Disney Parks attendance is plummeting in the summer, but the company’s SEC filings say differently.

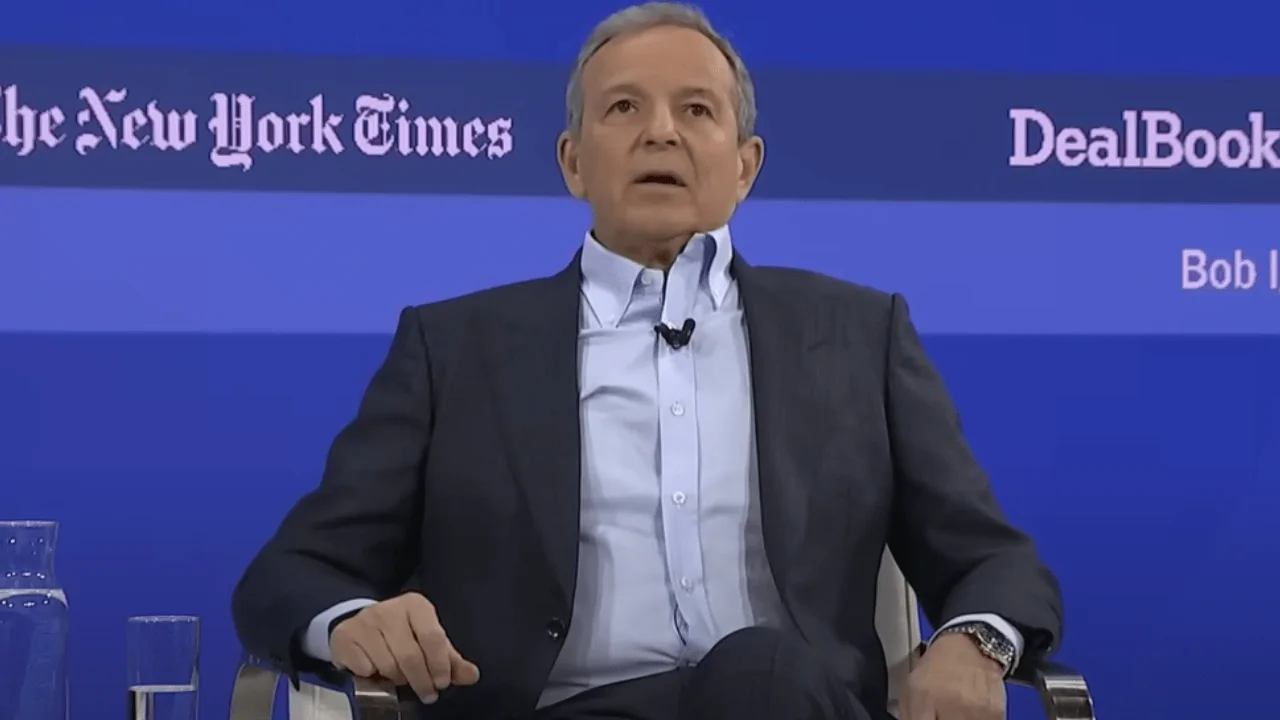

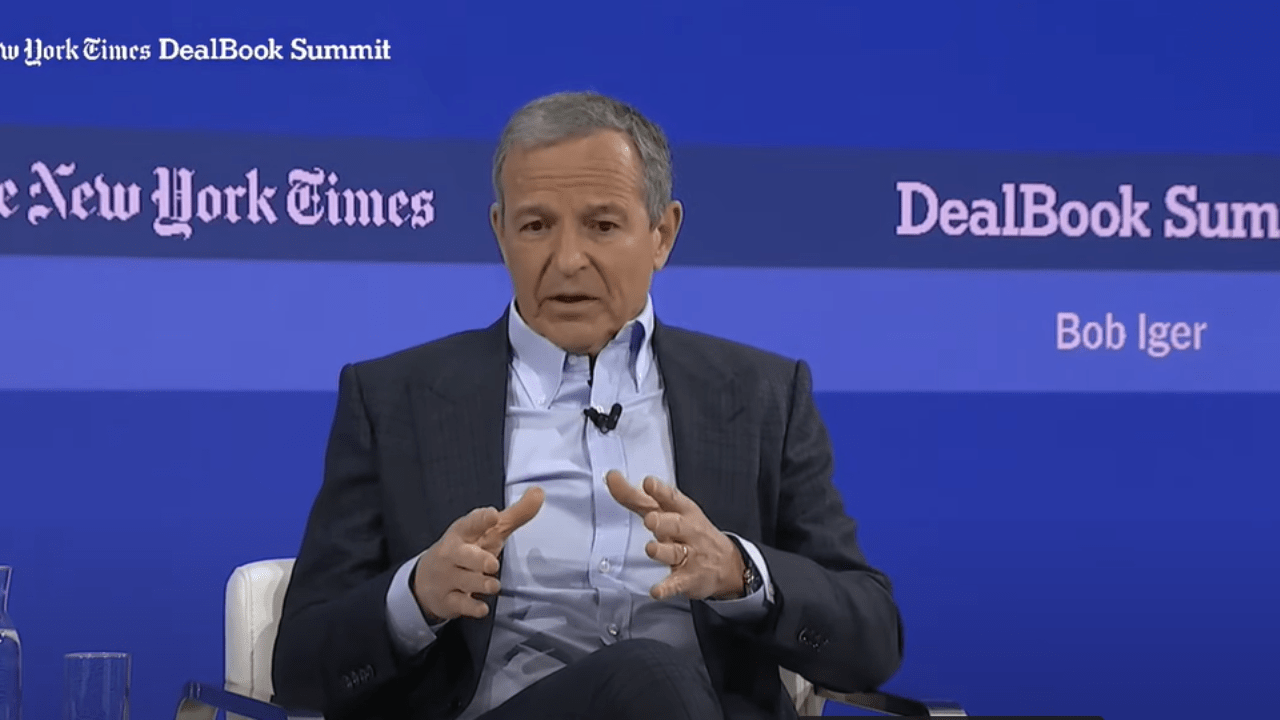

Disney, led by Bob Iger, is facing a serious new issue. It’s not about struggles with streaming, rising theme park costs, or losing fans – it’s a more basic problem: the company’s official financial reports don’t accurately reflect its current situation.

A recent Forbes report by Caroline Reid highlights a pattern in Disney’s financial reports: the company states that its Experiences segment – which includes theme parks, cruises, and merchandise – typically earns more revenue in the first and fourth quarters of each fiscal year. This is true for the first quarter, but the report questions whether it holds up for the fourth.

Not even close.

Disney Parks typically earn the least amount of money during the summer, despite Disney’s official reports to investors suggesting otherwise. This difference between what Disney says and what actually happens isn’t just a simple mistake—it could be a serious problem.

Below is the full breakdown of why this outdated claim could become a real liability for Disney.

1. SEC Could Step in if Filings Misrepresent Trends

Since these claims are made in official documents filed with the Securities and Exchange Commission (SEC), the potential problem is very real. If a company consistently makes statements that are no longer accurate, the SEC has various ways to respond.

This can involve requesting explanations, asking for corrections to inaccurate reports, or even conducting a full review of financial reporting if problems seem widespread. When investors are misled, the agency can also impose fines or require companies to strengthen their disclosure processes.

No one is accusing Disney of doing anything illegal. However, if old, standard language in their financial reports doesn’t match their declining earnings, it could attract the attention of financial regulators who are tasked with looking into such inconsistencies.

Disney is a high-profile company, so even a simple question could easily become negative news.

2. Disney’s Filings Must Reflect Present-Day Realities—Not Nostalgia From a Previous Decade

Financial statements are official records, meant to be accurate, not promotional materials. If a company keeps using language that’s clearly no longer true – such as claiming fourth-quarter park income usually goes up – it raises concerns about whether the information is reliable, properly reviewed, and presented honestly.

A recent Forbes study revealed that the last three years have seen the fourth quarter as the slowest revenue-generating period, except for one year. However, even that stronger quarter wasn’t enough to confidently say that the fourth quarter is typically the best.

Yet the boilerplate line lives on.

As a movie reviewer, I rely on accurate box office reports to understand how films perform throughout the year, and this error in the filings isn’t just a small oversight – it seriously impacts my ability to get a clear picture of seasonal trends. It’s a big deal for anyone trying to understand how movies truly perform at different times of the year.

3. It Misleads Investors About the Health and Trajectory of the Experiences Division

While Disney’s summer performance initially suggested high demand, the actual results tell a different story.

Revenue from domestic parks and experiences fell 8.5% from the third to the fourth quarter this year. Operating income dropped even more sharply, down 44.2% during the same timeframe.

The revenue drop was actually double last year’s decline.

Disney’s official reports create a misleading impression of consistent performance and predictable seasonal boosts, which isn’t accurate. This inaccurate portrayal impacts investor trust and future forecasts.

4. It Could Show a Hidden Disney Structural Problem

For many years, summer was Disney’s most profitable time, with parks packed with visitors and high sales. However, recent reports from Caroline Reid indicate that summer is now consistently their slowest quarter.

That immediately raises two questions corporate leadership does not want to answer:

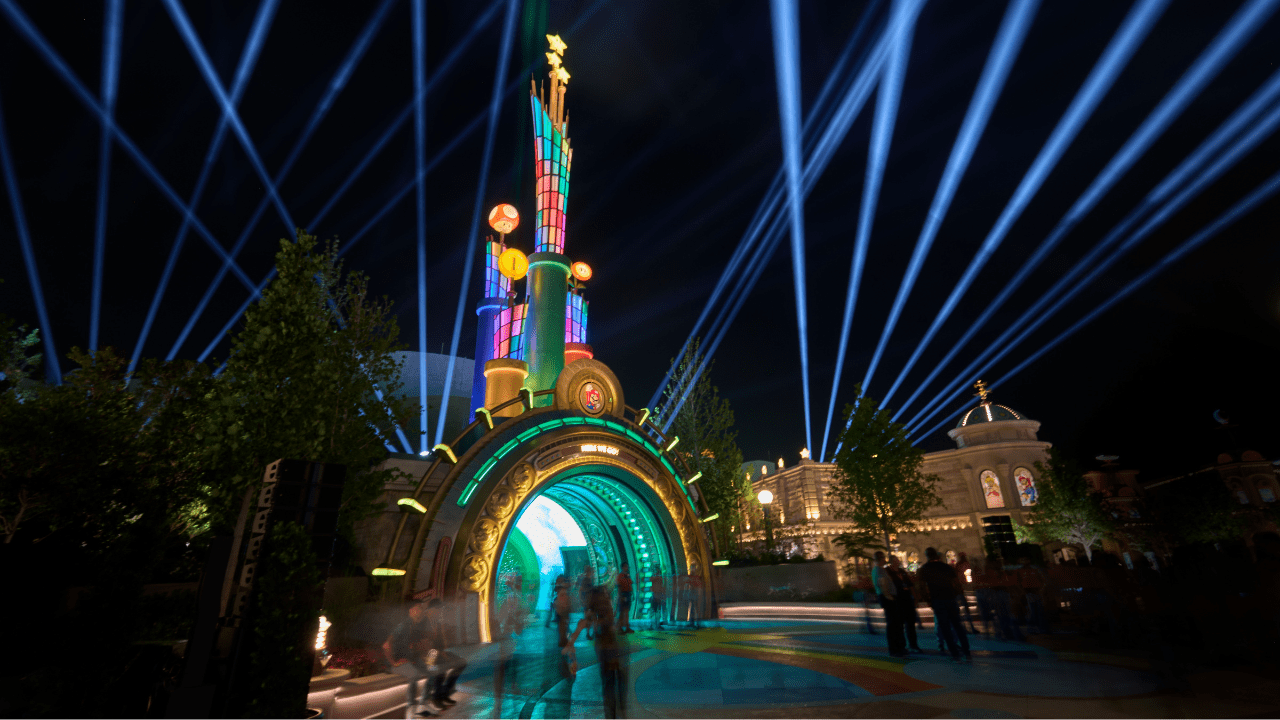

- Is Universal’s Epic Universe siphoning attendance?

- Has Disney priced out the average family?

During Disney’s latest earnings call, Chief Financial Officer Hugh Johnston tried to minimize the potential impact of Universal’s Epic Universe theme park.

We didn’t see weak demand; it met our projections. As we’ve previously discussed, the opening of Epic was expected to affect attendance at our domestic parks, and it did – exactly as we predicted. It appears to be impacting our competitors in Florida more than us, which we view positively from a customer standpoint.

The reported figures don’t support that optimistic outlook. When the official statements don’t match the data, it seems like Disney is trying to deflect criticism instead of being open and honest.

5. Undermines Executive Credibility

Investors are already pushing Bob Iger and Hugh Johnston for more details about Disney’s plans, how the company is spending money, and how they’re improving the theme parks.

Keeping outdated or incorrect standard language in financial reports can suggest poor financial management, old-fashioned thinking within the company, or an attempt to downplay problems.

None of those inspire shareholder confidence.

6. Elevates Risk of Future Shareholder Suits

If investors rely on company reports that exaggerate positive results, the company could be subject to complaints, lawsuits, or be forced to issue corrections.

As a movie buff, I’ve always thought it’s funny – it’s rarely the quality of a film that gets a studio into legal trouble. It’s almost always about how they sold it. They don’t get sued because a movie is bad, they get sued for misleading advertising – for promising something the film just doesn’t deliver. It’s not about failing to entertain, it’s about misrepresenting what you’re going to get.

This is exactly the kind of mismatch that becomes Exhibit A in a class-action complaint.

7. Refusal to Comment Makes the Problem Worse

Reid reached out to Disney to ask about some possible errors, but Disney didn’t offer a response.

In this situation, staying silent isn’t a neutral act. It signals to investors that the company lacks an explanation, is struggling with how to respond internally, or is deliberately avoiding the topic because the truth is more damaging than remaining quiet.

None of those interpretations is reassuring.

8. Internal Reporting May Not Align With Actual Operational Conditions

The most damaging implication isn’t legal or financial. It’s strategic.

If Disney hasn’t corrected this language, one of two things is true.

The company’s outdated filings suggest one of two things: either they’re disorganized and unaware of the problem, or they’re deliberately presenting misleading information.

This is particularly bad news for a company already struggling with unhappy customers, growing competition, and a loss of loyal fans.

Conclusion

As a huge Disney fan, I was really concerned to read Caroline Reid’s report in Forbes. It’s not just about typical summer dips in park attendance; it seems like there’s a bigger issue with how Disney is presenting things. The report suggests Disney Parks are actually facing some serious challenges this summer, but their official statements aren’t reflecting that reality. It’s worrying because it feels like a transparency issue, and as someone who loves the parks, I want to trust what Disney is telling us.

Because sales are down, profits are decreasing, and Universal’s new theme park is changing the competitive landscape in Florida, the company needs to ensure its official reports to the Securities and Exchange Commission (SEC) accurately reflect its own internal data.

The more Disney holds onto this old idea, the more obvious it becomes that their parks are no longer operating as they once did.

Read More

- YouTuber streams himself 24/7 in total isolation for an entire year

- Gold Rate Forecast

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- Shameless is a Massive Streaming Hit 15 Years Later

- ‘That’s A Very Bad Idea.’ One Way Chris Rock Helped SNL’s Marcello Hernández Before He Filmed His Netflix Special

- Mark Ruffalo Finally Confirms Whether The Hulk Is In Avengers: Doomsday

- XDC PREDICTION. XDC cryptocurrency

- Return to Silent Hill Star Breaks Down Her “Daunting” Experience on the Sequel Film

- ZCash’s Bold Comeback: Can It Outshine Bitcoin as Interest Wanes? 🤔💰

- Beyond Agent Alignment: Governing AI’s Collective Behavior

2025-11-20 15:59