As an experienced financial analyst, I have witnessed numerous market fluctuations and trends throughout my career. With the anticipation of the FED interest rate decision today, the market’s bearish sentiment is palpable, and Bitcoin’s sudden crash below key support levels is a clear indication of this trend.

As a researcher examining the current financial market landscape, I’m paying close attention to today’s anticipated Federal Reserve interest rate decision. Given this backdrop, the market has taken a turn for the worse, with Bitcoin experiencing a significant drop of over 5% within just a few hours. To better understand why the market is forming new local lows, let’s explore three distinct technical indicators:

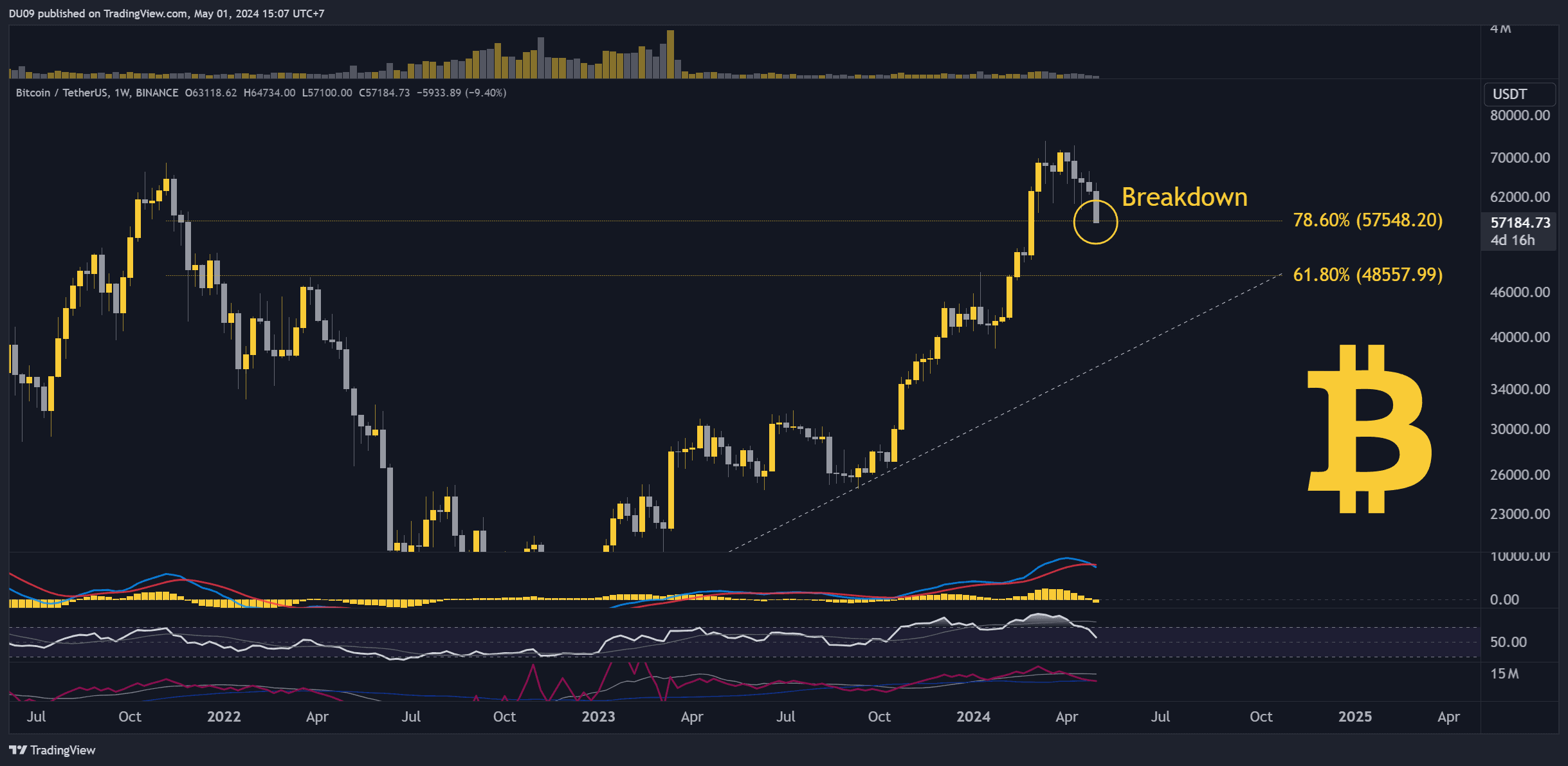

Key Support levels: $52,000, $48,500

Key Resistance levels: $57,500, $63,800

1. BTC Price Breaks Key Support

Beginning in April, Bitcoin has displayed a bearish pattern by reaching successively lower lows. Regrettably, this downward trend persisted into May, with the month commencing at an even lower point than before. The cryptocurrency dipped below $57,000 during this time and shattered the support level of $58,000.

2. Momentum Remains Bearish

As an analyst, I’ve observed that Bitcoin’s price action today has reinforced its downward trend. Currently, bears hold the upper hand as the value plunges. If this correction persists for another month, we may witness a retest of the significant support levels at $52K and even $48K.

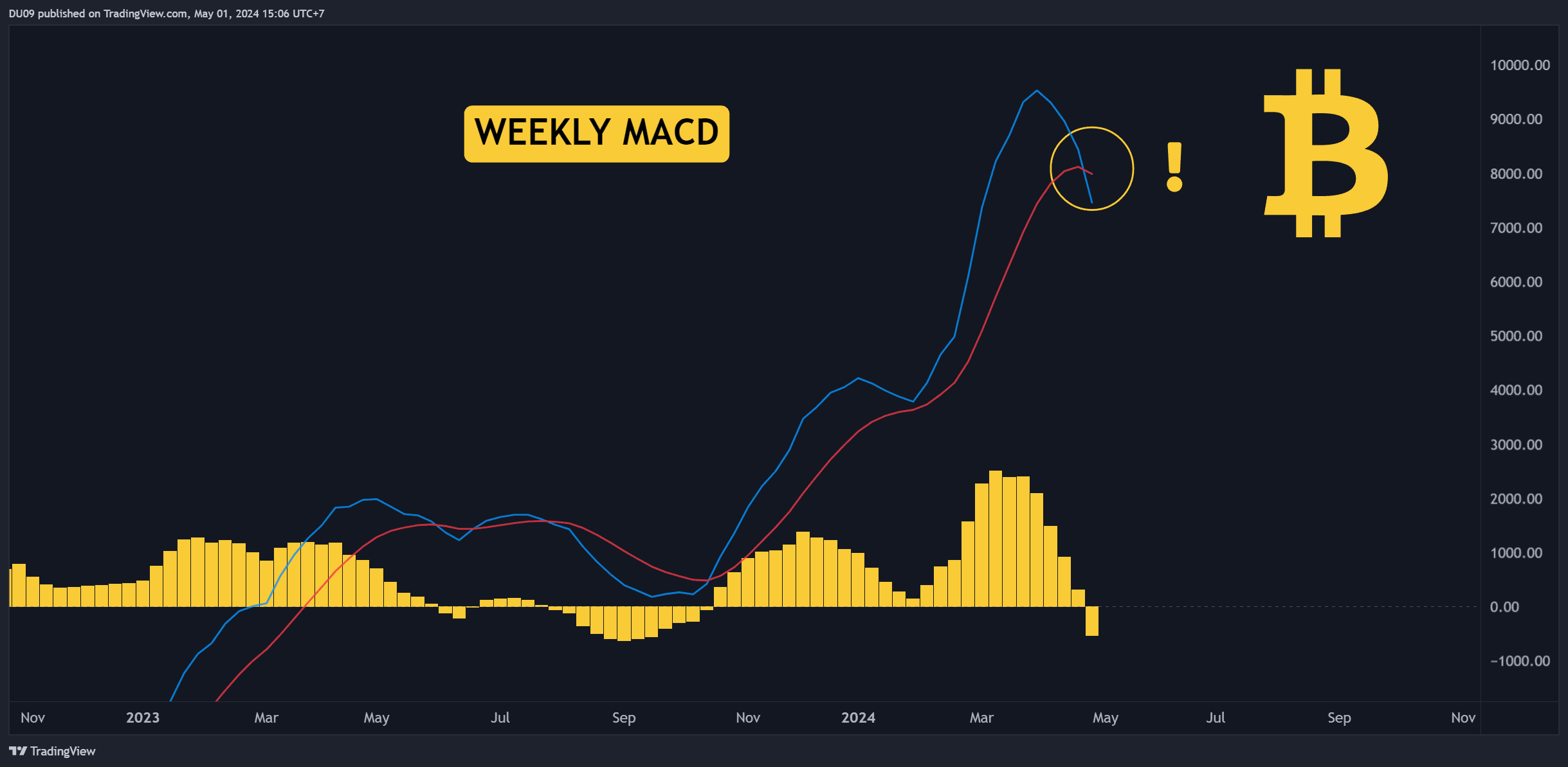

3. Weekly MACD Bearish Cross

The warnings we received were unmistakable. At the onset of this week, the MACD indicator for Bitcoin formed a bearish crossover. This is typically a harbinger of unfavorable price movements, and the market responded promptly to this development. In just two days, the value of Bitcoin has plummeted from nearly $64,000 to around $57,000 – representing a significant decline of over 10%.

Moving forward, if Bitcoin maintains its value above $50,000, the overall market trend will continue to be bullish. However, should the price dip below this threshold, even the most ardent optimists may become uneasy. Under such circumstances, several altcoins could potentially retrace their gains back to their early 2023 levels before the current bull run began.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- PENDLE PREDICTION. PENDLE cryptocurrency

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- W PREDICTION. W cryptocurrency

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- How to Handle Smurfs in Valorant: A Guide from the Community

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

2024-05-01 11:54