As a researcher with experience in the cryptocurrency market, I find the recent price developments of Chainlink’s LINK token intriguing. After a week of decline that saw its value drop by nearly 8%, LINK now hovers around the $14 mark. However, some prominent analysts predict a bullish reversal for this digital asset.

TL;DR

- Chainlink’s LINK is poised for a rebound from its current $14 price, indicated by a positive TD Sequential buy signal.

Prominent analysts forecast significant returns for the asset, supported by favorable on-chain metrics suggesting a bullish move.

LINK Price Predictions

The price of Chainlink’s native cryptocurrency, LINK, has taken a hit following the recent market correction. In just one week, its value has decreased by approximately 8%, and it now sits around the $14 mark.

According to several noted analysts, there’s a possibility that the current downtrend in Chainlink (LINK) will be reversed and give way to an uptrend. One such analyst is Ali Martinez, who has stated that the TD Sequential indicator is signaling a buy opportunity on LINK’s 12-hour chart. Martinez anticipates that if LINK manages to stay above the significant resistance level of $13.87, its value could reach as high as $15.50.

TD Sequential is a technical indicator used primarily to identify the timing of market reversals. It was developed by Thomas DeMark and is popular among traders for its ability to provide signals based on the exhaustion of current price trends.

Michael van de Poppe is yet another analyst who has shared a bullish perspective on LINK. According to him, LINK is one of the leading altcoins that could potentially deliver a 3x return against BTC, carrying the least amount of risk among other coins. The other members of this promising group consist of Optimism (OP), WOO (WOO), Celestia (TIA), and SKALE (SKL).

Additional Bullish Forecasts

Crypto Wolf and SlumDOGE Millionaire have also recently predicted a bright future for LINK. The former added the asset to the list of “mooners” for the next bull cycle, while the latter argued it is one of the top “blue chip” cryptocurrencies at the moment.

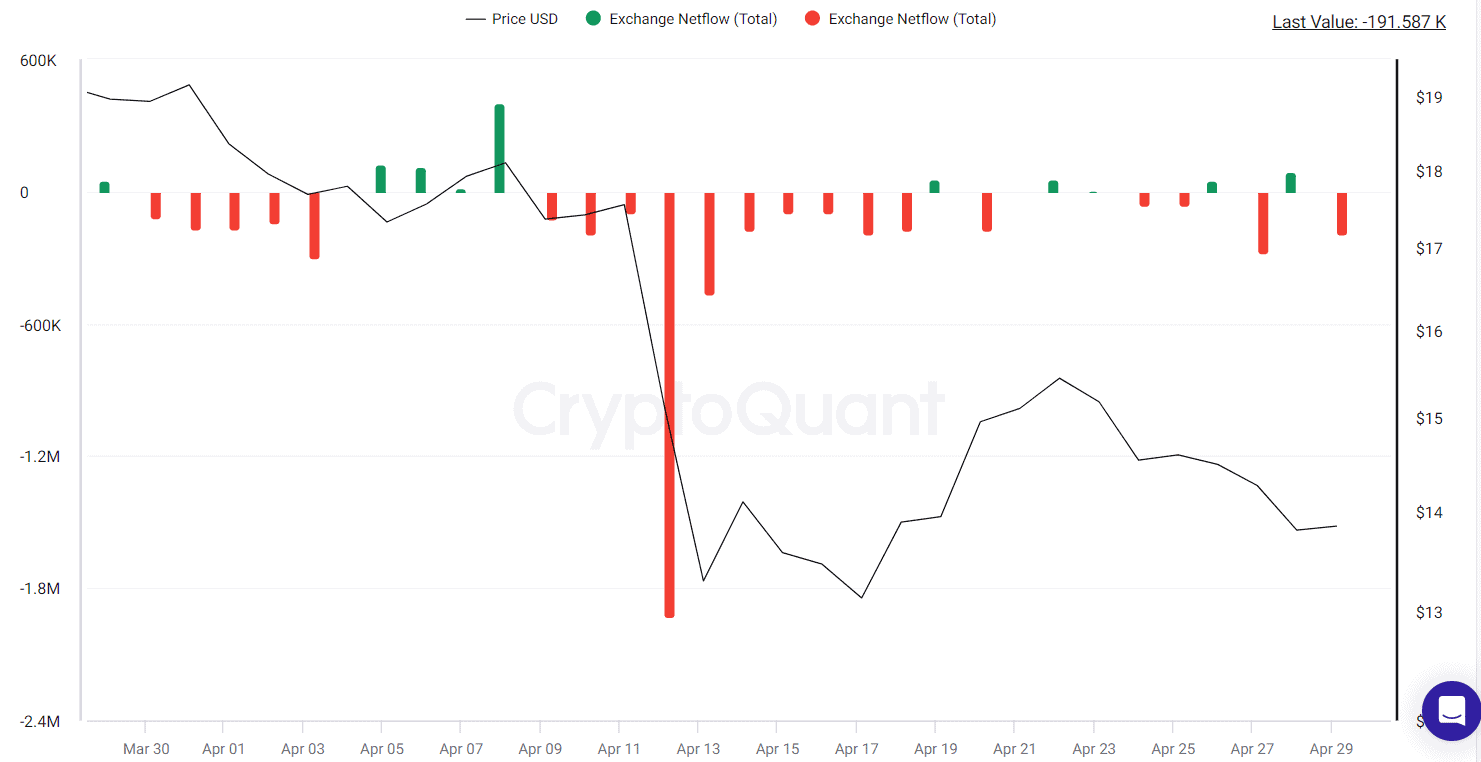

Some on-chain indicators point to a potential rally as well. Based on CryptoQuant’s information, there has been a predominantly negative LINK exchange netflow over the past month. In simpler terms, this means that more Link tokens have been moving from centralized exchanges to self-custody wallets. This trend is considered bullish because it reduces the immediate pressure for selling, leading some investors to view it as a positive sign.

Read More

- Finding Resources in Palworld: Tips from the Community

- UFO PREDICTION. UFO cryptocurrency

- Skull and Bones: Navigating the Quest for Extra Teeth in the Game

- AAVE PREDICTION. AAVE cryptocurrency

- Uncovering the Mystery of Red King Players in Clash Royale – What Reddit Users Have to Say

- BONE PREDICTION. BONE cryptocurrency

- The Last Epoch Dilemma: Confronting the Gold Dupe Crisis

- Discovering the Infinite Power: The Abiotic Factor that Could Change Everything

- Unveiling the Mystery of Palworld IVs: What Redditors Have to Say

- Gaming News: Like a Dragon: Infinite Wealth’s Dondoko Island Takes Expansion to New Heights

2024-05-02 23:22