After a dramatic conclave lasting two days—one expects at least a minor revolution after such an interval—the Federal Reserve’s FOMC, that most somber of economic salons, resolved not to shift the federal funds rate from its current lodgings between 4.25% and 4.50%. Markets, typically more excitable than a Victorian maiden at her first ball, showed all the surprise of a cat confronted with yet another houseplant. With all the certainty of an undertaker at a family reunion, 99% had already wagered on the outcome. As for the crypto market, it yawned, checked its hair, and flirted with indifference.

Tariffs, Trump, and the Timeless Tango of Inflation 💃

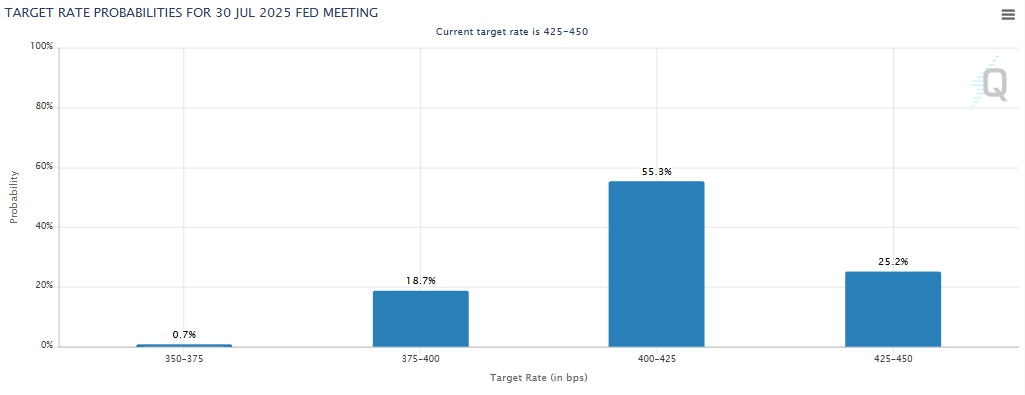

On Wednesday, the U.S. Federal Reserve—never ones to disrupt the afternoon nap—announced it would maintain interest rates immovably between 4.25% and 4.5%. This non-development, much like the British weather or cucumber sandwiches at tea, astonished precisely no one. The CME FedWatch tool, recent darling of those who like their anxiety quantified, placed odds of action at a minuscule 1%. One suspects even Lady Bracknell would have struggled to muster enthusiasm.

The Fed graciously acknowledged that inflation remains “somewhat elevated.” Translated from bureaucratese, this means “high enough to spoil one’s martini, but not so dire as to switch from gin to water.” Uncertainty about the fate of the economy looms larger than a Wildean wit at a dull party.

Undeterred, the Fed leaves its grand interest rate upon the dais, pausing only to cast a suspicious eye on President Trump’s tariffs—a set of policies as broad as a dowager Duchess’ hat and twice as controversial.

The American economy, much like an aspiring poet, is reportedly still “growing”—bolstered by hearty job numbers and unemployment so low that Parisian absinthe bars are envious. Yet the beast of inflation lingers under the table, while economic uncertainty wafts through the room like a misplaced bon mot.

Ah, but the risks! Like a poet in search of a patron, the threat of both galloping inflation and languishing employment has increased. Decisions on future rate hikes now rest—not with Reason, nor with Fortune—but with the fickle mistress known as New Data. The Fed, ever the romantic, clings to its 2% inflation ideal and a vision of robust employment with the tenacity of a dandy to his cravat. President Trump, meanwhile, pines for lower rates, but robust jobs data has dashed his hopes like so many poorly-written love notes. A June rate cut now seems as likely as a Wildean dinner party ending in sobriety.

Market expectations, which shift more than society’s opinion of marital fidelity, no longer wager confidently on swift rate reductions. July may see a cut, they muse, perhaps with a further two or three by year’s end if the stars and spreadsheets align.

And how did the crypto market respond to this pulse of monetary banality? It stayed as flat as a line of dialogue at a second-rate matinée. Bitcoin, not to be outdone, executed a modest swoon—0.2% down in the last hour—a gesture so subtle it would make even an aesthete sigh with ennui.

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- How to use a Modifier in Wuthering Waves

- Basketball Zero Boombox & Music ID Codes – Roblox

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-05-07 22:05