As an experienced analyst, I’ve closely observed Bitcoin’s recent price action and have identified some key technical and on-chain indicators that could influence its future trend.

Following a lengthy phase of price stability around $59,000, Bitcoin experienced a decline.

A noteworthy bounce back close to the 100-day moving average hints at the possibility of renewed purchasing power.

Technical Analysis

By Shayan

The Daily Chart

As a market analyst, I have conducted an in-depth examination of Bitcoin’s daily price chart. It is clear to me now that Bitcoin experienced a prolonged period of sideways movement between the crucial price levels of $59,000 and $72,000.

As a researcher observing the market trends, I’ve noticed a significant decline in prices that dropped below the lower end of the established range and fell beneath the 100-day moving average. This bearish shift prompted numerous long position holders to exit their trades, resulting in a momentary pause or cooling-down period within the perpetual markets.

Despite hitting a roadblock, Bitcoin demonstrated resilience and found a strong foothold at a pivotal point. This significant level coincided with the 0.618 Fibonacci retracement at approximately $59,395 and the influential 100-day moving average at around $59,000. This area ignited a bullish turnaround, generating optimism for a potential rebound in the medium term.

As an analyst, I would rephrase that as follows: A unexpected drop beneath the crucial $59,000 mark could lead to a significant decline in price, potentially reaching the $56,000 support level.

The 4-Hour Chart

Examining the 4-hour Bitcoin chart indicates increased selling activity following its inability to exceed the $68,000 mark. Consequently, there was a significant drop, falling beneath the lower boundary of the wedge pattern, with prices lingering around $59,000.

After the security incident occurred, many long positions were forced to be sold off, causing a sharp decline and a swift challenge of the $56K mark. Nevertheless, the price bounced back, climbing back above the lower edge of the wedge and the $59K support zone. (As a researcher studying market trends)

As a crypto investor, I’m excitedly watching Bitcoin (BTC) as it attempts to retake its previous daily peak of $65,000. Should this milestone be conquered, the bullish momentum could potentially propel BTC towards the next target at $68,000 in the near future.

On-chain Analysis

By Shayan

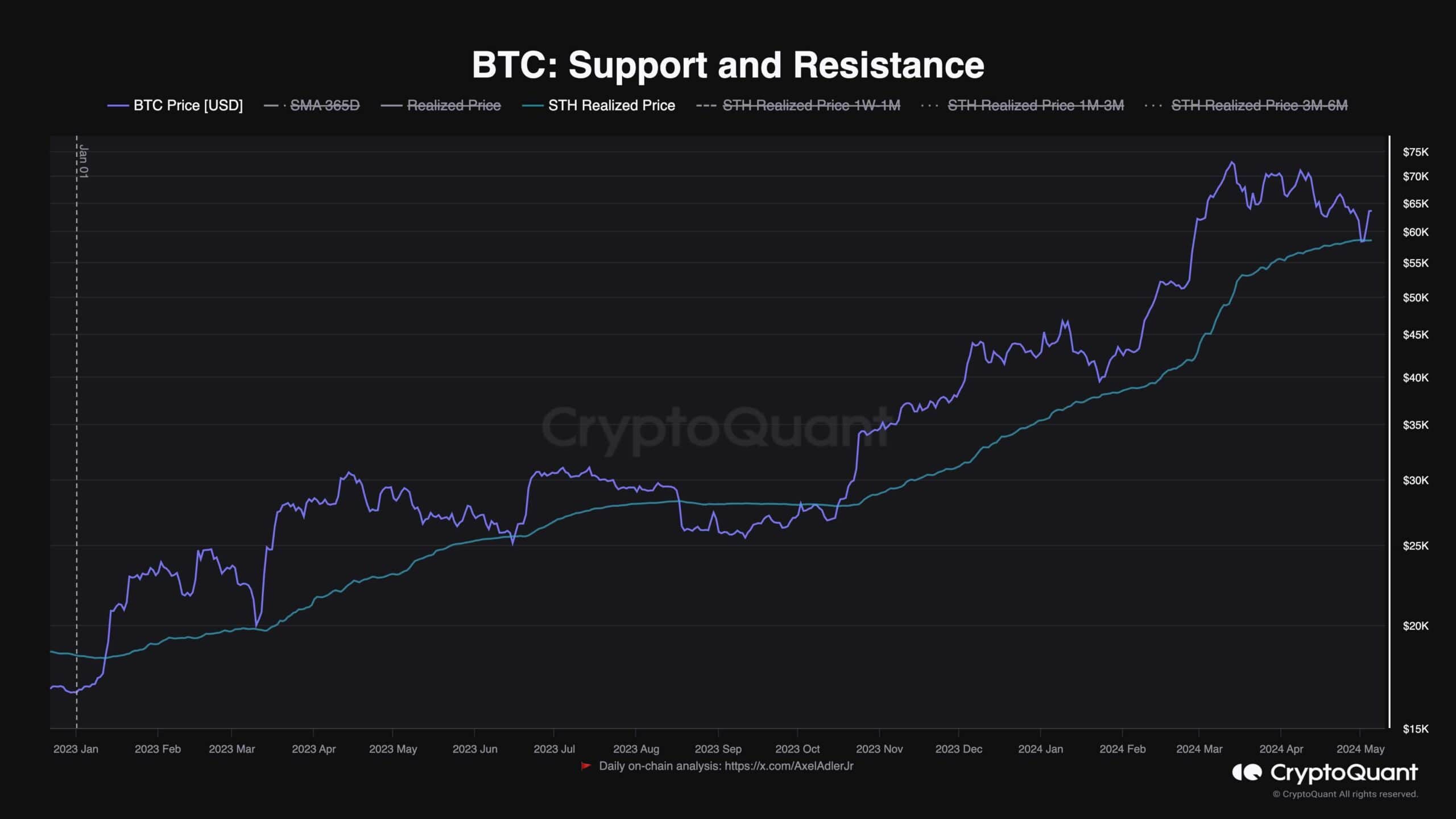

As a crypto investor, I closely monitor the Bitcoin Short-Term Holder (STH) Realized Price metric displayed on the accompanying chart. This valuable indicator is an essential tool for me in determining key levels of support and resistance when analyzing price movements.

As a crypto investor, I calculate the short-term average realized price by dividing the total value of all realized transactions from short-term holding periods (under 155 days) by the current supply of the specific cryptocurrency. This metric gives me a weighted average price representing what I and other short-term investors paid for our coins during those timeframes.

During the uptrend, this metric has repeatedly provided strong underpinnings for Bitcoin’s price. After the latest dip in Bitcoin’s value, the price touched this vital mark and rallied, leading to a bullish recovery. It’s crucial to keep in mind that if the price falls below this essential support level, there’s a possibility of a substantial market correction.

As a researcher studying market trends, I’ve observed that the general direction remains upward as the price surpasses the level at which active traders have previously sold. This benchmark plays a pivotal role in analyzing current market conditions and predicting short-term price fluctuations.

Read More

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- PENDLE PREDICTION. PENDLE cryptocurrency

- W PREDICTION. W cryptocurrency

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- How to Handle Smurfs in Valorant: A Guide from the Community

2024-05-06 16:05