As a seasoned analyst with years of observing and navigating the cryptocurrency market, I find the signals hinting at an upcoming price surge for Bitcoin by the end of 2024 intriguing.

By now, we’ve passed the midpoint of September, and there’s a lot of anticipation in the world of cryptocurrencies, with everyone keeping a close eye on October. This month is often known as “Uptober” due to the strong historical trends seen in Bitcoin and other digital currencies.

In simple terms, here are four clues that suggest a possible price increase for Bitcoin by the end of 2024.

Whale Activity (x2)

As an analyst, I’ve recently delved into a study by CryptoQuant focusing on two key areas of whale behavior. The first segment is composed of relatively new market entrants who have amassed their Bitcoin reserves within the last 155 days. Interestingly, these whales have an average purchase price of $62,038, implying they’ve incurred minimal unrealized losses of less than 5%.

Based on blockchain information, it appears these new big investors choose not to offload their bitcoins at the present rates; instead, they continue to amass them, demonstrating a strong belief in Bitcoin’s future.

Whales who joined the ecosystem over 155 days ago are accumulating in a different area when it comes to unrealized profits. Their initial investment cost was $27,843, which indicates that their funds have more than doubled. Despite this significant growth, they seem to be holding onto their assets instead of cashing out.

Miners Tend to HODL

Miners play a crucial role as the backbone of the Bitcoin network, ensuring the security of the world’s largest blockchain. They receive 450 Bitcoins per day (post-2024 halving) for their work, and many large mining corporations have amassed significant reserves. The way they manage these reserves can significantly influence Bitcoin’s price, particularly if they choose to sell a large quantity all at once.

On the other hand, things have been different recently. According to CryptoQuant’s analysis, the average base cost they incur comes out to be around $43,179. This implies that miners are currently sitting on a profit margin of approximately 40%, which remains unrealized.

According to the report, despite showing a profit, there’s no indication of widespread sales. This could mean that they are choosing to either keep their stock or gradually release it over time.

The only possible threat comes from Binance traders, as they seem more inclined to sell off quickly and realize profits. However, this is also questionable as the current trend shows that they are “actively buying.” Additionally, the BTC reserves on exchanges continue to decline, which reduces the immediate selling pressure.

According to CryptoQuant’s examination, newly active whales and Binance traders are purchasing cryptocurrency, whereas existing large investors are keeping their holdings. This combination might suggest market equilibrium and the possibility of future price increases.

Bonus: Rate Cuts

Although many market participants believe the potential rate cuts by the US Fed have already been priced in, they are still worth mentioning due to the impact they could have on the entire industry. History shows that lower interest rates (meaning cheaper money available for borrowing) have resulted in rising prices in the crypto market and vice-versa.

Several central banks, including those in Canada, the UK, and the EU, have already lowered their local interest rates. Last month, Jerome Powell, chair of the Federal Reserve, suggested that it might be time for other central banks to follow this trend. The upcoming FOMC meeting is scheduled for September 18-19, and predictions regarding a potential rate cut range from 25 to 75 basis points.

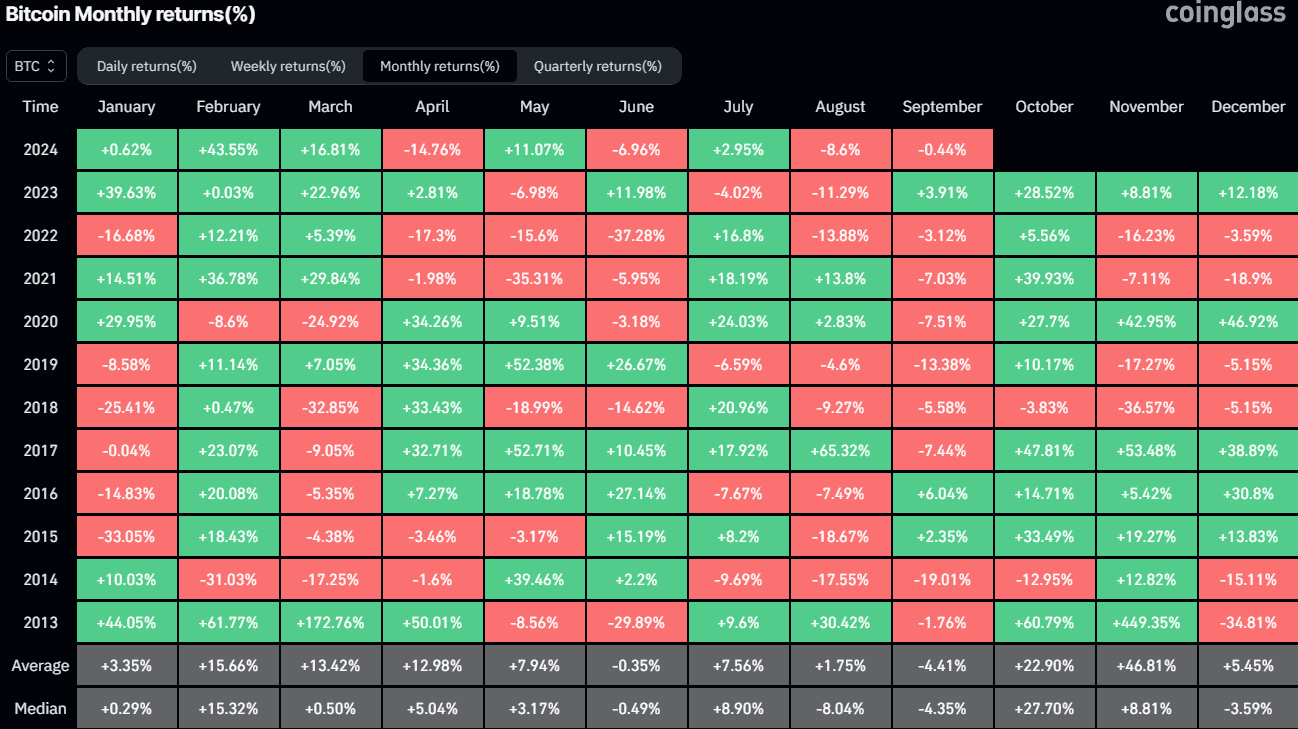

In a harmonious alignment, this situation may match up flawlessly with one of Bitcoin’s most optimistic months – October, often referred to as “Uptober”. Data from CoinGlass reveals that over the past 11 Octobers, only twice have shown a decline, while the average gains have been impressive at 22.9%.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- W PREDICTION. W cryptocurrency

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- PENDLE PREDICTION. PENDLE cryptocurrency

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- How to Handle Smurfs in Valorant: A Guide from the Community

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

2024-09-17 14:26