Key Takeaways:

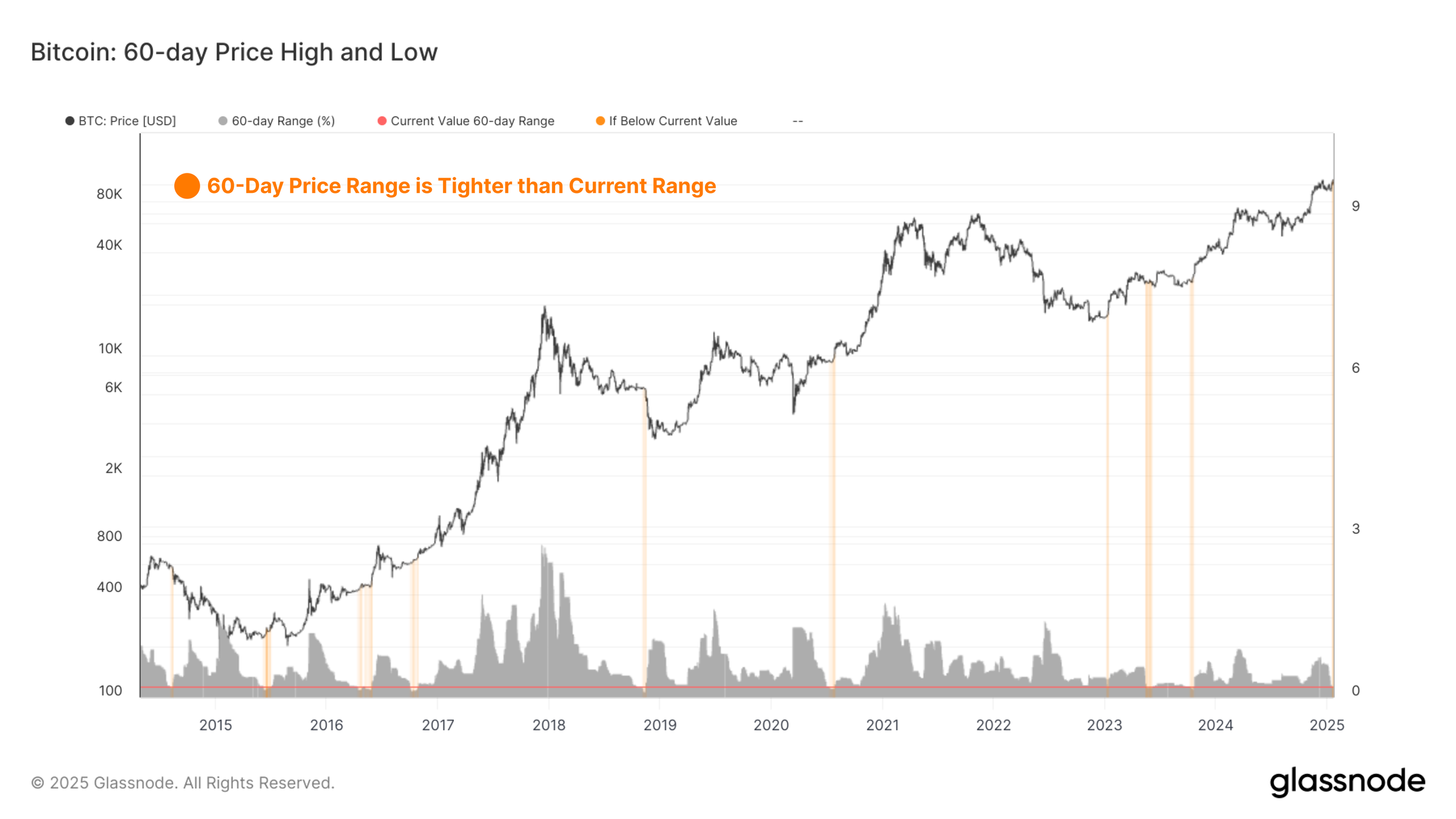

- Glassnode’s key indicator suggests bitcoin‘s price volatility is about to explode.

- Recent flows have been bullish, particularly on the Chicago Mercantile Exchange.

- Historically, tightening 60-day price ranges have presaged volatility explosions.

😈 Ah, the sweet anticipation of a volatile market! Bitcoin, the digital darling of the crypto world, is currently coiled tighter than a spring in a jack-in-the-box. According to Glassnode, a key indicator tied to BTC‘s 60-day price range is flashing a green signal to volatility bulls. 📈

This means that the prices changes are likely to become wider, and volatility traders looking to capitalize on significant price swings may soon find opportunities. 💰

But wait, there’s more! Recent flows have been biased bullish, particularly on the Chicago Mercantile Exchange, where traders have been piling into call options. A similar bullish bias is apparent on Deribit and other exchanges. 🐂

So, is Bitcoin a coiled spring ready to burst with price volatility, or is it a ticking time bomb waiting to explode? Only time will tell. ⏳

Remember, volatility is like a rollercoaster ride – exhilarating for some, terrifying for others. Higher volatility means price fluctuations will become bigger and potentially more unpredictable. It does not say whether prices will surge or slump. 🎢

So buckle up, crypto enthusiasts! The bitcoin market is about to get a whole lot more exciting. 🚀

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-23 11:57