As a seasoned crypto investor with several years of experience under my belt, I’ve seen my fair share of market volatility. However, the recent downturn in the crypto market has left me feeling uneasy, especially with bitcoin dipping below $60,000 and reaching a two-month low of around $57,000. It’s disheartening to see altcoins follow suit with massive losses, as well.

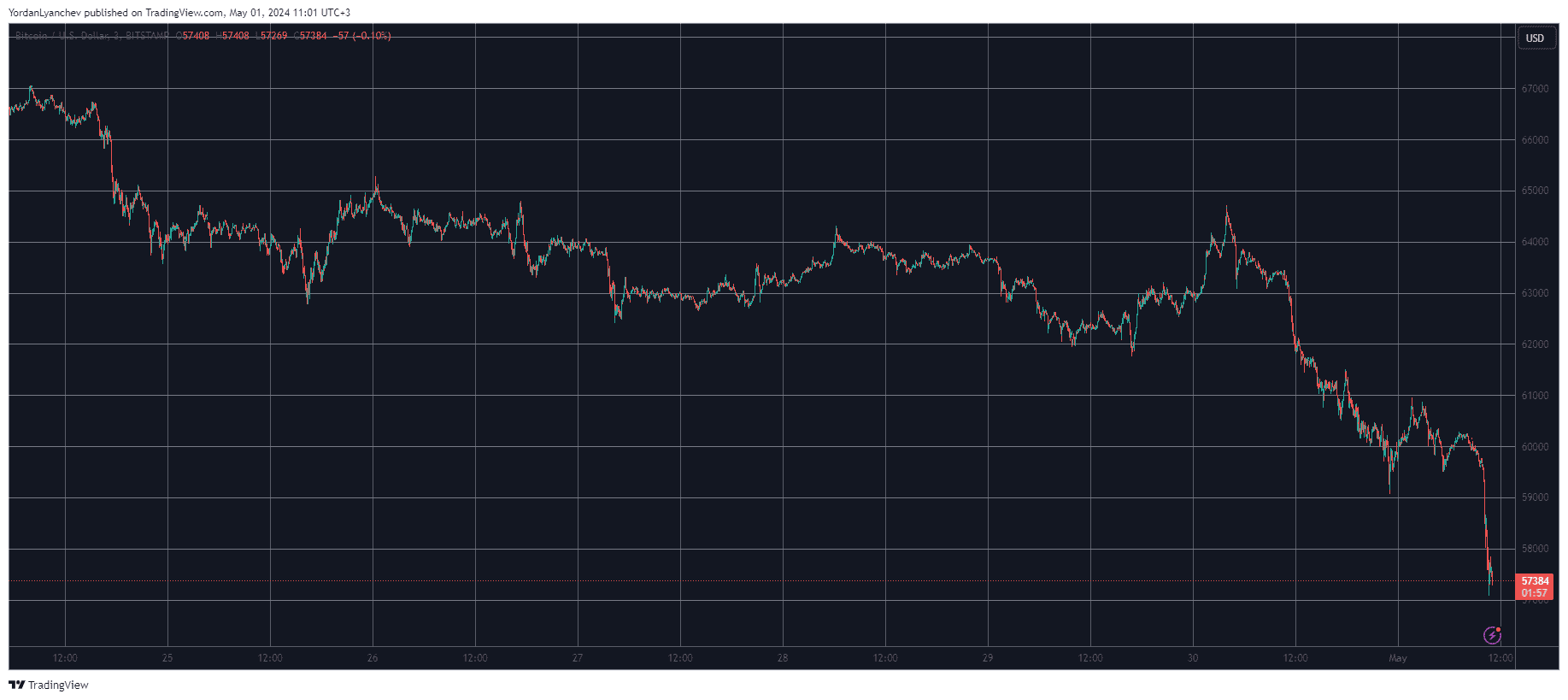

The challenging market situation for all cryptocurrencies persists and has grown more severe in recent hours, with bitcoin reaching a new low of approximately $57,000 over the past few months.

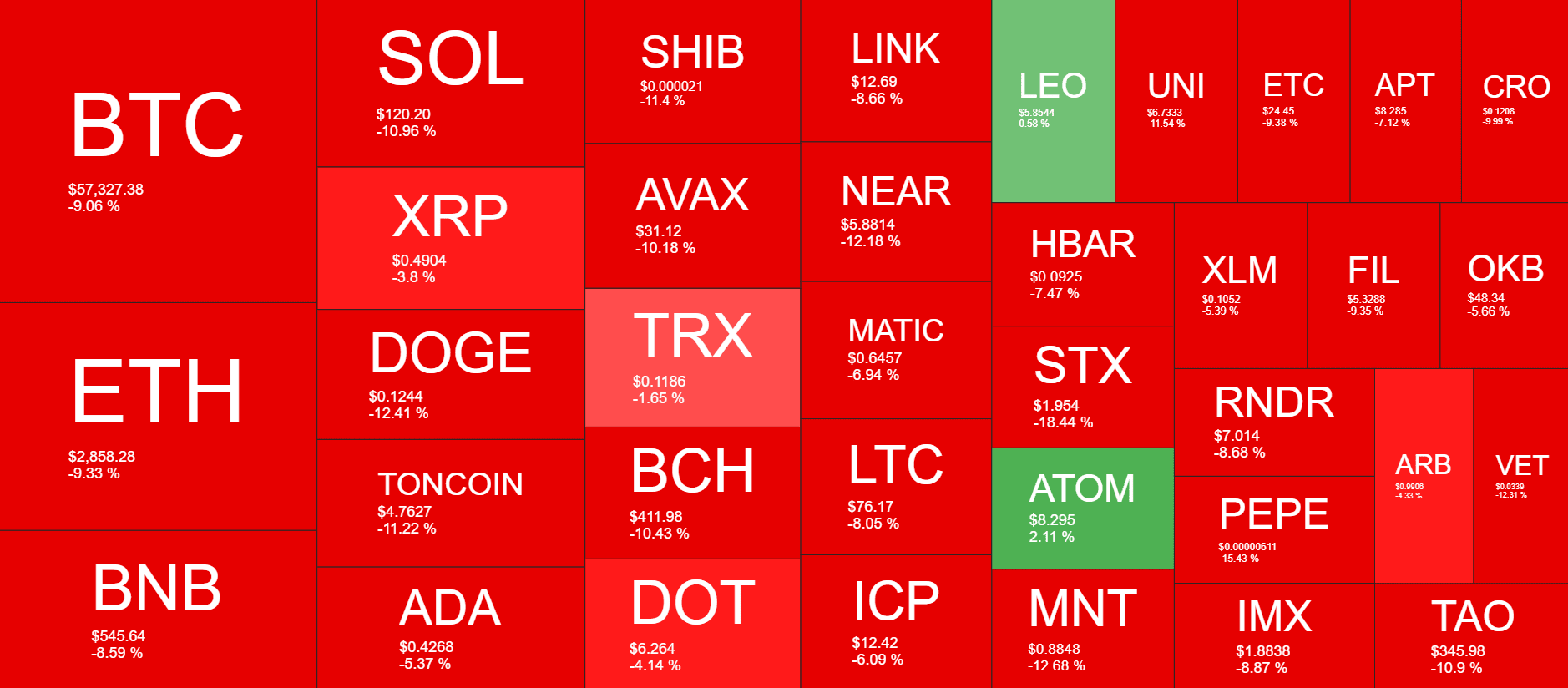

In the past 36 hours or so, altcoins have mimicked the trend and experienced significant declines, resulting in a total market capitalization loss of more than $200 billion.

Where Is Bitcoin’s Bottom?

In the rapidly shifting world of cryptocurrencies, significant developments can occur within a mere matter of days. For instance, just in the past few days, bitcoin’s price approached $65,000 early on Monday morning but ultimately fell short of reaching that mark. The subsequent 36 hours have brought about considerable volatility and turbulence.

I analyzed the price trends of the primary cryptocurrency and was prepared for a drop when it reached $62,000, having seen similar dips in the previous month. However, an unexpected decline ensued, pushing the asset down to a two-month low of $59,100 as reported last night.

In the past 1-2 hours, Bitcoin (BTC) experienced a sharp decline following a brief rise at the pump. The bears managed to push the price down to around $57,000, making it the lowest since February 28. This unexpected drop coincides with the upcoming US Federal Open Market Committee (FOMC) meeting, which historically brings significant market volatility.

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin (BTC) has experienced a 9% decrease in value today and is now 14% lower than its price one week ago. The total market capitalization of Bitcoin has dipped to an astounding $1.130 trillion on CoinGecko. Despite this downturn, Bitcoin continues to hold significant dominance over the alternative cryptocurrencies (alts), accounting for approximately 50.5% of the entire crypto market share.

Alts in the Red Sea

It’s not unexpected that most altcoins have mimicked Bitcoin’s decline. Ethereum hovered above $3,200 following the launch of Hong Kong’s ETFs yesterday, but it has since dropped over $300 to below $2,900. Binance Coin has also dipped, falling from around $600 to currently trade at roughly $550.

I’ve noticed that my investments in Solana (SOL), Dogecoin (DOGE), Theta Network (TON), Shiba Inu (SHIB), Avalanche (AVAX), Bitcoin Cash (BCH), and Near Protocol (NEAR), among others, have experienced significant daily losses, with some dropping by over ten percent.

As a crypto investor, I’ve noticed a significant downturn in the total crypto market capitalization, which now stands at approximately $2.240 trillion. This represents a loss of over $200 billion since Monday morning. Sadly, this is also the lowest the metric has been since February.

Read More

- W PREDICTION. W cryptocurrency

- ACT PREDICTION. ACT cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- Skull and Bones Players Report Nerve-Wracking Bug With Reaper of the Lost

- NBA 2K25 Review: NBA 2K25 review: A small step forward but not a slam dunk

- Mastering Destiny 2: Tips for Speedy Grandmaster Challenges

- Rainbow Six Siege directory: Quick links to our tips & guides

- Exploring Izanami’s Lore vs. Game Design in Smite: Reddit Reactions

- Overwatch Director wants to “fundamentally change” OW2 beyond new heroes and maps

- League of Legends: Saken’s Potential Move to LOUD Sparks Mixed Reactions

2024-05-01 11:12