Solana boasts a sizable decentralized finance (DeFi) sector among crypto projects. Despite being hit hard by the collapse of FTX exchange in 2021, Solana bounced back strongly in 2024, marked by significant advancements and making it one of the most sought-after networks within the industry.

With a total value locked at an impressive multi-billion dollar figure, Solana plays host to a vibrant ecosystem teeming with hundreds, if not thousands, of active projects.

The protocol, known for its impressive scalability, rapid speed, and economical gas fees, has become a thriving hub for numerous decentralized applications (dApps). These dApps cater to various sectors within Decentralized Finance (DeFi), including lending and borrowing platforms, liquid staking services, decentralized exchanges for swapping assets, NFT marketplaces, crypto asset bridges, and derivatives trading systems.

With so many intriguing and varied projects available on the Solana ecosystem, it’s natural to feel a bit daunted. You might wonder: How can I discover new Solana projects? Which project on Solana stands out as the best choice for me?

In this comprehensive walkthrough, I will address and provide clear answers to the specific queries you have, focusing on the leading 10 initiatives in the Solana ecosystem. Alongside an accessible explanation of each project, you’ll gain valuable insights into essential aspects, including but not limited to their unique features and potential impact on the blockchain industry.

- The founders

- Funding rounds and notable investors

- Important project milestones

So, without any further ado, let’s dive in.

Quick Navigation

- The Importance of Solana DEXs

The Top 10 Solana Projects in 2024

Phantom Wallet: The Biggest Self-Custody Wallet on Solana

Marinade Finance: Leading Solana Lending Project

Magic Eden: Solana’s Go-To NFT Marketplace

Dogwifhat (WIF): The Biggest Meme Coin on Solana

Render Network: Decentralized Physical Infrastructure (DePIN)

Ondo Finance: Real-Word Assets (RWA) on Solana

Jito: Solana’s Liquid Staking Behemoth

Kamino Finance: Leverage, Liquidity, Lending

Mad Lads: Executable NFTs on Solana

Helium Network: Internet of Things (IoT)

Frequently Asked Questions

Final Thoughts on the Top Solana Projects

The Importance of Solana DEXs

In the realm of Decentralized Finance (DeFi), decentralized exchanges (DEX) play a pivotal role. To construct robust and efficient DEXs, infrastructure is essential, which must be scalable, economical, and swift in handling transactions.

Solana is the ideal choice for decentralized exchange (DEX) developers, making it a perfect fit for their needs.

In simple terms, Decentralized Exchanges (DEXs) significantly contribute to the economic expansion of the Solana network. By utilizing Solana’s blockchain technology, these DEXs have flourished in the DeFi sector, drawing users with alluring features such as automated market makers (AMMs), liquidity provision, dollar cost averaging (DCA), and perpetual trading, among others.

As a crypto investor in the Solana ecosystem, I firmly believe that Decentralized Exchanges (DEXs) within this platform play a pivotal role. These DEXs nurture the core philosophy of decentralized finance by granting users the prime advantage—ownership and control over their digital assets through personal self-custody wallets.

For those who haven’t made a decision yet, I recommend checking out our comprehensive guide on the best Solana wallets. Alternatively, you might find our accompanying video helpful as well.

As a devoted analyst in the cryptocurrency space, I am thrilled to share that I’ve taken it upon myself to create an informative guide focusing on the most significant and widely-used decentralized exchanges (DEXs) operating on the dynamic Solana blockchain.

The list that follows deliberately excludes any decentralized exchanges, but these platforms are certainly worth considering as top projects on Solana based on various perspectives.

The Top 10 Solana Projects in 2024

As a crypto investor with an interest in Solana, I’ve compiled a thorough list of the most promising projects. I took into account various aspects including market dominance, unique features that stand out, the strength of their communities, and the capabilities of their development teams.

Here’s a short recap of the niches that we looked into and some of the projects in them:

Lending: Marinade Finance, Jito, Kamino Finance

Wallets: Phantom Wallet

NFTs: Magic Eden, Mad Lads

DePIN: Render Network, Helium Network

RWA: Ondo Finance

Meme Coins: Dogwifhat (WIF)

Phantom Wallet: The Biggest Self-Custody Wallet on Solana

Quick summary:

- Largest self-custody wallet on Solana.

- Integrated support for other networks.

- Millions of monthly active users.

As a Solana network analyst, I can confidently assert that Phantom is currently the go-to choice for self-custody wallet users on our network, boasting the largest user base. Debuted in January 2021, this app has quickly gained widespread popularity not only within the Solana ecosystem but also among users of other networks.

Users can securely keep their cryptocurrencies on the blockchain using Phantom wallet. This is ideal for individuals seeking self-custody solutions. The vast majority of Solana’s decentralized applications (dApps) are compatible with Phantom wallet, making it a preferred choice among SOL stakers due to its streamlined staking process and intuitive user interface. Over 100,000 monthly users find this wallet conveniently accessible as a web browser extension on Brave, Google Chrome, and Firefox.

Additionally, Phantom offers a stand-alone app for convenient use on iPhone and Android smartphones.

The CEO of Phantom, Brandon Millman, was interviewed by CryptoPotato on two occasions. You can access those interviews at these links: [link 1] and [link 2].

Founders

Phantom was co-founded by:

- Brandon Millman – currently serving as the CEO.

- Francesco Agosti – currently serving as the CTO

- Chris Kalani – currently serving as the CPO

Funding

As a crypto investor following Phantom’s progress, I’ve noticed some exciting updates based on data from CryptoRank. In January this year, the company completed a funding round valued at a staggering $1.2 billion. They managed to secure an impressive investment of $109 million in this round. Previously, back in July 2021, Phantom announced another successful funding round, where they raised $9 million.

A diverse group of investors such as Paradigm, Jump Capital, Andreessen Horowitz, DeFi Alliance, Variant, and Solana Ventures, among others, have invested in Phantom.

Notable Milestones

- Raised over $100 million at a $1.2 billion valuation in January 2022.

- Extended support for Ethereum and Polygon in April 2023.

- Reported at 2.7 million monthly active users in January 2024.

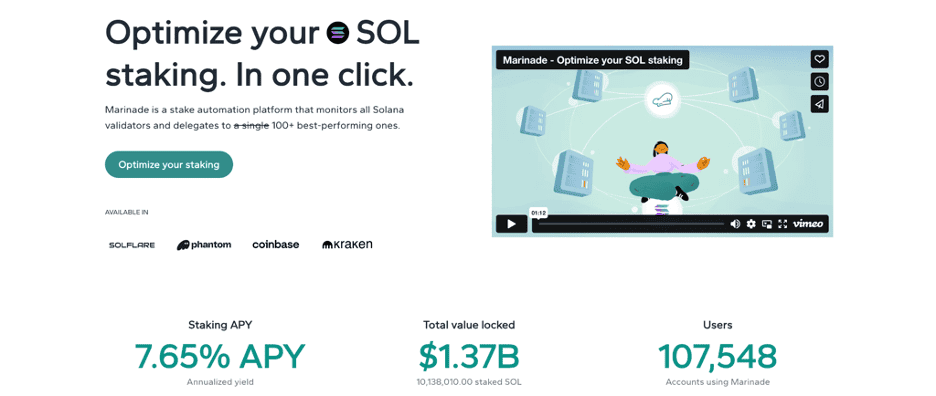

Marinade Finance – Leading Solana Lending Project

Quick summary:

- Occupies the lending field.

- Focuses on liquid staking on Solana.

- Largest lending protocol on Solana.

Marinade Finance ranks among the most significant initiatives on the Solana network, boasting over $1.5 billion in total assets secured as of April 2024.

With the protocol, users can deposit their SOL tokens to receive a equivalent amount of mSOL tokens as a representation of their staked assets. While their original tokens earn rewards and bolster network security and liquidity, users are free to utilize the mSOL tokens in other Decentralized Finance (DeFi) platforms to amplify their earnings.

Users have the flexibility to withdraw their staked assets whenever they desire, without any waiting period. Additionally, interacting with this protocol is convenient as it’s compatible with major platforms such as Coinbase and wallets like Phantom on the Solana network.

As a data analyst, I’ve observed that Marinada emerged as one of Solana’s leading projects by leveraging the liquid staking narrative alongside prominent Ethereum counterparts like Lido. However, following the significant crypto market downturn that began in late 2021 and persisted through 2023, Marinade saw a near-total loss of approximately 90% of its TVL (Total Value Locked). Yet, in the pivotal year of 2024, Marinade regained traction, amassing billions in TVL once more.

Founders

Marinade Finance, established in 2021, is the brainchild of Marco Broeken and Lucio Tato. However, details about these two founders are scarce due to the fact that their venture operates under a decentralized autonomous organization (DAO), which allows for a more anonymous management structure.

Funding

As a researcher, I’ve come across some intriguing information about Marinade Finance’s fundraising activities. While the precise amount they’ve raised remains undisclosed to the public, PitchBook provides insight into their financing history. Marinade has reportedly concluded at least one funding round and has attracted investment from two esteemed venture capital firms: Miton and Big Brain Holdings.

Notable Milestones

As a crypto investor, I’m excited about the significant advancements that our protocol is expected to achieve in the year 2024. Some noteworthy milestones include surpassing 160 validators and the implementation of pivotal developments. Here are some of them:

- The rollout of Protected Staking Rewards in Q1, 2024, which allows Marinade to stake to more than its fleet of 100+ validators, further supporting decentralization on Solana.

- Improved TX performance for the dApp.

- The rollout of new marketing strategies to build new partnerships and push institutional adoption of Marinade’s growing product suite.

Magic Eden: Solana’s Go-To NFT Marketplace

Quick summary:

- Occupies the NFT space.

Offers support for Ordinals, Ethereum, Polygon, Base.

Largest NFT marketplace on Solana.

Since 2021, Solana’s non-fungible token (NFT) sector has experienced significant growth. One of the most prominent marketplaces and preferred platforms for numerous NFT traders and investors is Magic Eden.

I joined the Solana ecosystem back in September 2021, and one of the projects that rapidly gained prominence was Magic Eden.

The Magic Eden platform is chiefly recognized for enabling users to trade non-fungible tokens (NFTs), while it also serves as a venue for creators to debut their unique collections. A fee, referred to as a tax, is imposed by Magic Eden on every NFT transaction.

Magic Eden initially emerged as a marketplace specializing in Non-Fungible Tokens (NFTs) on the Solana blockchain. However, it has since broadened its horizons and now accommodates other networks as well. While not yet rivaling the widespread popularity of Ethereum-based NFT powerhouse OpenSea, Magic Eden does extend compatibility to Ethereum.

The project stands out for the agility of its team in embracing new trends, often being among the first to introduce support for emerging networks such as Bitcoin (ordinals and runes), Polygon, and Base.

Founders

- Jack Lu – who currently serves as the CEO

- Sidney Zhang – who currently serves as the CTO

- Zhuoxun Yin – who currently serves as the COO

- Zhoujie Zhou – who currently serves as the Chief Engineer

Funding

Magic Eden has had three funding rounds:

- Seed – raised $2.5 million in October 2021.

- Series A – raised $27 million in March 2022.

- Series B – raised $130 million in June 2022.

Several distinguished investors have made significant investments. Among them are Paradigm, Solana Ventures, Sequoia Capital, Electric Capital, and 6th Man Ventures, alongside other notable entities.

Notable Milestones

- Raised $130 million at a $1.6 billion valuation in June 2022.

- Extended support for Bitcoin Ordinals in March 2023.

- Surpassed OpenSea and Tensor in terms of transaction volume in April 2024 (temporary).

Dogwifhat (WIF): The Biggest Meme Coin on Solana

Quick summary:

- The dog still has its hat.

In the latter half of 2023 and the beginning of 2024, meme coins on the Solana platform gained significant attention. The trading activity on this protocol surged, leading to congestion within the network and, in some cases, causing it to malfunction or become unavailable.

Among the influential meme coins in the entire industry, and not just on the Solana network, Dogwifhat (WIF) stands out as particularly significant.

As a crypto investor, I’ve come across an intriguing digital asset with a unique name and backstory. It goes by the moniker WIF – an acronym for “Wearing Is Key,” which describes a corgi in a simple pink hat. This quirky alias gained traction within the close-knit Solana community towards the end of 2023. However, its popularity soared in the ensuing months and by March, WIF had broken into the big leagues with a market capitalization valued at billions. It even managed to secure a place among the top 50 cryptocurrencies on my watchlist.

The coin serves no practical function or reason for amusement other than its humorous aspect. The canine’s hat remains a source of humor regardless of the situation.

Founders

The creators of Dogwifhat remain unknown to the public, and they reportedly disposed of their tokens prior to the coin gaining widespread popularity as a meme asset.

Funding

Dogwifhat has received no funding – it’s a meme coin.

Notable Milestones

- Went parabolic in 2024.

- The community raised $650K to put the dog on the popular Las Vegas Sphere.

- The dog still has its hat.

Render Network – Decentralized Physical Infrastructure (DePIN)

Quick summary:

- Occupies the DePIN Narrative.

- Focuses on decentralizing GPU cloud rendering.

- Multiple applications in various fields.

In the Solana blockchain community, RNDR (Render Network) stands out as a prominent project. Its objective is to create a decentralized marketplace that connects individuals requiring on-demand GPU rendering with high-performance GPU owners. This setup allows artists, businesses, and individuals to effectively expand their rendering capabilities at reduced costs and increased speed compared to traditional centralized GPU cloud systems.

As an analyst, I’d describe the business model of Render Network in this way: I serve as a bridge between two key players – creators and node operators. Creators are the ones who submit rendering jobs, while node operators utilize their spare GPU capacity to complete tasks and receive RNDR as remuneration. However, our platform offers more than just simple rendering assignments for gaming, entertainment, or art. We cater to complex requests as well, such as those for artificial intelligence (AI) or machine learning (ML) applications.

Founders

Jules Urbach established Render Network back in 2017. Notably, he is the brains behind OTOY, a cloud-based GPU rendering solution designed for content production and media delivery. With an impressive 25-year career in computer graphics, streaming technology, and 3D rendering under his belt, Urbach is recognized as a trailblazer in these fields.

Notable team members include Kalin Stoyanchev, who serves as the Project Lead at Render Network and is known for his investment in Bitcoin and tech entrepreneurship. Additionally, there’s Charlie Wallace, an accomplished software engineer, holding the role of CTO within the team.

The esteemed advisory team at Render Network is graced with the presence of influential figures hailing from various sectors. Notable members include J.J. Abrams, a renowned filmmaker; Jennifer Zhu Scott, a successful entrepreneur specializing in deep tech from Hong Kong; and Ariel Emanuel, the CEO of Endeavor, a global enterprise encompassing sports and entertainment industries.

Funding

“As reported by CoinCarp, Render Network successfully raised $30 million during its Seed funding round which was concluded on December 21, 2021. The investment came from renowned venture capital firms such as Multicoin Capital and Solana Foundation, as well as angel investors like Vinny Lingham.”

Notable Milestones

In the year 2023, Render Network stood out among other DePIN (Decentralized Processing Infrastructure Network) projects due to its exceptional performance. During this period, there was a significant increase in requests for rendering tasks. The primary cause of this surge was the emergence of advanced projection mapping and immersive rendering initiatives. As a result, Render Network experienced its busiest workload since its establishment.

The Render Network currently holds the title as the most valuable DeFi project, boasting a market capitalization that surpasses $3.3 billion, according to data from April 2024.

Ondo Finance – Real-World Assets (RWA) on Solana

Quick summary:

- RWA narrative on Solana.

Institutional-grade on-chain products.

Focus on compliance.

I analyze Ondo Finance as a revolutionary blockchain protocol that enables access to institutional-caliber financial products, such as tokenized bonds and treasuries. By bringing these securities onto the blockchain, investors can enjoy several advantages, including expedited trading on secondary markets without the usual delays and administrative barriers. This ultimately results in heightened efficiency and liquidity.

As a researcher studying the blockchain industry, I can tell you that Ondo offers a controlled platform for investors eager to explore tokenized assets. Nevertheless, potential users must complete KYC (Know Your Customer) processes prior to joining this network. This crucial step is taken to maintain regulatory compliance.

Through the belief in self-reliance, Ondo accomplishes this by forming alliances and linking up with asset managers, custodians, lawyers, and other essential entities for effective on-chain asset management.

Founders

I was established in the year 2021 with the inception of Ondo. I, being a part of its founding team, previously held a position on Goldman Sachs’ digital assets squad. My colleagues include individuals who have an extensive background in the financial sector. Among them are Ian De Bode, who has worked with Goldman Sachs and McKinsey & Co. prior to joining Ondo.

As a blockchain analyst, I’ve noticed that while platforms like Ondo diverge from the traditional anonymous and privacy-focused decentralized finance (DeFi) projects, they play a significant role in driving blockchain adoption and economic growth within ecosystems. Given their unique offerings of tokenized bonds, which are securities, it’s essential for these platforms to take the necessary steps to comply with regulatory laws.

Funding

In a single public offering and a Series A round, Ondo Finance managed to secure approximately $46.4 million in funding – $22.4 million from the public sale and an additional $24 million from the series A investment.

Notable Milestones

On April 2024, Ondo Finance transferred $95 million into BlackRock’s tokenized investment vehicle, BUIDL. This action facilitates swift transactions for Ondo Finance’s OUSG tokens, which represent short-term government securities.

A notable achievement for the project more recently is collaborating with Noble, a Cosmos-linked chain, to introduce tokenized assets to the Cosmos blockchain. The initial asset from Ondo intended for launch on Noble’s platform is USDY, which represents a short-term U.S. Treasury-backed token yielding 5.2% annually. Anticipated release date: Q2 of 2024.

By joining the Cosmos multiverse, Ondo’s token offerings will become accessible on over 90 connected blockchains through Cosmos’ Inter-Blockchain Communication (IBC) protocol. This integration is anticipated to boost the usage of Ondo’s products, such as earnings assets, payment tools, and collateral options.

Jito – Solana’s Liquid Staking Behemoth

Quick summary:

- Liquid staking on Solana.

- Hosted one of the most trending airdrops.

- Leverages MEV strategies.

Among the prominent liquid staking protocols on the Solana blockchain, Jito holds a significant position. What sets it apart is its uncomplicated user experience and intuitively designed dashboard.

One reason for Jito’s success is its approach to MEV frontrunning.

MEV, or Maximal Extractable Value, is a contentious issue in the crypto sphere. Some critics claim that MEV miners employ underhanded tactics such as market manipulation and transaction reordering on decentralized exchanges. By doing so, they allegedly gain an unfair edge, taking advantage of positions within the network at the expense of regular users, ultimately leading to a suboptimal user experience.

Some people believe that Multi-Exchange Arbitrage (MEV) bots play a crucial role in enhancing market efficiency by identifying optimal token prices across various exchanges and addressing economic disparities within Decentralized Finance (DeFi) platforms, particularly lending protocols. In these scenarios, MEV plays a pivotal function by enabling lenders to recover their funds when borrowers fall short of the mandatory collateral requirements.

In simpler terms, MEV, or Miner Extractable Value, has both advantages and disadvantages. Jito aims to address this issue by introducing an auction system. Traders can place bids on transaction sequences they believe will yield a profit. Subsequently, external block engines run simulations to determine the most lucrative combinations of transactions.

In this system, validators and stakers receive the finalized bids from JitoSOL. This process eliminates potential spam advantages, thereby improving incentives for stakers.

Founders

Jito was founded by Jito Labs, whose co-founders are Lucas Bruder, CEO, and Zano Shermani, CTO.

Before starting Jito Labs with his co-founders, Lucas gained experience in robotics control systems for self-driving bulldozers and worked on embedded firmware development at Ouster and Tesla.

In contrast, Shermani held the position of Software Engineer at Parsec while simultaneously working on her education at George Mason University.

As a crypto investor, I’ve come across some prominent figures in the industry, one of whom is Brian Smith. He holds the title of COO at Jito Labs and is an essential contributor to the Jito Network.

Funding

In the year 2022, Jito Labs secured a Series A investment of twelve million dollars, with Multicoin Capital and Framework Ventures spearheading the funding round.

Notable Milestones

- Jito has become a household name in the Solana ecosystem. The total value locked within the protocol has surged in Q1 2024

- Jito distributed its token through a massive airdrop on December 7th, 2023.

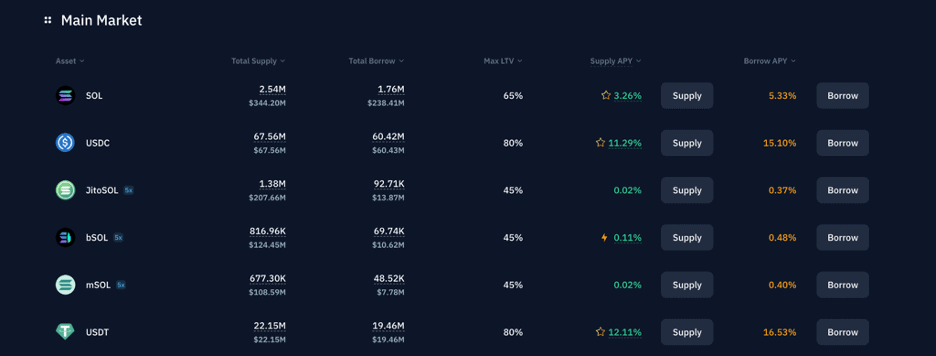

Kamino Finance – Leverage, Liquidity, Lending

Quick summary:

- Occupies lending, liquidity, and leverage fields.

- Provides a number of features for many needs.

- Rewards users through Kamino points.

Among the captivating initiatives on the Solana platform, Kamino Finance stands out with its comprehensive array of offerings for lending, borrowing, and financial investment.

Founded in 2022 with its base in London, England, Kamino has rapidly gained prominence among Solana’s leading projects. Known for its extensive selection of decentralized financial solutions, Kamino specializes primarily in liquidity provision, leverage, and lending and borrowing services.

The “Multiply” function has made Kamino more alluring for users. Essentially, this feature lets users amplify their interaction with a profit-yielding asset by obtaining the underlying asset on loan.

A user can obtain SOL through Kamino Lend to amplify their involvement with JitSOL. Essentially, these loans function as overcollateralized borrowing schemes, presented in a more accessible interface for users.

Kamino Points are also an integral part of the platform. Since announced, points have served as a reward and incentive mechanism, encouraging user engagement across borrowing, lending, and liquidity vaults. This system has played a pivotal role in Kamino’s growth as it serves as the accounting measure to gauge which users will be rewarded best in any upcoming airdrops.

Founders

Gonzalo Parejo Navajas and Ben Gleason are the originators of the protocol. Previously, Navajas held the position of Operating Partner at Niche Partners. He is also a co-founder of OnTruck, a merchandise transportation service, and served as the managing director at tech and shipping company iContainers.

During this time, Gleason held the positions of Chief Financial Officer and Managing Director for Groupon’s e-commerce branch in Latin America. Before joining Groupon, he worked as an Engagement Manager at McKinsey.

Funding

Kamino managed to raise more than $10 million in investment, with support coming from renowned venture capital firms such as Solana Ventures and Jump Capital.

Notable Milestones

Kamino has become the largest USDC venue in Solana, with over $180 million in its USDC products.

Kamino’s goals extend beyond what has been achieved so far; in collaboration with Jito and DeFi research firm Gauntlet, they are working to boost USDC usage on Solana, commencing with $140,000 worth of monthly incentives distributed across three different products.

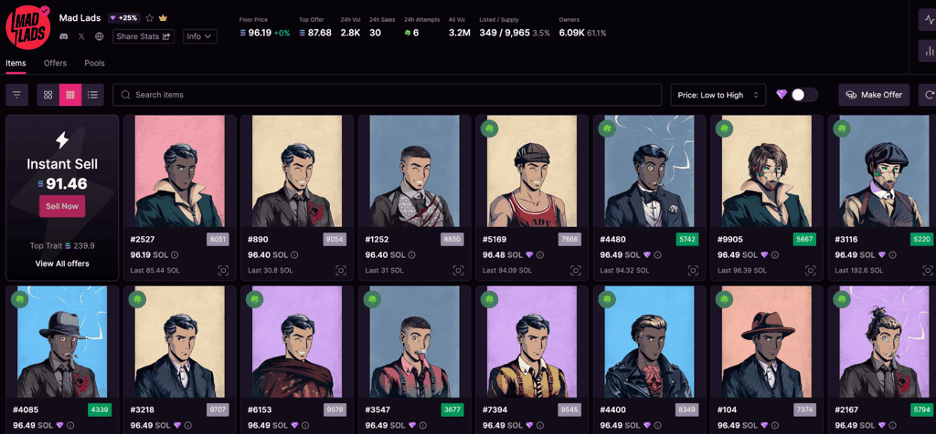

Mad Lads: Executable NFTs on Solana

Quick summary:

- Occupies the NFT space.

Created and developed by an established infrastructure developer.

Is mad, lad.

Mad Lads has become one of the biggest collections of non-fungible tokens on Solana.

It was launched by a company called Coral. It’s focused primarily on Solana framework development.

A set comprised of 10,000 distinct avatar designs makes up the collection. These humanoid figures possess unique characteristics, and each one boasts varying degrees of rarity. Generally speaking, the rarer a non-fungible token (NFT) is, the more costly it becomes.

Around 9,966 units of the Mad Lad NFT collection have been created and owned by collectors. Importantly, every piece is distinctly unique in terms of its shape and form.

As a researcher delving into the captivating realm of digital collectibles, I’ve come across an intriguing aspect of Mad Lads – they are xNon-Fungible Tokens (xNFTs). This designation carries a significant implication: each Mad Lad NFT comes with a built-in script, coded within its very essence. With the assistance of applications specifically designed to work with Mad Lads, these scripts can be activated and executed.

Founders

Coral’s founding was led by Armani Ferrante, a tech industry veteran with early experience at Apple.

Trystan Yver is a co-founder of Coral.

Funding

Coral received a $20 million funding round in September 2022.

Notable Milestones

- The Mad Lads peaked in December 2023, reaching an all-time high floor price of around $20K.

Largely recognized as one of Solana’s “blue chip” NFT collections.

Helium Network – Internet of Things (IoT)

Quick summary:

- Occupies the DePIN narrative

- Focuses on distributed hotspot network

- Uses Proof of Coverage (PoC)

As a researcher exploring the latest developments in decentralized infrastructure, I’ve come across the Helium Network – an intriguing project that was once part of the Decentralized Pipeline Infrastructure Network (DePIN). In pursuit of leading-edge technology, this innovative network made the strategic decision to migrate its operations to the dynamic Solana blockchain. Consequently, Helium Network is now poised to spearhead the decentralized wireless infrastructure sector.

In simpler terms, hotspots serve as the foundation of the Helium network, enabling local internet connectivity for people and businesses in proximity through your active hotspot. In return, you receive HNT tokens as compensation.

The Helium Network functions using Proof of Coverage (PoC), an innovative approach that motivates users to authenticate network coverage. In turn, this verifies their location and connectivity. PoC is seamlessly incorporated into the Helium Consensus Protocol, which employs HoneyBadgerBFT as its consensus mechanism.

Users set up Hotspots to expand the network and receive Helium cryptocurrency compensation via a Helium blockchain-driven incentive scheme. This form of mining relies on radio frequency technology instead of conventional methods that utilize large amounts of energy from GPUs or ASIC rigs, resulting in substantial energy savings.

Founders

Helium initially emerged as a telecommunications company, Helium Inc., in 2013, founded by Amir Haleem, Shawn Fanning, and Sean Carey. However, it wasn’t until 2019 that the founders made the transition to a crypto project. The rapid growth of the network was impressive – expanding from approximately 20,000 hotspots worldwide in late 2019 to over a million by February 2021.

Funding

As a crypto investor, I can tell you that Helium is a highly-backed project in the cryptocurrency world, having raised an impressive $364 million from more than 33 distinguished investors. Among these esteemed backers are Google Ventures, FirstMark, Pantera Capital, and Munich Re Ventures.

Notable Milestones

Helium has demonstrated the value and creativity of DePIN and decentralized wireless infrastructure through a string of collaborations and endorsements by prominent entities. For example, in January, Telefónica, a leading Spanish multinational telecommunications company, teamed up with Nova Labs to install Helium-enabled 5G hotspots in Mexico City and Oaxaca. This arrangement lets Telefónica shift some data traffic from conventional cellular networks onto the Helium 5G network.

Frequently Asked Questions

What is the best project on the Solana blockchain?

In terms of noteworthy projects on the Solana blockchain, the optimal choice can fluctuate based on specific niches and personal preferences. There is an abundance of trustworthy development teams working on innovative infrastructure within Solana’s ecosystem. Additionally, a multitude of talented creators are showcasing captivating digital art through NFTs (Non-Fungible Tokens).

How do I find new Solana projects?

Engaging with existing Solana community networks is an effective method for discovering new projects. By building connections with individuals who share similar interests, you’ll expand your knowledge base and gain valuable insights into potential opportunities in the Solana ecosystem. Working together, you’ll be able to keep informed about market trends and upcoming projects.

Is Solana still popular?

In the thriving world of cryptocurrencies, Solana continues to hold a significant position, experiencing a noteworthy increase in user attention during the years 2023 and 2024.

Final Thoughts on the Top Solana Projects

Solana serves as a thriving center for an assorted array of decentralized applications (dApps). It has gained prominence in sectors such as lending, liquid staking, decentralized exchanges (DEXs), and real-world asset tokenization.

In spite of facing numerous challenges, Solana experienced a remarkable comeback in the year 2024. Notably, its decentralized finance (DeFi) sector has amassed billions in total value, demonstrating its robustness and drawing interest for its impressive scalability, swift transaction speeds, and cost-effective solutions.

This development can be attributed to the efforts of promising teams creating top-notch projects, as illustrated by those cited previously.

Read More

- The Last Epoch Dilemma: Confronting the Gold Dupe Crisis

- BONE PREDICTION. BONE cryptocurrency

- UFO PREDICTION. UFO cryptocurrency

- Last Epoch: Why Keystroke Registration Issues Are Frustrating Players

- EUR INR PREDICTION

- Skull and Bones: Gamers’ Frustrations with Ubisoft’s Premium Content Delivery

- Celebrating Hu Tao’s Birthday in Genshin Impact

- Michelle Yeoh Will Not Appear in ‘Avatar 3,’ Says James Cameron: ‘She’s in 4 and 5’

- Abiotic Factor: Players Discuss the Need for Quick Character Adjustments in-game

- Diablo Accomplishments: Epic Journey Through the Pit and Beyond

2024-04-29 19:11