As a seasoned crypto investor with a decade-long journey through the rollercoaster ride that is the cryptocurrency market, I must admit that the current state of Bitcoin (BTC) leaves me in a state of cautious optimism. On one hand, the recent price action has been less than ideal, with BTC failing to live up to its “Uptober” reputation so far. However, certain indicators are pointing towards a potential bullish phase that I can’t help but feel excited about.

TL;DR

- Despite recent volatility, several indicators suggest that BTC might be entering a bullish phase.

On the other hand, one essential element hints at an intensified pullback in the short term.

‘Uptober’ Still in the Cards?

Bitcoin (BTC) has experienced significant ups and downs since October’s beginning, performing less favorably than many had anticipated. Surprisingly, this typically prosperous month for the crypto world, often referred to as “Uptober,” hasn’t been as promising as usual within the community.

At the moment, Bitcoin is trading slightly below $61,000, which represents a 5% drop over the past ten days. Yet, certain key indicators hint at a potential comeback in the near future.

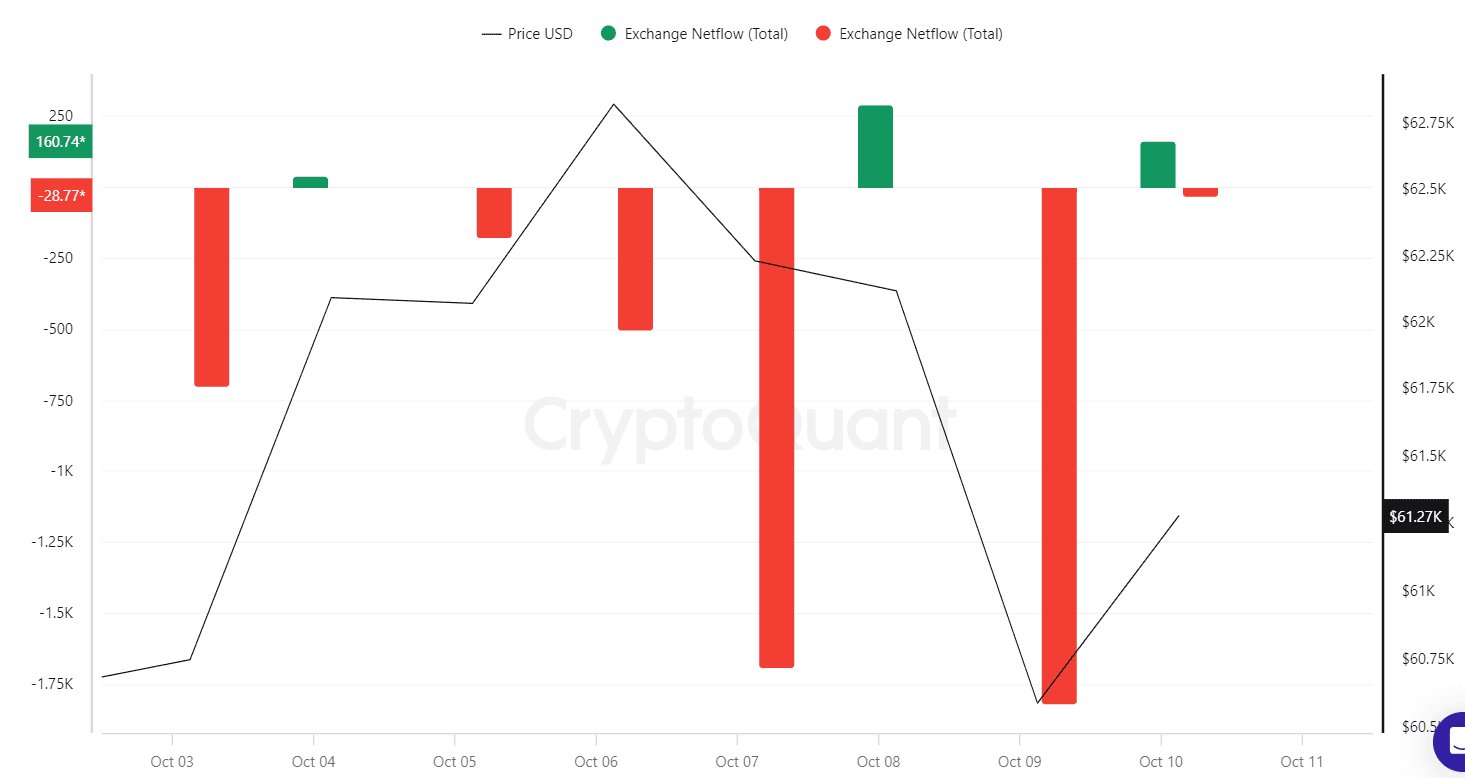

As per CryptoQuant, there has been a significant increase in Bitcoin exchange outflows compared to inflows over the past week. This trend, as illustrated in the chart below, suggests a possible move from centralized exchanges towards self-custody options. Such a shift might be seen as a positive sign due to the decrease in immediate selling pressure it could bring about.

Coming up next, we’ll discuss the BTC MVRV (Market Value to Realized Value), which has recently fallen below 2. Values lower than this usually suggest that the market is in an accumulation stage, implying possible opportunities for purchasing.

Additionally, let’s discuss Bitcoin’s Relative Strength Index (RSI). This momentum oscillator, which gauges the pace and direction of price fluctuations, approached the optimistic region of 30 on October 9 and is now hovering around 38. At present, it indicates a potential “buy” signal.

Something for the Bears, too

Despite the factors mentioned earlier suggesting a potential price resurgence, there’s one that points towards a contrasting scenario. As a crypto investor, I’ve noticed an indication from whales who have offloaded or redistributed approximately 30,000 BTC within the past 72 hours, which translates to nearly $1.9 billion. This could signal a possible downturn in the market.

As development proceeds, the available amount of the main cryptocurrency might increase significantly. This increase could potentially lead to a decrease in its value if the demand fails to keep pace with the supply.

Furthermore, the moves of big investors might provoke fear amongst smaller ones, leading them to sell off their assets swiftly, thereby intensifying the market retreat.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- AEVO PREDICTION. AEVO cryptocurrency

- ORB PREDICTION. ORB cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- MAGIC PREDICTION. MAGIC cryptocurrency

- LSK PREDICTION. LSK cryptocurrency

2024-10-10 22:54