As a seasoned crypto investor with a keen interest in technical and on-chain analysis, I closely monitor Bitcoin’s price action and market sentiment. Following a brief recovery from the significant $59K support level, Bitcoin has once again encountered selling pressure, retreating back to the crucial 100-day moving average at $61K.

As a crypto investor, I’ve observed Bitcoin bounce back moderately after hitting the significant support level of $59,000. However, this bullish trend was short-lived as selling pressure resurfaced, causing Bitcoin to slide back down towards the crucial 100-day moving average at around $61,000.

The price action around this pivotal juncture is likely to dictate its next decisive move.

Technical Analysis

By Shayan

The Daily Chart

As an analyst, I have conducted a comprehensive analysis of Bitcoin’s daily chart. I have identified that Bitcoin has been in an extended sideways consolidation phase near the significant resistance level of $60,000. Following a bullish rebound from the $59,000 mark, Bitcoin experienced a decline and retraced towards a critical support region.

As an analyst, I’ve noticed that Bitcoin sellers have faced challenges in pushing through the substantial support zone, which includes the 100-day moving average and the 0.618 Fibonacci level ($59,395), for quite some time. Nevertheless, a sudden drop beneath the crucial $59,000 mark could lead to a significant downward trend, potentially reaching the $56,000 threshold.

At this critical turning point, there’s a chance for a pause in the declining trend and even possible short-term gains. Therefore, the price behavior near it will be vital in predicting Bitcoin’s upcoming direction.

The 4-Hour Chart

As a researcher studying the cryptocurrency market trends, I’ve noticed an intriguing pattern in the 4-hour chart. The buying pressure has been significantly stronger around the $58K mark, causing a bullish run that propelled the price toward the resistance level at $66K. However, selling pressure emerged around this level with greater intensity, triggering a downtrend and pushing the price back down to the vital support region at $60K.

Currently, sellers are making efforts to force the price under the noteworthy $60,000 support threshold and the bottom end of the wedge shape. Should they achieve this goal, it might indicate a prolonged bearish trend, potentially leading towards the pivotal $56,000 support zone.

Given the current market atmosphere, Bitcoin could persist in its consolidation or even witness minor decreases prior to generating enough buying pressure to spark a new rally. Keep a close eye on price fluctuations near significant support areas, as shifts in investor sentiment might signal a change in trend.

On-chain Analysis

By Shayan

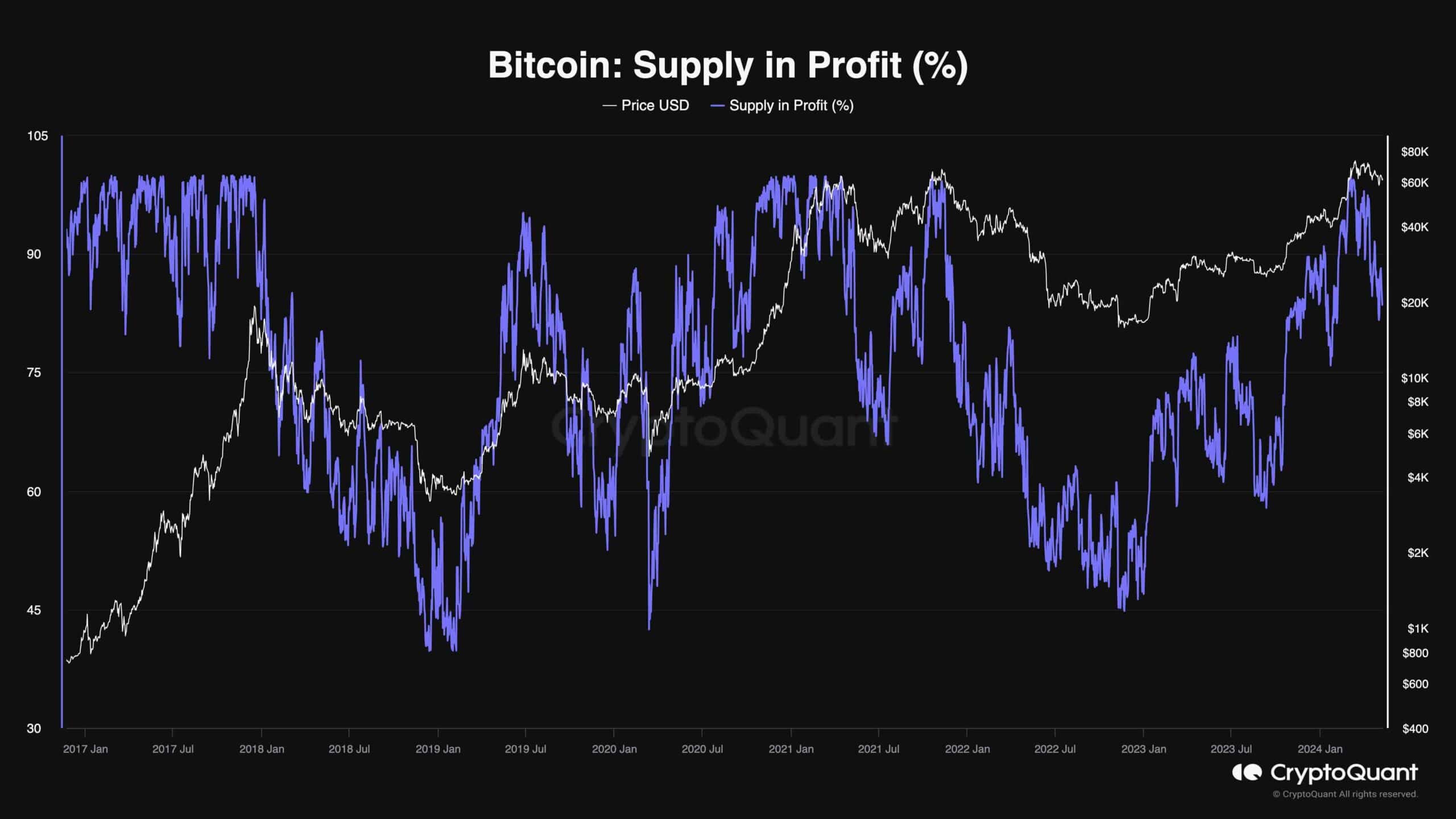

As a market analyst, I can’t stress enough the importance of profitability in shaping market psychology, especially during unfavorable macroeconomic conditions for risk assets. By examining the profitability of market participants, we can gain significant insights into the current state and sentiment of the market. The provided chart displays the Supply-in-Profit percentage metric, which represents the proportion of Bitcoin’s supply that is currently in profit.

Based on the graph’s representation, I notice that the metric has spiked to record highs lately. This could signify that a significant number of market participants might be contemplating cashing out their gains. Consequently, this may result in heightened selling pressure within the market. Historically, such peaks have frequently been precursors to market instability and possible declines as investors start to dispose of their holdings.

Despite a significant drop in the metric, the price has merely stabilized slightly, implying that the recent decrease could be a corrective reaction due to profit-taking. It’s possible that once this correction phase ends, the price may initiate a robust and dynamic uptrend.

Read More

- Uncovering the Mystery of Red King Players in Clash Royale – What Reddit Users Have to Say

- UFO PREDICTION. UFO cryptocurrency

- The Last Epoch Dilemma: Confronting the Gold Dupe Crisis

- Finding Resources in Palworld: Tips from the Community

- BONE PREDICTION. BONE cryptocurrency

- Skull and Bones: Navigating the Quest for Extra Teeth in the Game

- Discovering the Infinite Power: The Abiotic Factor that Could Change Everything

- AAVE PREDICTION. AAVE cryptocurrency

- The 10 Best Movies of 2024 (So Far)

- Gaming News: Like a Dragon: Infinite Wealth’s Dondoko Island Takes Expansion to New Heights

2024-05-09 14:05