Additionally, firms such as QCP Capital and Paradigm have noted a resurgence of interest in purchasing upside call options. Some investors are closing out their previous option contracts with expiration dates in June or August, and replacing them with new ones that expire in July or September.

In addition to today’s batch of Bitcoin options, 276,000 Ethereum contracts are also set to expire.

Approximately $840 million in notional value and a put-call ratio of 0.74 characterize these derivatives. The significant open interest of approximately $636 million at the $3,600 strike price suggests that Ethereum options traders hold a bullish stance.

Crypto Market Outlook

As a crypto investor, I’ve noticed that the overall market value has surged by 2.1% today, bringing it up to an impressive $2.45 trillion. However, this growth spurt seems to have hit a plateau since mid-April. The markets have been treading water around this level with minimal fluctuation, leaving us in a state of limbo as we wait for the next significant shift.

Bitcoin experienced a dip and fell below the $61,000 mark on May 9. However, it bounced back during the Asian trading session on Friday morning, reaching a level of around $63,000. The digital currency has been following a downward trend since its peak in mid-March, resulting in a loss of approximately 15% from its previous value.

As a crypto investor, I’ve seen Ethereum prices touch a low of $2,953 during today’s trading session, but they’ve bounced back and are currently sitting at $3,032 as I pen this down.

At present, most altcoins are experiencing price increases. Notable growth can be observed in Solana (SOL) and Toncoin (TON).

Read More

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- PENDLE PREDICTION. PENDLE cryptocurrency

- W PREDICTION. W cryptocurrency

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- How to Handle Smurfs in Valorant: A Guide from the Community

2024-05-10 09:24