As a researcher with extensive experience in cryptocurrency analysis, I have closely monitored Polkadot’s price action and have formed an opinion based on the current market conditions. After breaking below the crucial 200-day moving average, Polkadot’s price has found support around the significant $6.5 mark. However, a sudden break below this pivotal support could trigger a notable cascade in the short term.

As a crypto investor, I’ve noticed that Polkadot‘s price has dipped below its important 200-day moving average. Surprisingly, it has managed to find some footing around the significant $6.5 level. Nevertheless, a sharp decline beneath this key support could lead to a significant sell-off in the near future.

Technical Analysis

By Shayan

The Daily Chart

An in-depth analysis of the day-to-day price chart reveals a patch of indecision and sideways drifting around the significant $6.5 mark. The latest trading activity caused a breakdown beneath the crucial 200-day moving average, now situated at $7.1, indicating that sellers are in control and looking to push the price below the $6.5 support.

As a researcher studying market trends, I can tell you that if the bears manage to successfully breach the current price levels, there’s a high probability that the price will begin to trend significantly downwards towards the critical support of $5.5.

If there is an unexpected surge in buying activity, investors will focus on the important moving averages of $7.1 (200-day) and $8.1 (100-day) as potential targets in the near future.

The 4-Hour Chart

In the last 4 hours, Polkadot’s price rise has faced significant selling pressure near the important resistance mark formed by the $7.4 (0.5 Fib) and $7.8 (0.618 Fib) levels according to Fibonacci analysis, causing a noticeable drop in price.

I’ve observed a decline in prices recently, signaling a dominant bearish attitude among market participants.

As an analyst, I observe that the current price trend suggests a prolonged decline towards the $6 support level. This key support zone becomes the crucial benchmark for forecasting the cryptocurrency’s future trajectory based on subsequent price actions in this area.

Sentiment Analysis

By Shayan

With the recent major drop in prices and the subsequent reach of a robust support level, traders might be keen to explore possible future price targets if a bullish turnaround ensues. In such a scenario, examining the liquidity conditions in the continuous market could offer useful information.

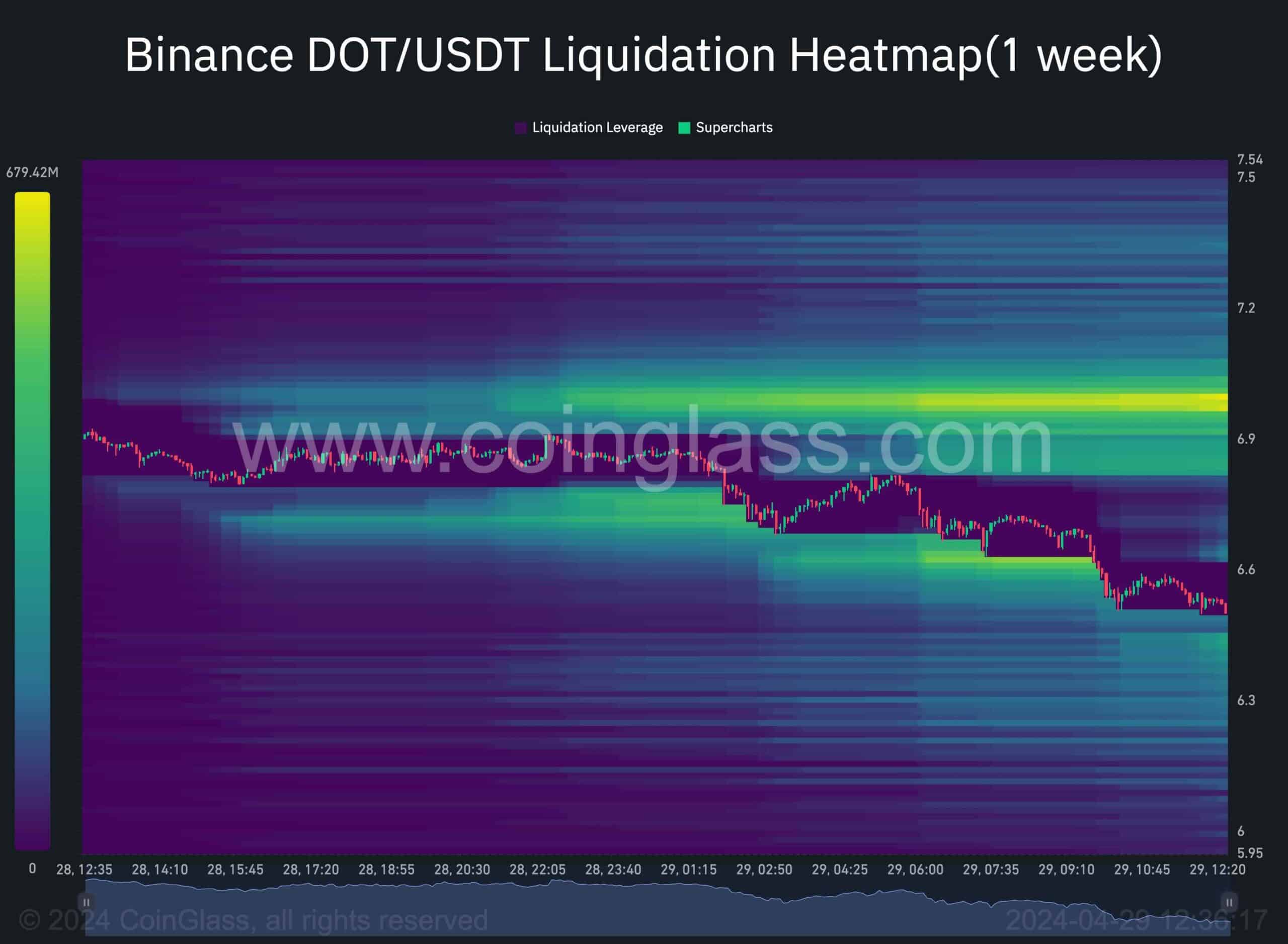

A chart showcases the liquidation levels for the Binance DOT/USDT pair in the form of a heatmap. This visualization marks significant price points where substantial liquidity is present, which could potentially sway the price movement.

Noteworthy is the fact that the recent sharp decline was mainly fueled by the aggressive short selling activities. The graph indicates that the price level above $6.9 holds substantial buy-stop orders, making it a strong resistance zone.

If enough market demand brings about a bullish recovery, Polkadot’s price is expected to reach the region above $6.9.

Read More

- CKB PREDICTION. CKB cryptocurrency

- EUR INR PREDICTION

- PENDLE PREDICTION. PENDLE cryptocurrency

- ICP PREDICTION. ICP cryptocurrency

- PBX PREDICTION. PBX cryptocurrency

- W PREDICTION. W cryptocurrency

- TANK PREDICTION. TANK cryptocurrency

- IMX PREDICTION. IMX cryptocurrency

- USD DKK PREDICTION

- LDO PREDICTION. LDO cryptocurrency

2024-04-29 16:03