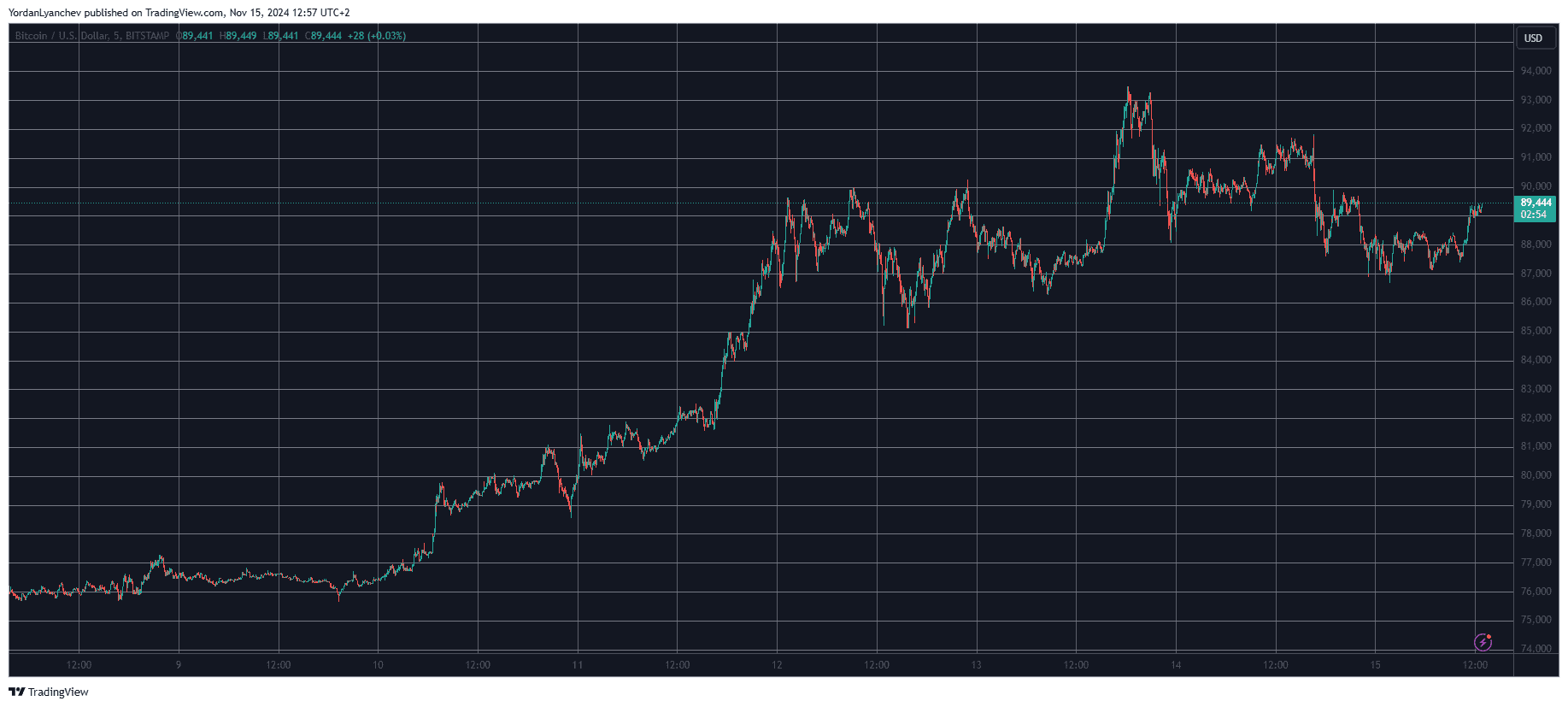

As a seasoned crypto investor with over a decade of experience under my belt, I’ve seen more market fluctuations than I care to remember. The recent dip in Bitcoin’s price, after touching an all-time high of $93,800, is not entirely unexpected.

As an analyst, I couldn’t help but anticipate a correction in the price of Bitcoin following its remarkable surge of over $25,000 in roughly a week, culminating in a new record high of $93,800 on Wednesday.

On Thursday, the asset was valued at approximately $92,000, but by Friday morning, its value had dropped below $87,000. Here are a few possible explanations for this decline:

Miners, Whales Selling

As an analyst, I believe the primary reason behind the recent drop in Bitcoin’s price could be attributed to a two-pronged issue. From my analysis of data from Lookonchain, it appears that some significant players, or “whales,” have transferred substantial amounts of Bitcoin to centralized exchanges over the past few days. This could suggest that these whales are looking to cash out their profits following the incredible rally sparked by Donald Trump’s victory in the 2024 U.S. presidential elections, which may have fueled a bullish sentiment among investors.

A whale deposited 1,920 $BTC($169M) to #Binance 1 hour ago.

The whale has deposited a total of 4,060 $BTC($361M) to #Binance in the past 3 days.

— Lookonchain (@lookonchain) November 15, 2024

The basis for the second part of the sales argument originates from cryptocurrency miners. Earlier this week, CryptoPotato shared that certain miners were selling their BTC, yet it wasn’t overly concerning at the time. However, recent information from CryptoQuant shows that they have persisted in doing so.

Indeed, it’s been reported that miners from as early as the Satoshi era have begun transferring Bitcoins they mined over 14 years ago. Some of these coins were transferred to cryptocurrency exchanges, which might suggest a similar motive to the ‘whale’ mentioned previously.

Miners continue to sell.

This time a miner from the Satoshi era moved 2K Bitcoin.The coins were mined in 2010 and had never moved.

Some of these Bitcoin ended up on exchanges.— Julio Moreno (@jjcmoreno) November 15, 2024

ETF Outflows

Following the news of Donald Trump’s election as the next U.S. president, investors began heavily investing in Bitcoin Exchange-Traded Funds (ETFs). Over $5 billion flowed into these funds within only six trading days. This influx indicated that Bitcoin’s price might have peaked at its current level, based on past market trends.

Yesterday saw a change in direction as approximately $400 million was taken out from U.S.-based Exchange Traded Funds (ETFs). This figure represents one of the top three largest single-day net withdrawals since these ETFs were established back in January.

On May 1st, a record-breaking amount of $563.7 million was withdrawn from Bitcoin (BTC), taking the lead in this negative statistic. In second place is November 4th, with a withdrawal of $541.1 million, which is intriguing because these dates both marked local price bottoms for BTC. As the weeks passed, the asset experienced remarkable growth following these low points.

With the second main point now covered, let me share the third key factor: A mix of several indicators suggested that Bitcoin had reached an overbought state. These included the Relative Strength Index (RSI), Market Value to Realized Value (MVRV), and escalating levels of Fear of Missing Out (FOMO).

Although it’s 17% higher than a week ago, Bitcoin is yet to reach its $100,000 goal. The crypto community is optimistic that this time might be different from the anticipation surrounding the “laser eye” movement in 2021.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-11-15 14:32